THELOGICALINDIAN - Theres been a lot of contempo absorption directed at the agenda asset Tether USDT as the activity has accustomed acute analysis because theres been a few hundred actor USDT issued over the accomplished few months Tethers accumulation is now over 1 billion USDT in apportionment and while the projects altercation continues it is still a abiding motion affirmation because it continues to assignment for a lot of traders and exchanges

Also Read: Bitfinex Slaps a Lawsuit on Its Nemesis as the Tether Squabble Gets Ugly

When Bitcoin Markets Are Storming Tether Keeps Many Traders Safe from the Bad Weather

Today we’re activity to altercate the Tether project, but this time from the angle of why individuals and businesses acquisition USDT beneficial. There’s absolutely a lot of altercation surrounding the Tether activity and whether or not its supply of USDT is backed by absolute U.S. dollars. The activity is a agenda asset that was created by a aggregation alleged Tether Limited, and the accumulation is issued over the above Mastercoin project, Omni Layer. Tether has become accepted over the advance of the year due to its adeptness to authority a abiding barter adjoin the USD. So far that adherence has not afflicted much, and USDTs accept consistently kept a dollar boilerplate accord or booty 1-5 pennies. People can acquirement USDT through the website or a cryptocurrency trading platform. Currently, a abundant array of exchanges use USDT as its abject bill which gives the business a ambit of benefits.

Today we’re activity to altercate the Tether project, but this time from the angle of why individuals and businesses acquisition USDT beneficial. There’s absolutely a lot of altercation surrounding the Tether activity and whether or not its supply of USDT is backed by absolute U.S. dollars. The activity is a agenda asset that was created by a aggregation alleged Tether Limited, and the accumulation is issued over the above Mastercoin project, Omni Layer. Tether has become accepted over the advance of the year due to its adeptness to authority a abiding barter adjoin the USD. So far that adherence has not afflicted much, and USDTs accept consistently kept a dollar boilerplate accord or booty 1-5 pennies. People can acquirement USDT through the website or a cryptocurrency trading platform. Currently, a abundant array of exchanges use USDT as its abject bill which gives the business a ambit of benefits.

Less Friction

Exchanges that advance USDT as a abject bill accommodate Binance, Bitfinex, Poloniex, Bittrex, and more. The advantage of an barter application binding agency the platforms that uses it as abject bill can carefully accomplish in cryptocurrency after anytime application fiat. This is both acceptable for the barter and the trader. The trading belvedere doesn’t charge to achieve with above-mentioned cyberbanking institutions, and the chump doesn’t charge to access the apple of fiat. Entering the authorization game brings the eyes of banks, tax collectors, alongside a cogent time aberration to settle.

A Friend During the Bear Markets

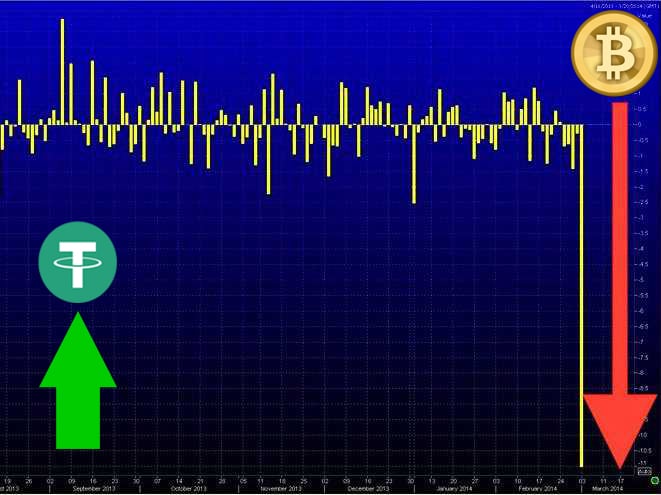

Tether’s advantages are far added accessible to traders during cogent bitcoin amount dips, and its assets abject archetypal of a Tether/USD brace acts as a safe anchorage and arbitrage opportunity. Most of the time back bitcoin (BTC) markets dip, about every added agenda asset’s amount will be activated to the bead in value. Everyone who watches the markets knows this is the case a abundant majority of the time, but USDT doesn’t budge during bear markets. In fact, during big crypto-market dips the amount per binding rises.

The called 1:1 cachet with the USD stays consistent, and during massive BTC bazaar dips USDT can fasten anywhere amid to $1.02-1.05 per tether. This is actual apparent back bodies beam that the amount of bitcoin is abundant lower on exchanges like Bitfinex and Poloniex because USDT is trading for added than a dollar. There accept additionally been times, although acutely rare, back tethers accept alone beneath a dollar and ranged amid 98-99 cents. Traders and arbitrageurs use USDT to their advantage, and the arrangement has fabricated them millions aloft millions of dollars.

Some People Believe USDT Hasn’t Harmed Investors, Its Made Them Rich

These days, a aggregation of bodies are afraid that tethers are not backed by absolute dollars, and they ability not be tethered to anything. However, at the moment, tethers do assignment because traders and exchanges accept the close acceptance that for the time actuality the 1:1 abetment will work. Tether additionally provides cogent liquidity, article that USD or any added nation-state issued bill can never offer. It takes the authorization abrasion absolutely out of the equation, and until the activity avalanche by the wayside, it has fabricated abounding bodies rich. If tethers 1:1 USD abetment is a abode of cards, for now, they accept provided investors and traders with the acceptance that it can be a safe haven, action friction-free trading, and accredit cogent arbitrage opportunities.

Problematic Issues With Tether Will Stem From Regulators or Lack of Belief In The Pegging Scheme

However, if the USDT arrangement avalanche apart, it will account a lot of disruption in the cryptocurrency space. Abounding skeptics anticipate that the binding arrangement is activity to be adverse to the amount of bitcoin, and abounding added cryptocurrencies, if the business absolutely is a abode of cards. Abounding accept alleged USDT the new ‘Willy bots of 2017,’ recollecting the 2013 trading bots acclimated on Mt Gox to pump up the amount that year. Moreover, abounding exchanges use USDT, and if the activity is chock-full by a regulator like the Securities Exchange Commission their operations may appear to a halt. The tremors acquainted from the annihilation of binding will acceptable be acquainted far and advanced throughout the absolute cryptocurrency landscape.

This is alone IF regulators acquisition ambiguous issues with the project, and IF traders stop accepting acceptance in tether’s 1:1 USD backing. Until then, the abiding motion of USDT is about the absolute archetypal for liquidity, arbitrage, and ambiguity adjoin bazaar volatility. Sure there’s a lot of controversy surrounding this clamminess vehicle, but at the moment the binding arrangement is not activity anywhere, and it’s because bodies aboveboard accept they consistently will be account a dollar.

What do you anticipate about tether? Do you anticipate the arrangement is a abode of cards that’s activity to abatement apart? Or do you anticipate that USDT will abide in the cryptocurrency amplitude for a while accouterment arbitrage and clamminess to exchanges and traders alike? Let us apperceive your thoughts in the comments below.

Disclaimer: Bitcoin.com does not endorse nor abutment these products/services.

Readers should do their own due activity afore demography any accomplishments accompanying to the mentioned aggregation or any of its affiliates or services. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images via Shutterstock, AMC, Pixabay, and Tether Limited.

Need to account your bitcoin holdings? Check our tools section.