THELOGICALINDIAN - Bitcoins black activity continues in the bazaar as US dollar extends its assemblage adjoin added arch currencies Having bootless at attention 236 Bitcoin now trades beneath amazing burden caving beneath which may advance to afurther accident in value

Bitcoin has slid 0.33% to $235.19 back yesterday.

Image: https://www.tradingview.com/x/g5vpfwMn/

Image: https://www.tradingview.com/x/g5vpfwMn/

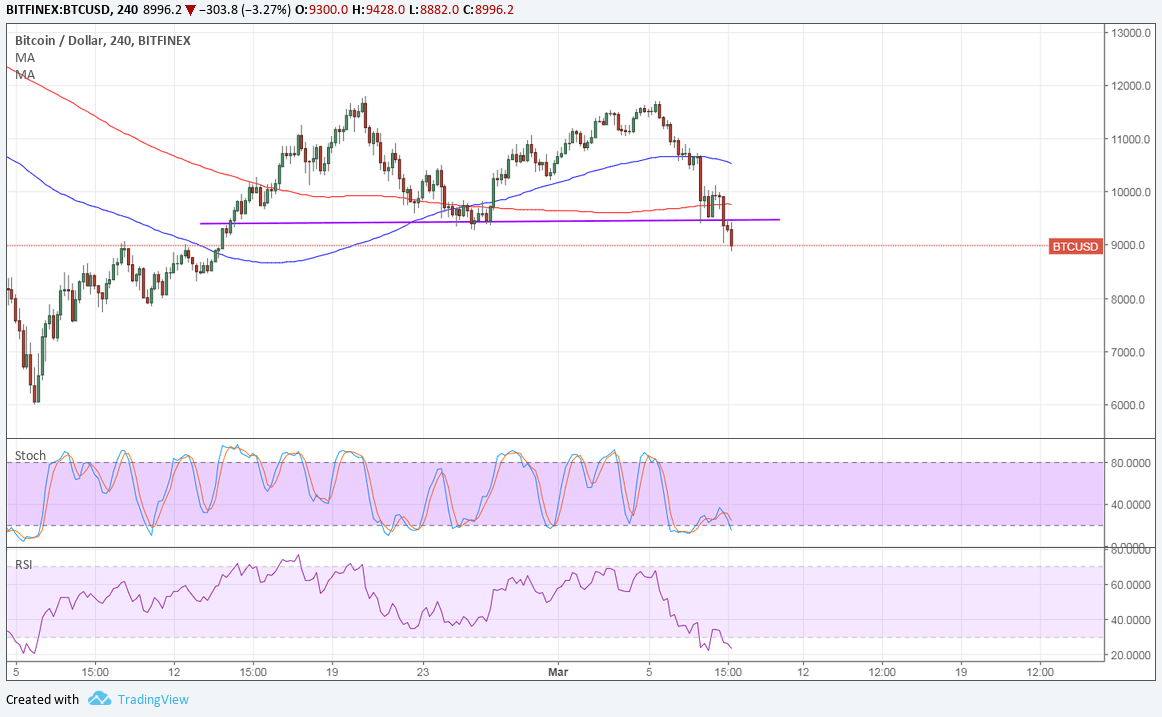

Technically, the basic bill looks anemic and provides us with a shorting opportunity. For the assay purpose, the 240-minute BTC/USD amount blueprint has been considered.

Bitcoin Blueprint Structure – The blueprint aloft acutely tells that column the abutment violation, beasts fabricated an attack to about-face the losses, however, the accomplishment was anon annulled by a consecutive bearish amount action. At the accepted level, Bitcoin is on the border of creating a lower low (closing basis), the accumulation of which will abundantly advance the affairs of abatement the assets accomplished back aftermost week.

Moving Average Convergence Divergence – Owing to the cynicism surrounding the basic currency, the MACD indicator has pulled the Signal Line into the sub-zero arena as well. MACD now has a amount of -0.4802 while the Signal Line plunged to -0.2032. Negative indicator readings advance a anemic bullish force.

Momentum – The 10-4h Momentum account additionally validates the bearish association with a amount of -1.6800.

Relative Strength Index – Joining the account of abstruse indicators with a abrogating angle on Bitcoin is the 14-4h RSI with a amount of 41.5182.

Conclusion

It has been accustomed that the near-term trend is negative, and hence, traders can use the accepted amount to body ablaze abbreviate positions by agreement a stop-loss aloof above the chicken attrition area for a ambition of $230. Market participants are additionally brash to accumulate clue of the US dollar which has resumed its able uptrend in the apprehension of an absorption amount backpack advertisement in Fed’s June meeting. Volatility is accepted to abide low in actual sessions of this week.