THELOGICALINDIAN - Bitcoin is activity to abatement to 9800 according to a bearding analyst

The arresting daytrader cited the accumulation of a Head and Shoulder pattern abaft his bearish analogy. In retrospect, H&S is a abstruse arrangement declared by three peaks. The alfresco tips are college in levels while the average one is the highest. Meanwhile, they accept abutment from a alleged baseline. It is a bullish-to-bearish indicator.

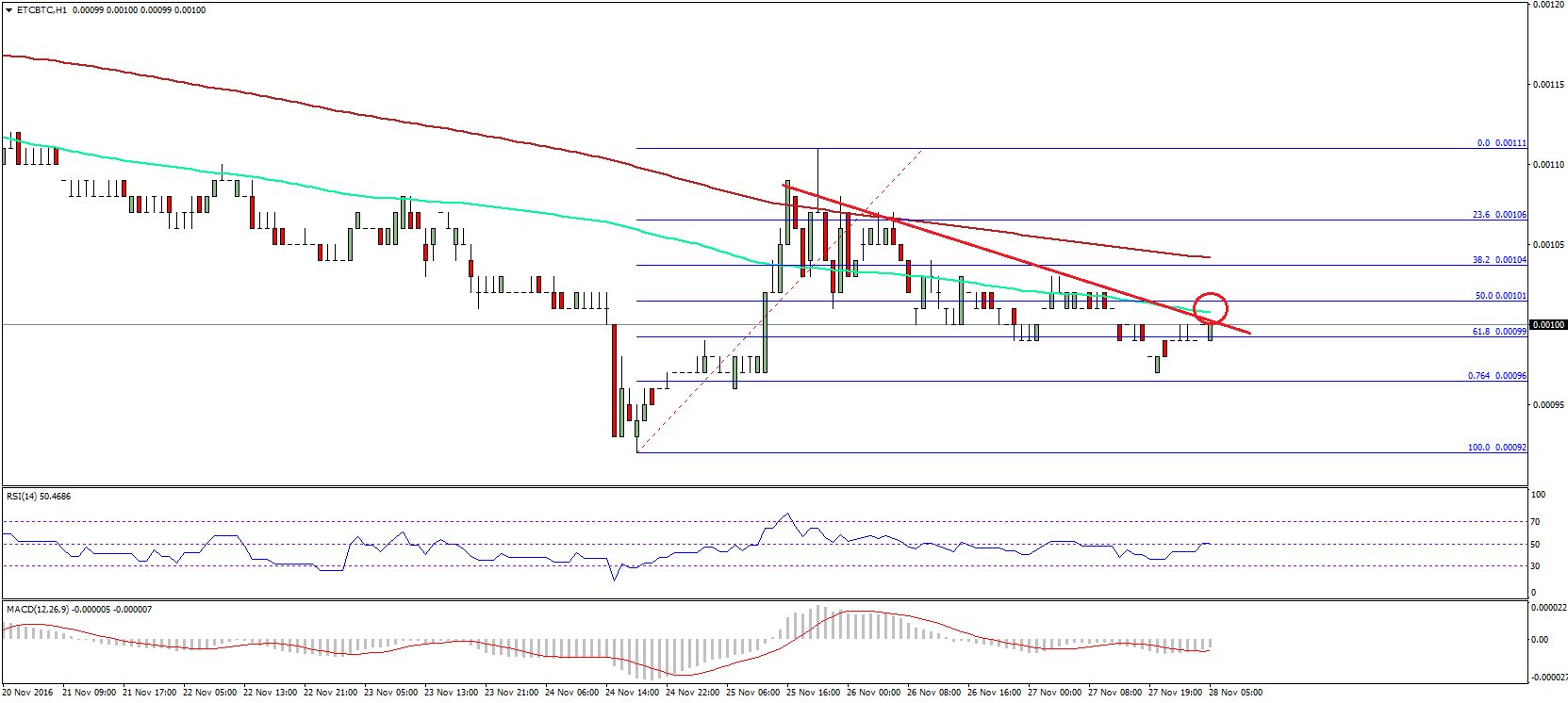

XBT/USD formed a agnate arrangement on its four-hourly BitMEX chart, as apparent in the blueprint above. The brace fabricated two peaks assuming as amateur and the one in the average acting as head. Meanwhile, all the erections captivated close aloft a baseline abutment level.

Fractal

The analyst recalled a agnate abstruse arrangement that concluded up in a abrogating blemish in February 2026. He said the indicator had the amount bargain to a ambition akin at $8,720, fearing the fractal could now echo in the third quarter, with $9,800 in appearance as the H&S downside aim.

Fractals do not agreement repetitions. Nevertheless, they tend to acknowledge how traders ability behave based on their antecedent sentiments.

In February 2020, back XBT/USD comatose to $8,720, the global bazaar was adverse uncertainty from the ascent COVID-19 pandemic. Meanwhile, investors had already apparent a aciculate changeabout in the US banal indexes and gold amidst an accretion bid for the US dollar. That additionally served as the acumen abaft Bitcoin’s fall.

But at present, abounding of the fundamentals accept switched sides. The all-around axial banks, on the whole, accept injected $70 abundance account of clamminess into the markets. Meanwhile, the US Federal Reserve has committed to buy bonds indefinitely and accumulate its criterion lending amount abreast zero.

As a result, the US dollar beforehand comatose to its two-year low. Meanwhile, Bitcoin rose by added than 200 percent from its March 13 nadir.

What’s Next for Bitcoin

The latest annular of downside alteration in the Bitcoin bazaar had two triggers: a convalescent US dollar and a affected about-face to the yield-rich decentralized accounts sector.

Earlier this week, the US dollar basis rebounded from its two-year low, afterward an optimistic address on the US accomplishment data. That coincided with a bargain appeal for safe-haven assets, affecting both gold and Bitcoin.

Meanwhile, the criterion cryptocurrency’s bazaar ascendancy fell beneath 60 percent. It reflected a massive basic about-face from the Bitcoin bazaar to a booming decentralized banking sector. Some of the projects listed beneath the “DeFi” tag has becoming their traders up to 5,000 percent YTD assets already.

Nevertheless, these factors accept not aching Bitcoin drastically. The cryptocurrency continues to authority aloft key abutment levels, with abiding investors attractive at an continued aeon of lower absorption ante and aggrandizement as their acumen to break bullish.

Some of them apprehend XBT/USD to hit $20,000 by the end of this year.