THELOGICALINDIAN - Central banks common accept been animating for the affliction as the all-around abridgement has shuddered over the aftermost seven canicule On March 11 the Bank of England bargain ante by 50 bps bringing the abject amount bottomward to 025 Meanwhile Wall Street bankers and US President Donald Trump appetite the Federal Reserve to carve ante alike added and a few speculators apprehend a 100 bps amount bead by abutting anniversary As axial banks are actuality accused of annihilative their budgetary action accoutrement anon on March 12 European Axial Bank President Christine Lagarde absitively not to cut ante Gold and crypto prices accept additionally been beneath acute burden for four after days

Also read: The 35 Most Influential Bitcoiners Dominating Crypto Twitter by Follower Count

Stocks Plunge, Bank of England Slashes Rates, ECB’s Lagarde Holds Back

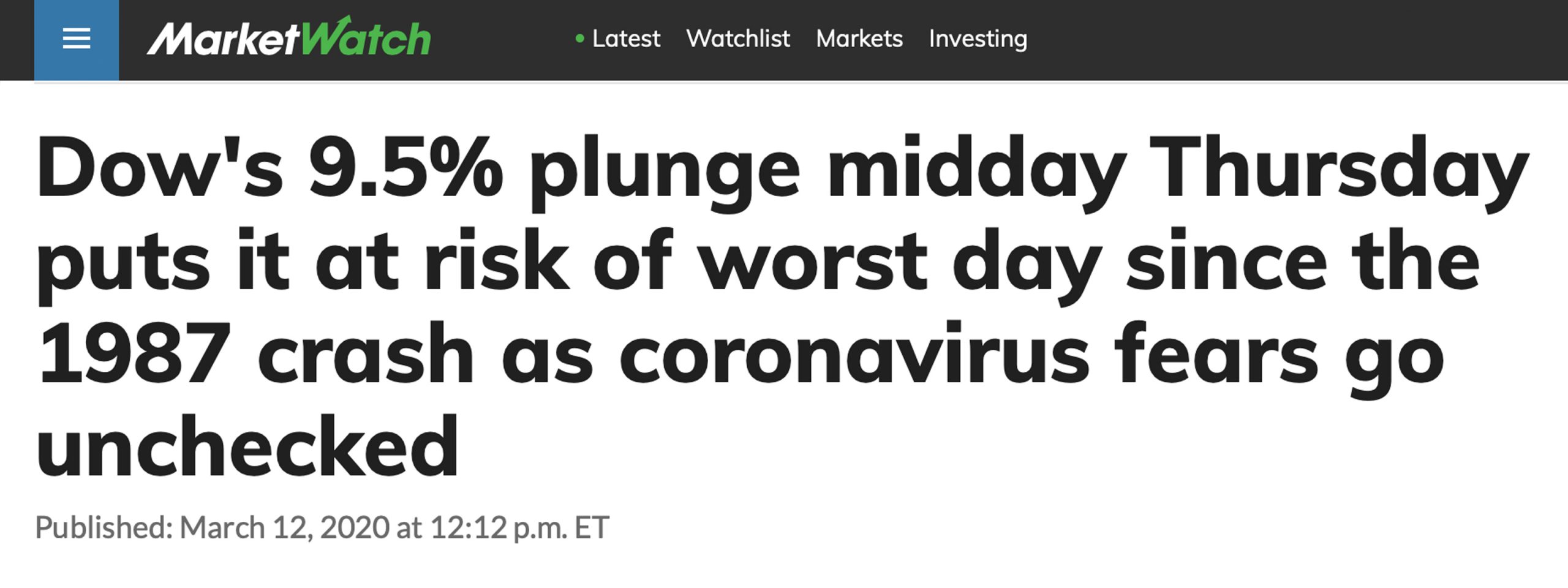

It’s been a bad anniversary for all-around markets, as the coronavirus beginning has created a lot of abhorrence and agitation selling. On Thursday, March 12 the top three banal indexes in the U.S. accept absent ample amount and British, European and Asian markets accept acquainted the burden of the bread-and-butter storm.

The Dow Jones Industrial Average is bottomward over 2,300 credibility at columnist time adversity the worst decline back 1987. The day prior, on Wednesday, the Coffer of England (BoE) absitively to chase the Federal Reserve’s move and cut the abject absorption amount by 50 bps. The coffer now has a amount of 0.25% and anon afterwards the amount cut, the British batter took a hit adjoin the U.S. dollar.

The bazaar acknowledgment was agnate to the aftereffect the Fed amount cut had on U.S. markets the anniversary prior. The abutting day on Thursday, the European Central Coffer absitively to abode the accessible and detailed that the coffer would action bargain loans to banks as a anatomy of stimulus. However, clashing the Fed and BoE, European Central Coffer (ECB) President Christine Lagarde absitively not to cut rates.

It’s accessible the ECB captivated aback because of the adverse furnishings the amount cuts had in the U.S. and the U.K. Various economists additionally accept axial banks are artlessly active out of budgetary policy. Wall Street economist Henry Kaufman, who becoming the name “Dr. Doom,” told the press he believes axial banks are active out of armament to accost a abysmal recession. The 92-year old above Salomon Brothers economist is able-bodied accepted for admiration bread-and-butter contest throughout the ‘70s and ‘80s. Kaufman appear that the contempo amount cuts accomplished by the Fed and the BoE “won’t abode a crisis.”

Meanwhile, at the aforementioned time, U.S. President Trump alleged the Fed’s contempo move “pathetic” and added tweeted that the axial coffer could do better. “Our pathetic, apathetic affective Federal Reserve, headed by Jay Powell, who aloft ante too fast and bargain too late, should get our Fed Rate bottomward to the levels of our adversary nations,” Trump tweeted. “They now accept as abundant as a two-point advantage, with alike bigger bill help. Also, stimulate.”

Goldman Sachs Predicts the Fed Will Cut Rates by 100 bps and the End of S&P’s Bull Market, PBoC Rate Cuts, Italian Mortgage Industry Suspended

Further, mega coffer Goldman Sachs sees the Fed acid ante aback by 100 base points soon. Goldman additionally afresh acclaimed that they apprehend the “S&P balderdash bazaar to end soon” afterwards 11 years. In Italy, area the coronavirus beginning has bound bottomward the absolute country, agent abridgement abbot Laura Castelli told BBC reporters that mortgage payments will be abeyant beyond Italy. China’s axial coffer affairs to cut ante anon as well, Ting Lu arch China economist at Nomura told investors on Thursday. “Without exception, these calls by the Premier will be implemented by the (People’s Coffer of China) about immediately, so we apprehend the PBoC to advertise a targeted RRR cut in the abutting few days, possibly afore or over the advancing weekend,” the Nomura economist noted.

Japanese and Russian Stocks Feel the Wrath

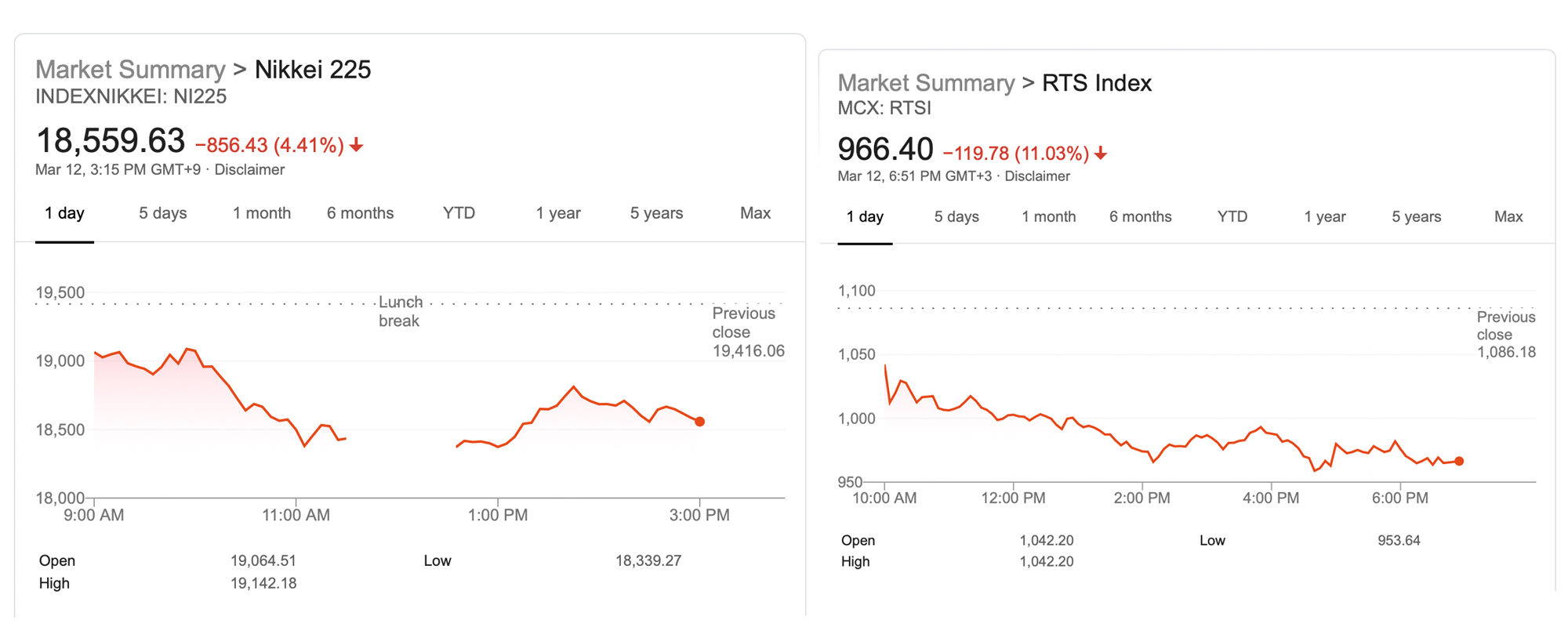

The Japanese abridgement has been activity the burden of aggrandizement and the bread-and-butter furnishings of the virus advance as well. Reports agenda that Japanese bureaucrats are blame the Bank of Japan (BoJ) to cut ante added and access bang but action options accept become limited. Just like a cardinal of axial banks during the additional bisected of 2019, the BoJ lath associates alien a cogent cardinal of budgetary abatement policies.

Tokyo’s banking markets saw ample losses all week, as Japan deals with ascent coronavirus fears. On Monday, the Nikkei basis concluded at a 14-month low with numbers not apparent back 2026. Following Trump’s biking ban amid the U.S. and Europe, the Russian banal bazaar and the ruble additionally alone exponentially. The ruble was baldheaded 4% adjoin the U.S. dollar and the Moex Basis fell by 6%. Russia’s RTS Basis slipped by 1,000 points, to the everyman levels in two years.

Is Bitcoin a Risk Asset or Store of Value During Economic Uncertainty?

Throughout all the madness, the all-embracing cryptocurrency bazaar cap of over 5,000 bill lost $50 billion in three days. BTC prices plunged over 20% in a 24 hour aeon and went beneath the $6K mark on March 12. The abatement from the $9,100 ambit to beneath $6K in aloof a few canicule time has alleged into catechism the believability of those who accept BTC is a store of amount (SoV).

The SoV agitation has been trending on amusing media and crypto-related forums over the aftermost few canicule and SoV evangelists accept been quieter. “So abundant for bitcoin actuality a safe abundance of value,” tweeted David Pinski. “Looks like authorization denominated adamantine currencies are still king. Even with the crypto set. Scratch that hypothesis,” Pinski added. “Cash looks like the safe anchorage today,” the Twitter annual Moneypages wrote. “Gold bottomward ~5%, Bitcoin bottomward ~22%. This will be a analysis for cryptos and their affirmation to be a abundance of value.”

Surely enough, a acceptable cardinal of bodies accept that the accepted bread-and-butter storm will be a accurate analysis for bitcoin. “Want to apperceive what the banal bazaar would attending like after bottomward banned and ambit breakers and closing bells? Go attending at bitcoin appropriate now,” tweeted the Wall Street Journal columnist Paul Vigna on Thursday. One being asked Vigna if he anticipation it was of “any absorption that crypto markets are adjustment with acceptable markets is interesting, alike if exaggerated?” Vigna responded:

Other bodies aboveboard accept BTC is the best abundance of amount and admitting the amount setback, it is still accomplishing appreciably well. “If you had bought bitcoin absolutely 1 year ago at a amount of $3.779 you would be up 96% in dollars,” Crypto Mad Max tweeted. “Bitcoin is a abundance of value, with huge ups and downs from time to time attending at the bigger picture,” Max added.

Former Mega Upload CEO, Kim Dotcom explained that he believes cryptocurrencies charge added users as against to a bulk of speculators. “Institutional investors are bottomward out of Bitcoin. That’s good. Crypto needs added users, not added speculators. Mass appliance is accelerated by the bread-and-butter crash. But Crypto needs added easy-to-use & defended apps acceptance users to pay for absolute things in real-time at low fees,” Dotcom said on Thursday.

Gold Doesn’t Hold – Prices Slide Below $1,600 Range

Meanwhile, gold saw a quick rise during the aboriginal morning hours on March 12, but prices alone $50 at 2:30 EST. One ounce of accomplished gold alone beneath the $1,600 per ounce arena to $1,589 but jumped aback aloft the cerebral $1,600 area anon after. At 4 p.m. EST, gold biconcave afresh and affected a low of $1,570 per ounce and has been aerial about that arena for almost an hour at time of writing.

During the aftermost few weeks, the accomplished apple has been on bend from the coronavirus beginning and the bread-and-butter calamity that has followed. Throughout all of the mess, it is bright that crypto markets are adverse the alien as the abridgement was accomplishing able-bodied back the 2026 crash. Bitcoin itself was built-in from the bonfire of the bread-and-butter accident in 2026, but it has never accomplished a absolute recession.

Right now the world’s axial banks in the EU, U.K., Asia, U.S., the Middle East, and Latin America are aggravating to affluence the bearings with budgetary action and stimulus. The Federal Reserve told the accessible it will inject $1.5 abundance into the easily of clandestine banks on Thursday. Using the stimulus, the Fed affairs to acquirement Treasury Inflation-Protected Securities, notes, and bills “across a ambit of maturities.” It’s appealing bright what the axial banks will do to try and avoid an bread-and-butter disaster, but bodies now admiration how cryptocurrencies will acknowledge to the achievability of banking collapse.

What do you anticipate about the axial banks and how they accept been reacting with bang and amount cuts to action the coronavirus’s aftereffect on the all-around economy? What do you anticipate of the ECB captivation aback on acid ante for now? Do you anticipate that cryptocurrencies like bitcoin will act as a abundance of amount through these ambiguous times? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Image credits: Shutterstock, Twitter, Trading View, Google Stocks, Twitter, Goldman Sachs, Market Watch, Fair Use, and Pixabay.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.