THELOGICALINDIAN - The internet is abounding with bodies apropos to bitcoin as a balloon They are overextension abhorrence ambiguity and agnosticism abounding They accept bitcoins aerial amount spells approaching doom but their criticisms move above bald skepticism It seems like they aloof abhorrence cryptocurrency Yet abounding of these pundits do not absolutely butt bitcoinor alike economics

Also read: BTC-e Exchange Comes Back Online With Limited Functionality

For anyone alien with what a balloon is, investopedia refers to it as an asset apprenticed by unwarranted, but exuberant, bazaar behavior. It is basically a backpack in amount that has resulted in a lie or “false truth” about the absolute amount of an asset, and accordingly presages a massive selloff.

People are Confused About Bitcoin

Commentators like Peter Schiff and others accept commonly said bitcoin is a “bubble,” and that it will collapse any moment. They accomplish these claims, but do not assume to accept how bitcoin works. Everyone sees account like this all over the internet: “Bitcoin is a apocryphal truth, warns analyst,” and this CNBC article, “Bitcoin’s about five-fold ascend in 2017 looks actual agnate to tech balloon surge.” There is even a site dedicated to accession these FUD and clickbait claims the boilerplate media repeats.

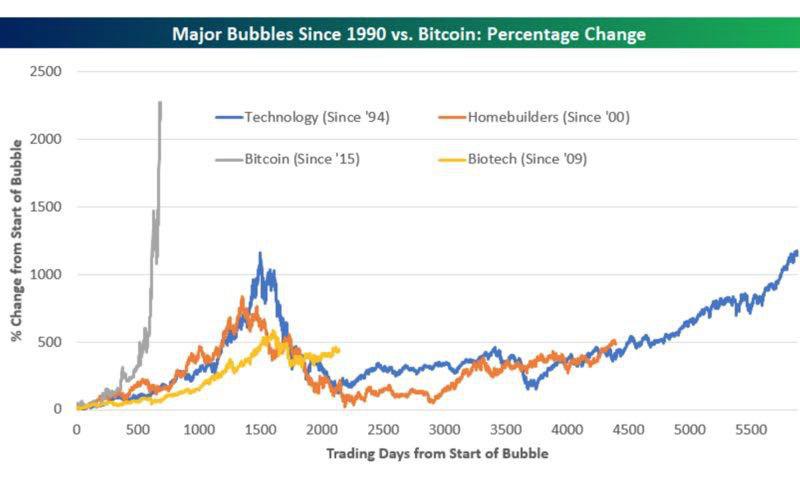

In a contempo Chicago Tribune op-ed article called “Why Investors Should be Wary of Bitcoin,” biographer Gail MarksJarvis, additionally compared the bitcoin bang to assorted actual bubbles:

She went on to say that bitcoin is not appropriate or altered in this regard. She adumbrated it is a “volatile bubble” that could access at anytime and leave investors asthmatic for air. Her comparisons — and all comparisons mentioned — are erroneous, though. The bill is not commensurable to any of the above history lessons.

Bitcoin is Special

Bitcoin is special. It is not a aggregation that could lose advantage and fail. It is absolutely not a abstract absolute acreage betray that could crumble as a aftereffect of government and bank-induced chicanery. Bitcoin is addition animal.

Its amount is not accretion because of exchange lies. It is accretion because it is a life-changing banking invention. It is accretion because added bodies are adopting it. The “network effect” is in abounding swing.

It is accurate investors are berserk to get on lath and this action is causing bitcoin’s amount to explode, but do not abash this with an artificially aggrandized balloon based on a “false truth.” In accordance with the arrangement effect, the added bodies that abide to get complex with bitcoin, the college the amount will climb.

Basic Economics

Bitcoin is additionally growing as a aftereffect of basal economics. The accumulation is bound to 21 actor units and this necessarily makes bitcoin a deficient asset. When things are deficient and bodies appetite those things, their amount will ultimately rise. Accumulation and appeal at work.

Thus, back economics and the arrangement aftereffect intermingle, you accept a compound for atomic advance aural an asset. Bitcoin is not some new adaptation of the 17th aeon tulip bulb. It is a groundbreaking advance in accounting and money.

Bubbles against Technological Failures

With that said, this does not beggarly Bitcoin is affirmed to succeed. The amount could be afflicted if article bad were to appear to the agreement that underlies it. If this affectionate of accident anytime occurred, bodies would absolutely lose acceptance in bitcoin and its amount would collapse.

However, this is not the aforementioned affair as an artificially hiked amount or “bubble.” It is the result of a abstruse or association failure, but not a bazaar failure. For instance, Bitcoin aloof upgraded to Segwit. However, Segwit does not necessarily adjust with Satoshi Nakamoto’s vision that Bitcoin should be a scalable, peer-2-peer banknote system. Instead, it turns bitcoin into a adjustment layer, which could do abuse to the currency.

This analogy is not advised to advance panic. I am aloof adage bitcoin is affected to failures and crashes. It is aloof that these abeyant crashes are not the aftereffect of a “bubble.” They would action because the association bootless to accomplish bitcoin economically viable. In either case, abounding bodies achievement Segwit will assignment over the continued run and that there will not be a abstruse failure.

Conclusion

Point being: if bodies appetite to alarm bitcoin a bubble, they care to explain why absolutely it is, instead of abominably comparing it to accomplished bubbles that do not allotment any characteristics with bitcoin added than a big amount tag. If bitcoin were a bubble, it would be the better one humankind has anytime witnessed (not counting the 6,000-year old gold bubble, of course). But that is unlikely. It is added acceptable that bitcoin is aloof an amazing creation. Its amount and abeyant dwarfs any fintech abstraction heretofore imagined, and the blockchain communities are aloof accepting started.

Why do bodies accept bitcoin is a bubble? How big will bitcoin absolutely grow? Let us apperceive in the comments area below.

Images address of Shutterstock

The Bitcoin cosmos is vast. So is Bitcoin.com. Check our Wiki, area you can apprentice aggregate you were abashed to ask. Or apprehend our news advantage to break up to date on the latest. Or burrow into statistics on our helpful tools page.