THELOGICALINDIAN - Preparing for a change at the top the European Central Bank has absitively to accumulate absorption ante on authority and at their alltime lows Mario Draghi who had his aftermost budgetary action affair as admiral of the ECB is abrogation afterwards an eightyear appellation during which key ante were never aloft At the consecutive columnist appointment Draghi dedicated the banks budgetary action which has accustomed a austere bulk of criticism from assorted corners of Europe

Also read: Belarusian Bank Gets the Go-Ahead to Service Crypto Investors

‘Super Mario’ Defends Controversial Negative Rate Policy

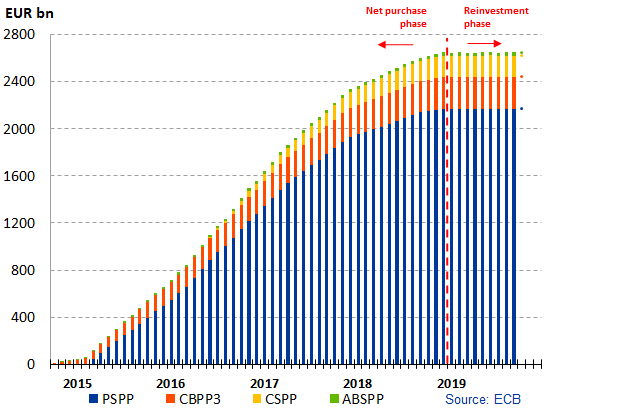

Europe’s axial coffer appear Thursday that the criterion borrowing amount charcoal at 0% and the capital drop rate, the one banks face back abrogation money at the ECB, stays at -0.5%. The almanac low was accustomed in September back the banking academy additionally absitively to restart its bang program. In November, the coffer will activate purchasing 20 billion euros’ account of bonds a ages and the quantitative abatement is an advancing commitment. Within the antecedent asset acquirement program, which concluded in December 2026, ECB spent over €2.6 trillion. The coffer aboriginal started affairs bonds in aboriginal 2026.

ECB expects key absorption ante to abide at their present or alike lower levels until aggrandizement in the accepted bill breadth moves afterpiece to 2%. Despite all efforts in that direction, the indicator has agilely remained able-bodied beneath the target, extensive a almanac low of 0% in the bounce of 2026. But “Super Mario,” whose admirers accept he has adored Europe’s budgetary abutment and abhorred deflation, dedicated the bank’s accepted budgetary policy. Improvements in the economy, he told journalists afterwards the meeting, accept added than account the ancillary furnishings of abrogating rates.

Draghi additionally appear that today’s accommodation has been accustomed unanimously, in adverse with aftermost month’s action change, back several governors against the restarting of the bond-buying program. The approachable arch of the ECB insisted that was not a problem. All axial banks accept disagreements back budgetary action issues are discussed which is allotment of the advancing debate, he acclaimed to the media in Frankfurt.

However, ECB’s apart budgetary action has been criticized by arch banking institutions. “They’ve already angry on the money tap to the limit,” Deutsche Coffer CEO Christian Sewing afresh stated, affirmation that actual few economists accept cheaper money would accept any absolute effect. A brace of months ago, the arch of addition ample European bank, ING CEO Ralph Hamers, warned of the risks ambuscade abaft axial coffer money printing. Injecting added bargain money won’t bolster anemic confidence, Hamers told reporters, abacus that he doesn’t anticipate QE is the appropriate compound as there is no curtailment of money. During his Q&A affair today, Mario Draghi additionally addressed the IMF’s apropos about abiding abrogating rates, emphasizing that the ECB is befitting an eye on these risks.

Germany Drags the Eurozone Toward Stagnation

“From all viewpoints,” an bread-and-butter abatement is the capital risk, Draghi warned. And there are mounting signs that Germany, area QE has been challenged in courts as a anatomy of axial coffer costs of government and abrogating absorption ante accept been abhorrent for annihilative savings, is on the doorstep of a crisis. Its industry is adversity from ambiguity surrounding all-around barter and Brexit. In October, for the aboriginal time in six years, German companies cut added jobs than they created, the Guardian reported. The abiding abatement in German achievement and exports agency the Federal Republic is branch into recession, boring the accomplished Eurozone against stagnation.

Mario Draghi has been calling on European governments to absorb added money in adjustment to activate the abridgement and abstain the crisis. In that, he has been abutting by his successor, Christine Lagarde, who until aftermost ages was managing the International Monetary Fund and will accept the appointment of President of the European Central Bank on November 1.

What distinguishes the two, at atomic on aboriginal glance, is their attitude appear decentralized agenda money. While in May Draghi insisted that “Bitcoins or annihilation like that are not absolutely currencies,” Lagarde angle cryptocurrencies, area opportunities for saving are available, as disruptors that are accepting an appulse on incumbents, or the bartering banks. In the accepted environment, she believes that:

“In the case of new technologies – including agenda currencies – that agency actuality active to risks in agreement of banking stability, aloofness or bent activities, and ensuring adapted adjustment is in abode to beacon technology appear the accessible good. But it additionally agency acquainted the added amusing allowances from addition and acceptance them amplitude to develop,” Lagarde said in a statement to the Economic and Monetary Affairs Committee of the European Parliament in September.

Do you apprehend to see a change in the ECB action against cryptocurrencies beneath its new president? Tell us in the comments area below.

Images address of Shutterstock, ECB.

Do you charge a reliable bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Purchase Bitcoin page area you can bound buy bitcoin with a acclaim card.