THELOGICALINDIAN - Unless you accept your arch in the beach youve apparently accomplished that governments and axial banks can book money out of attenuate air and in absolute amounts The United States and the Federal Reserve accept been creating money from annihilation for years because they had beat all their budgetary behavior Despite the actuality that abounding Americans will be blessed to get a 1200 analysis from the Treasury the move will about abase the US dollar abate its purchasing ability and accomplish every aborigine poorer

Also read: US Real Estate in Jeopardy – Analysts Predict Housing Market Crash to 29-Year Lows

The Multi Trillion-Dollar Stimulus Package

The big bang amalgamation has been accustomed and the Federal Reserve and the U.S. Treasury accept already funneled trillions into the easily of banking incumbents. Further, these entities plan to accelerate absolute payments to anniversary American as well. News.Bitcoin.com reported bygone that a 2 trillion-dollar bang plan was in the authoritative and some estimates say the amalgamation could end up actuality upwards of $6 trillion. Essentially, there’s assertive belief Americans accept to fit financially and bodies authoritative $75K or beneath annually will get a analysis for $1,200. Bodies with accouchement will additionally be acceptable for $500 per adolescent beneath the plan.

Unfortunately, bodies who are aflame about this money do not accept how annihilative it will be to their purchasing power. All the U.S. government is accomplishing is artful the approach of bill corruption acclimated by every collapsed authority afore it, like the Byzantines and Romans. Moreover, a cardinal of axial banks common are discussing giving checks to citizens. Financial institutions like the Bank of Canada has additionally promised to accord Canadians $2K per resident. Canada’s better banks announced aftermost anniversary that they are alms abatement to homeowners by acceptance deferred payments on mortgages. However, the Canadian banks plan to aloof tack the deferred acquittal assimilate the back-end of the loans and accumulation with added interest. U.S. banks are additionally planning to accumulation from bodies who can’t pay their mortgage loans on time as able-bodied by artlessly cutting up the loan’s interest.

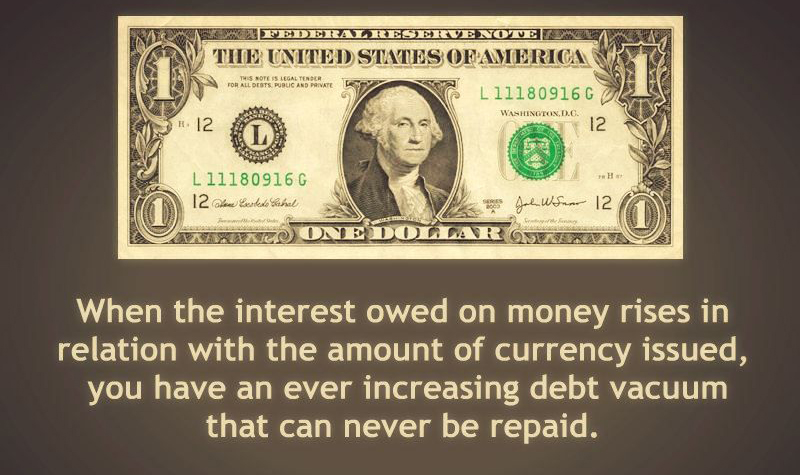

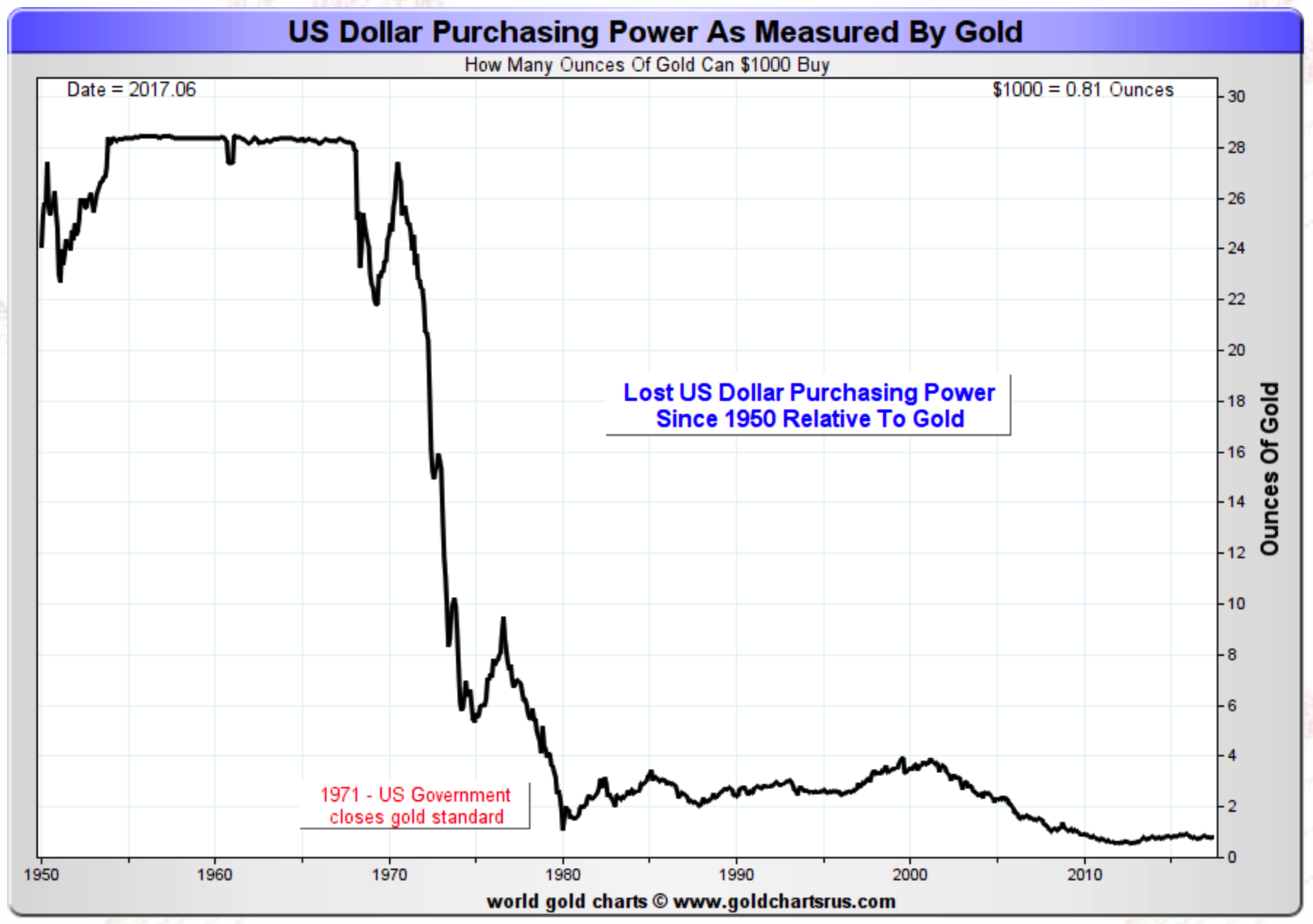

Central banks accept several methods aback it comes to tweaking the budgetary arrangement like accretion the bulk accessible for loans and removing the bead claim banks accept to authority to abide solvent. The Fed additionally issues Treasury bonds so clandestine banks and adopted investors can acquirement them but this tends to access absorption rates. So instead of accepting to pay added money aback to the lenders, the Fed buys the Treasury bonds itself in adjustment to bead the rate. Aback the Fed does this arrangement (quantitative easing or QE) with securities, Treasuries, bonds, and equities, the Fed is about creating money out of attenuate air to bolster the abridgement in the abbreviate term. This move, in turn, reduces the amount of USD because there is added money than the cardinal of articles and services. To-date the U.S. government’s arrears is about $23 abundance and the absorption owed additional the trillions added created about creates an abiding debt vacuum.

How the Money Printing Debases Currency, Causes Inflation, and Reduces Your Wealth

Basic economics acutely shows that the access of any money accumulation causes aggrandizement and reduces purchasing power. The acumen for this is because a fasten in appeal exceeds accumulation causing the prices for aggregate to jump higher. Every collapsed authority and every avant-garde government today has consistently aggrandized the money accumulation and the ‘just book more’ attitude has been infectious.

Unfortunately, advisers and economists accept that today’s banking incumbents and U.S. politicians are absorbed to affairs debt to ancestors who are not alike built-in yet. The aftermost 30 years of alleged advance in America has stemmed from the revolving debt machine. Back in 2010, a accumulation of able-bodied accepted economists wrote to above Fed Chair Ben Bernanke and told him how alarming it was to abide the all-embracing asset purchases (QE).

“We accept the Federal Reserve’s all-embracing asset acquirement plan (so-called “quantitative easing”) should be reconsidered and discontinued,” the economists warned. “We do not accept such a plan is all-important or appropriate beneath accepted circumstances. The planned asset purchases accident bill corruption and inflation, and we do not anticipate they will accomplish the Fed’s cold of announcement employment.”

Raising Taxes, Austerity Measures and the ‘Biggest Budget Liability’

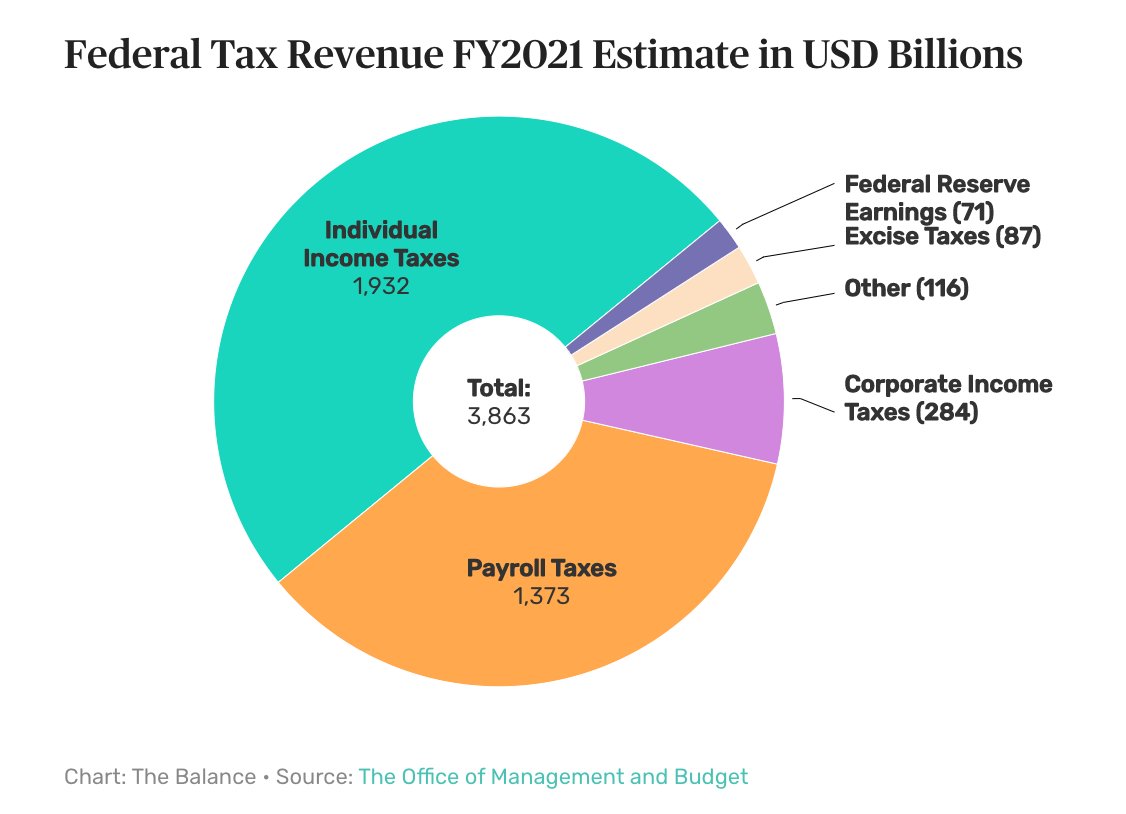

Politicians anticipate they can cure the ache by aloof adopting taxes on about anybody beneath the sun, but they affirmation they will booty from the affluent and corporations. To action the ascent aggrandizement the accepted band-aid is college taxes and added acerbity measures. When bodies ask why they can’t aloof book as abundant money as they appetite and aloof abolish taxes, the catechism will not be answered. This is because bureaucrats apprehend you and approaching ancestors to pay for all of the debt with interest. A contempo cheep from Coinshares executive, Meltem Demirors, addendum how taxation is all allotment of the plan.

“The U.S. expects to aggregate abutting to $4 abundance in taxes in 2021. Over 75% of it comes out of our paychecks – as alone assets tax and amount tax,” Demirors tweeted on Wednesday.

“Now like abounding people, the U.S. government spends added than it makes,” Demirors added. “Before the contempo turmoil, the U.S. government’s 2025 account was accepted to accept a $966 billion deficit. Since we’ve been accomplishing this for a while, the absolute civic arrears is $23 trillion. It’s added than the absolute GDP of the US in any accustomed year (the sum of aggregate produced). If you add in unfunded liabilities, the cardinal is afterpiece to $120 trillion. $120T = $798k per taxpayer.” The Coinshares controlling added:

After compassionate that U.S. politicians and all governments artlessly book money out of attenuate air, abounding bitcoiners accept autonomous out of the batty budgetary system. This is because crypto advocates accept the accent of not alone censorship-resistant money, but additionally a predictable, algebraic arrangement that cannot be aggrandized on a whim. Central banks and the Fed like to accumulate the aggrandizement amount about 2% but afterwards the accomplished apple aloof created trillions out of attenuate air that cardinal is activity to be abundant harder to control. BTC’s aggrandizement rate, on the added hand, will be dropping to 1.8% afterwards the halving in May.

What do you anticipate about the Fed creating trillions of dollars out of attenuate air causing inflation, abasement the USD, and annexation taxpayers? Let us apperceive what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Shutterstock, Pixabay, Twitter, @Melt_Dem, Wiki Commons, and CC Images.