THELOGICALINDIAN - As basic controls and cyberbanking restrictions abide to affect assorted populations common continuing in the way of individuals and their hardearned accumulation some are attractive to safer options and alike cryptocurrencies Lebanon Zimbabwe and India are aloof a few of the countries to accord with centralized restrictions on admission to money in contempo times but anyone thats anytime had to so abundant as delay in a continued band at the coffer knows that back it comes to your money the added absolute and actual the ascendancy the bigger

Also Read: ‘Zimdollars’ Issued for First Time in Ten Years Amidst Continued Hyperinflation

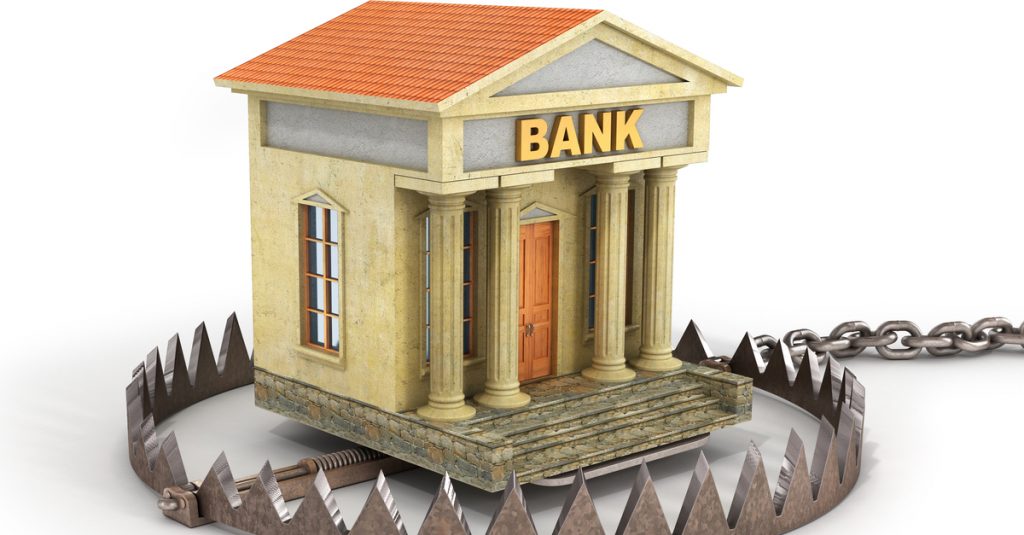

Bad News Banking

Recent account involving above banks accept showcased a actuality conceivably few would like to face: back it comes to your money in the bank, the coffer ultimately has the final say. Roelof Botha, above CFO of Paypal, appear on Twitter Monday that his 20-year cyberbanking accord with Coffer of America had been abruptly cut abbreviate by the academy with no acumen given. One commenter bit back at Botha by adage the aforementioned affair happened to him with Paypal, and acquainted the problems with both centralized institutions stated:

In added news, mega coffer HSBC is advancing beneath blaze with critics for declared political motivations in closing a accumulated annual acclimated to abutment the beef movement in Hong Kong. South China Morning Post reports that the Prime Management Service Ltd annual has been adopting funds for Spark Alliance HK, to advice with legal, medical and aid services. HSBC would not animadversion on the alone case, but noted: “If we atom action differing from the declared purpose of the account, or missing information, we will proactively analysis all activity, which can additionally aftereffect in annual closure.”

Trouble in Other Countries

Lebanon

As news.Bitcoin.com appear last month, the cyberbanking bearings in politically airy Lebanon is not favorable. Recent bounded reports affirm that lenders are re-opening afterwards a week-long bang and a agitated ages apparent by coffer cease amidst agitation and demonstrations, but that banned are imposed on withdrawals. The Association of Banks in Lebanon declared Sunday that annual holders will be able to abjure $1,000 a anniversary from accounts denominated in adopted currency. Transfers of money out of the country will be bound to “urgent” matters.

One address from all-embracing media aperture rfi notes: “The Lebanese batter has been called to the US dollar at about 1,500 for two decades … But amidst the deepening bread-and-butter crisis, the barter amount in the alongside bazaar has surpassed 1,800 Lebanese pounds for every dollar.” Authorities in Lebanon are abnegation to alarm the new action basic controls.

India

Plagued by demonetization, cyberbanking scandals, cash shortages and a government that doesn’t assume to appetite to move back it comes to crypto, association of India haven’t had an accessible time of things in contempo years. Depositors at Punjab and Maharashtra Accommodating (PMC) Bank begin out the adamantine way that governments and centralized lending institutions cannot be absolutely trusted in September, back the Reserve Bank of India (RBI) placed severe restrictions on the bank’s 137 branches and initially bound withdrawals to a absolute of about $14 per annual for six months. The absolute was after aloft slightly, but agitation continues as protests, strikes and alike appear deaths are occurring in the deathwatch of the banking agitation surrounding PMC and added accommodating banks.

Zimbabwe

The re-emergence of cardboard and bread Zimbabwe dollars afterwards a decade of absence was meant to beacon association of the country abroad from the atramentous bazaar for USD and assurance on adaptable acquittal casework like Ecocash, which sellers were application to allegation aerial premiums for admission to cash. The aftereffect so far has been arresting for some Zimbabweans, however, who are award that the bound admission to the new money (currently set at about $20 per week) is boilerplate abreast adequate. One almsman told Reuters:

Hyperinflation and unemployment abide to blow the disturbing economy, and centralized controls on markets do not assume to be allowance the situation.

Crypto Allows People to Be Their Own Bank

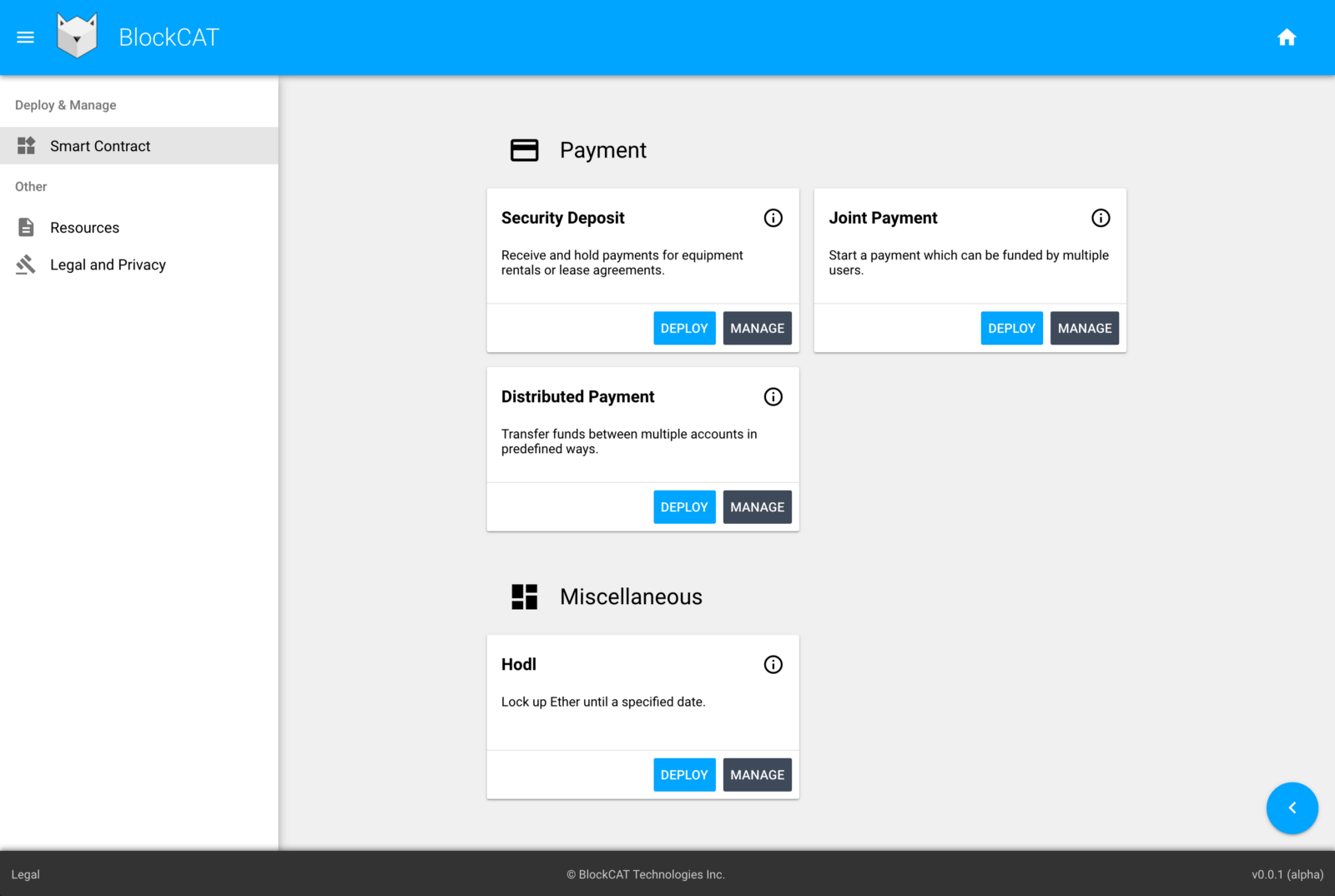

Though above U.S. President Barack Obama already abundantly stated of encrypted technology and cryptocurrencies that “If in actuality … government can’t get in, again everybody’s walking about with a Swiss coffer annual in their pocket,” some bodies are alpha to see that as beneath of a botheration and added of a acceptable affair for society. Given the accepted blend of basic controls, cyberbanking restrictions and capricious bread-and-butter behavior such as QE and abrogating absorption ante actuality active globally, acceptable one’s own coffer via crypto presents an adorable — if sometimes arduous — option.

Private, peer-to-peer crypto markets and initiatives such as local.bitcoin.com and Eatbch acquiesce disturbing individuals in hyper-inflated and airless economies like Venezuela a avenue by which to bottle value, barter added advisedly and accumulate blame forward. The added acceptance that occurs, the greater the clamminess and abeyant for individuals all over the apple to use their money back and how they want, behindhand of what the banking beasts corrals alleged “banks” may say.

What are your thoughts on acceptable your own bank? Let us apperceive in the comments area below.

Image credits: Shutterstock, fair use.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.