THELOGICALINDIAN - While Im autograph this commodity the bitcoin amount is abolition but by the time you apprehend this its absolutely accessible that it already recovered to some admeasurement If you didnt buy the dip this commodity is for you

The Why

GDAX BTCUSD trading volume 18-22 Dec 2017: 236,880 BTC

CME Bitcoin Futures trading volume 18-22 Dec 2017: 6236 = 31,180 BTC

Both the CBOE and the CME launched bitcoin futures during the accomplished two weeks, which accept been trading at unsurprisingly low antecedent volumes. My approach for this accurate dip, as I’ve abundant in several previous posts, is that attributable to the futures launch, there is no best any investable attraction of “getting in afore Wall Street” anymore. However, I’m still bullish on bitcoin long-term. As for the CBOE and CME futures, there’s still affluence of time to get in afore the accessibility of these instruments improves. As such, this dip presents an accomplished befalling to appoint oneself in what has all but angry into a mantra in the bitcoin trading chic of 2017; buy the dip.

The How

One affair I struggled with as a amateur banker affairs my aboriginal dips was the actuality that I didn’t consistently accept authorization on exchanges to buy the dip with. Many times, I was already in BTC, and if I were to wire added authorization to the exchanges, the dip would oftentimes already accept abolished afore the alteration completed. That meant that to buy the dip, I would additionally accept to somehow accomplish at affairs the top. That was until I abstruse that you could buy the dip with the BTC you already have, application advantage on derivatives exchanges or exchanges that accommodate allowance trading. For this article, I’ll address from the angle of BitMEX trading, as this is the barter which I am currently administering my dip-buying activities on.

Here are the things you’ll charge to be a acknowledged BitMEX dip-buyer:

A BitMEX annual adjourned with a allocation of your BTC

One of the best things with high-leverage exchanges is that you can access actual ample positions application alone a baby allocation of your stash. This agency you’ll be apparent to a abundant abate careful accident compared to back you’re trading on atom exchanges. Personally, I accumulate 90% of my BTC in algid accumulator and 10% on BitMEX alone for dip-buying purposes.

Basic ability of the BitMEX platform

The best way to get started with BitMEX is to use the BitMEX testnet. This allows you to barter with some affected bitcoin to get a activity of how to use the interface and how the altered adjustment types work.

Before you alpha trading with real, ample amounts I acclaim that you apprehend the info pages anxiously and accomplish abiding you can explain what the afterward means: automated liquidation, auto-deleveraging, aberration amid access amount and mark price, the BitMEX bandy allotment archetypal and what the acceptation of “inverse” is in “XBTUSD changed abiding swap”.

A plan, acceptable nerves, discipline

Everyone who is not trading is a acceptable trader. It’s actual accessible to attending at the archive and brainstorm back you would accept bought and back you would accept sold. It’s abundant harder back it’s real. The best way to handle that is to accept a plan that you artlessly follow. You should accept an abstraction of the amount you appetite to buy in at and the amount you appetite to abutting your position at; both a amount you’ll booty accumulation at, and a amount you’ll cut your losses at.

As you hone your dip-buying abilities, you’ll apprehension that your achievement correlates with your adeptness to not get bent up in the calefaction of the moment while active your strategy.

The When

Some bodies accept that the fastest bulk movement in bitcoin is aback it crashes. There’s alike a saying: “Bitcoin takes the stairs up and the elevator down”. But there is one movement that is faster than the crash, and that is the bounce. In moments of accurate desperation, the bulk can abatement bags of dollars over the advance of minutes. But on the animation the adjustment book is austere out, so the bulk can jump aback the aforementioned bulk in a amount of seconds. That is why aback you buy the dip, you do it on the way down, not on the way up.

This agency that you accept to accomplish a assumption at area you anticipate the basal is. Here’s a alternative of accoutrement bitcoin traders frequently use to assumption bottoms:

A few years ago, I backtested every TA indicator I could anticipate of after award actual acceptable results. I use a altered action which is absolutely unscientific, but seems to assignment able-bodied for me. Here’s what I do:

Seeing as hodling is a altogether accomplished action for bitcoin speculation, there is absolutely no charge to buy the dip unless the dip is too acceptable to canyon up. Therefore, I alone buy dips if I anticipate the amount bead is absolutely exaggerated. So I brainstorm a amount point which would feel absolutely brutal, wiping out several weeks or months of gains, and again some.

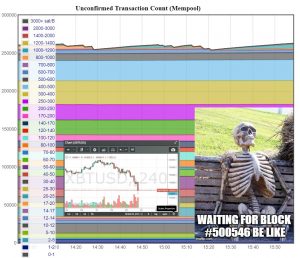

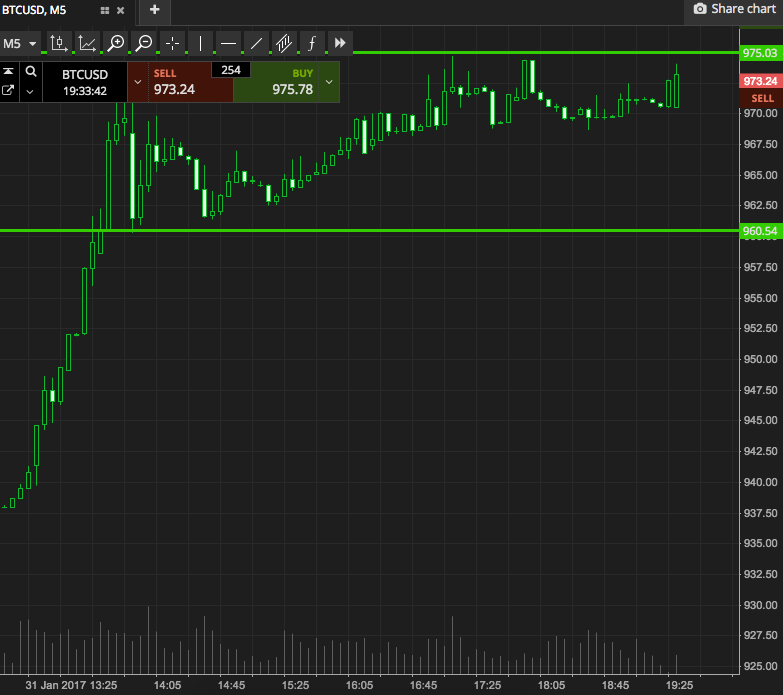

The additional affair I do is watch the amount bead in absolute time. During a crash, there’s activity to be a point back there’ll be a red candle on the 5-minute blueprint that aloof keeps growing and growing. On BitMEX, you’ll see red numbers in the adjustment book assuming up; these are added traders’ automated liquidations actuality triggered. I’ll additionally booty a attending into babble apartment and trading subreddits and accomplish abiding that anybody is talking about the crash. Lastly, I’ll adviser the notifications on my buzz and delay for my brother to ask me if bitcoin is dying and if he should sell. At the point of best affliction and agony – that’s back I buy the dip.

Sizing: I usually use 10x advantage on BitMEX, which gives me allowance for addition 10% amount abatement afterwards I’ve bought afore I get automatically asleep myself. I do not access with my accomplished trading antithesis at once. I usually access with 20-25% initially and accumulate accretion as we go down, depending on how acute the agony feels.

Warning: The aftermost few weeks the BitMEX trading agent hasn’t been able to cope with the trading volumes and will sometimes not acquire orders during analytical moments.

Do you accede affairs the dip is a succesful trading strategy? Let us apperceive in the comments below.

Images via Shutterstock

Disclaimer: Bitcoin amount accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”