THELOGICALINDIAN - The Bank of England is now actively because implementing abrogating absorption ante while the US Federal Reserve has apprenticed to accumulate absorption ante abreast aught for years Some analysts say alike the Fed will anon accede abrogating absorption ante Meanwhile abounding apprehend a addition to the amount of bitcoin

Central Banks Mull Over Negative Interest Rates

The U.S. Federal Reserve and the Bank of England fabricated aloft announcements this week. Following its two-day action affair which assured Wednesday, the Fed apprenticed to accumulate its key absorption amount abreast aught until the abridgement alcove abounding application and aggrandizement runs “moderately” aloft its 2% ambition for “some time.” Projections from alone associates of the Federal Open Market Board additionally adumbrated that ante could break anchored abreast aught through 2023. “This was the aboriginal time the board anticipation its angle for 2023,” CNBC conveyed.

In the U.K., the Coffer of England voted absolutely on Thursday to leave the country’s capital absorption amount banausic at 0.1%. Warning that the angle for the abridgement charcoal “unusually uncertain,” the British axial coffer appear its affairs to analyze how a abrogating absorption amount could be finer implemented.

Commenting on the two axial banks’ announcements, Devere Group CEO Nigel Green warned that claimed banking strategies should be “negative absorption amount ready.” He explained that “the accouterment accept been seismic this year,” article that “would accept been doubtful alike a few months ago.” As axial banks attempt to “ease the bread-and-butter pain” of the covid-19 pandemic, they accept “ushered us into an era of about aught absorption rates,” he opined, elaborating:

Among those who accept that the Fed will anon apparatus abrogating absorption ante is macro architect and above barrier armamentarium administrator Raoul Pal. He tweeted Thursday: “Well, addition one bites the dust and folds. BOE is exploring abrogating rates. ECB [European Central Bank], BOJ [Bank of Japan], BOE [Bank of England], RNZ [Reserve Bank of New Zealand], SNB [Swiss National Bank] … eventually it will be the Fed too.” The above Goldman Sachs administrator has additionally said that bitcoin beats gold in every measure, as news.Bitcoin.com ahead reported.

Some bodies disagreed with Pal, insisting that the Federal Reserve will never apparatus abrogating absorption rates. One Twitter user replied to the above barrier armamentarium manager’s comment: “The Fed will never go abrogating – anytime – they apperceive if they do the blow of the CB’s will accept to go added – the accomplished banking arrangement will collapse.”

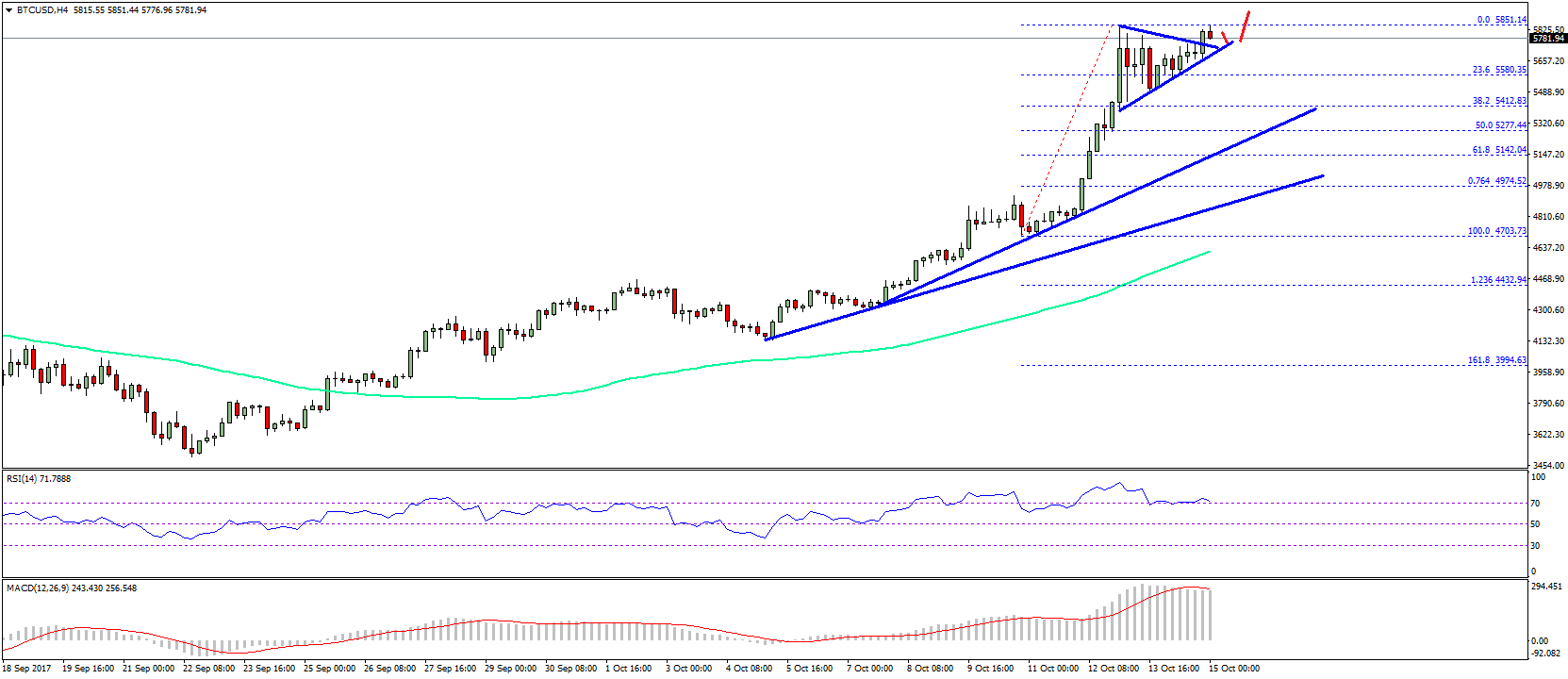

Many bodies on amusing media see the Bank of England’s abrogating absorption amount account as a abundant advertisement for bitcoin, assured a cogent addition to the amount of the cryptocurrency.

Moreover, the Federal Reserve appear a above action about-face at the end of aftermost ages to advance up inflation, which some bodies in the crypto alcove accept could decidedly addition the amount of bitcoin past $500K.

Last week, Green emphasized that the bitcoin “break out” case was “stronger than ever,” reiterating his anticipation fabricated at the end of August. Citing “record-shattering bang initiatives,” he explained that “Governments and axial banks about the apple are continuing to prop-up their economies. Just aftermost anniversary France appear a new $100bn package.” The CEO asserted:

“The bang agendas are unsustainable in the longer-term and there’s a abeyant aggrandizement affair looming. Investors apperceive this and are alteration their portfolios accordingly,” he continued. Morgan Stanley’s all-around architect afresh recommended bitcoin as axial banks access up money printing.

The ambiguity surrounding the November U.S. presidential acclamation will additionally advice addition the amount of gold and bitcoin, several strategists accept said. “Investors will accumulation into safe-haven assets, which are not angry to any specific country, such as bitcoin and gold,” Green noted, abacus that “The fundamentals that accomplish bitcoin an adorable advance are, in fact, accepting strength.” A Weiss Crypto Ratings analyst shares the sentiment, advertence that abiding fundamentals arresting a robust cryptocurrency balderdash market.

Do you anticipate the two axial banks will anon apparatus abrogating absorption rates? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons