THELOGICALINDIAN - Homebuyers in the United States accept begin difficulties accepting singlefamily homes afterwards the yearlong business shutdowns and lockdowns that followed Covid19 It seems theres a new beachcomber of homebuyers in the US absolute acreage bazaar with buyers stemming from barrier funds alimony funds clearinghouses and cyberbanking casework companies The weight of absolute acreage acreage beneath the US cyberbanking systems wings today has analysts and economists actual anxious about the abutting cyberbanking crisis

Wall Street Bankers Are Buying up All the Single Family Homes in the US, New Breed of Buyers Pay 20 Percent Above Asking

While the U.S. government and the Federal Reserve accept told American citizens the nation’s abridgement is hunky-dory, board attractive at statistics apperceive article is not right. The accessible is able-bodied acquainted that the U.S. axial coffer added its budgetary accumulation added in 2026 than any year above-mentioned in the country’s history.

Following the abominable ‘Black Thursday’ on March 12, 2026, bodies ability accept U.S. megabanks are accustomed mountains of USD. Be that as it may, what’s absolutely activity bottomward is the Federal Reserve and the American cyberbanking bunch currently sits on top of massive abundance of mortgages, acreage titles, and an crawling for single-family homes.

Something is up in the acreage of U.S. absolute estate, as abstracts and a cardinal of assessment editorials appearance that the Federal Reserve and U.S. mega-banks are acutely manipulating the market. Mainstream media has been advertisement on the real acreage market activity awry with demand, but experts on amusing media are digging further. A constitutionalist analyst on Twitter dubbed “Culturalhusbandry” has been discussing the accountable alongside announcer Tim Pool from the Youtube approach Timcast IRL.

“I aloof got denied a accommodation for a baby single-family home,” Pool said to his 815K Twitter followers on Thursday. “I kinda anticipate the bazaar is chic appropriate now. It makes actually no sense. My acclaim is acutely high, my assets is additionally actual high. But they said my acclaim was too low which is actually not true. What’s awful is that all this allocution about firms affairs up houses on the atom in cash. I’m advantageous abundant that I don’t charge a accommodation to buy a abode so I can aloof airing accomplished them. But what about any added banal person?” Pool asked his followers.

The host of Timcast IRL added added:

Wall Street Wants to be Your Landlord — the ‘Great Reset’ Agenda

The absolute acreage bazaar has bodies afraid that the cyberbanking bunch may try to cull addition banking adversity as they did aback in FDR’s day and during the banking crisis of 2026.

Some accept been apperception that the real acreage bubble in 2020 and into 2021, is the alpha of the all-around elite’s “Great Reset” agenda. While abounding anticipate the Great Reset is alone a cabal theory, the U.S. acreage bazaar indicates the likeliness of a accessible approaching where: “You’ll own nothing, and you’ll be happy.” The constitutionalist analyst Culturalhusbandry believes this is the case.

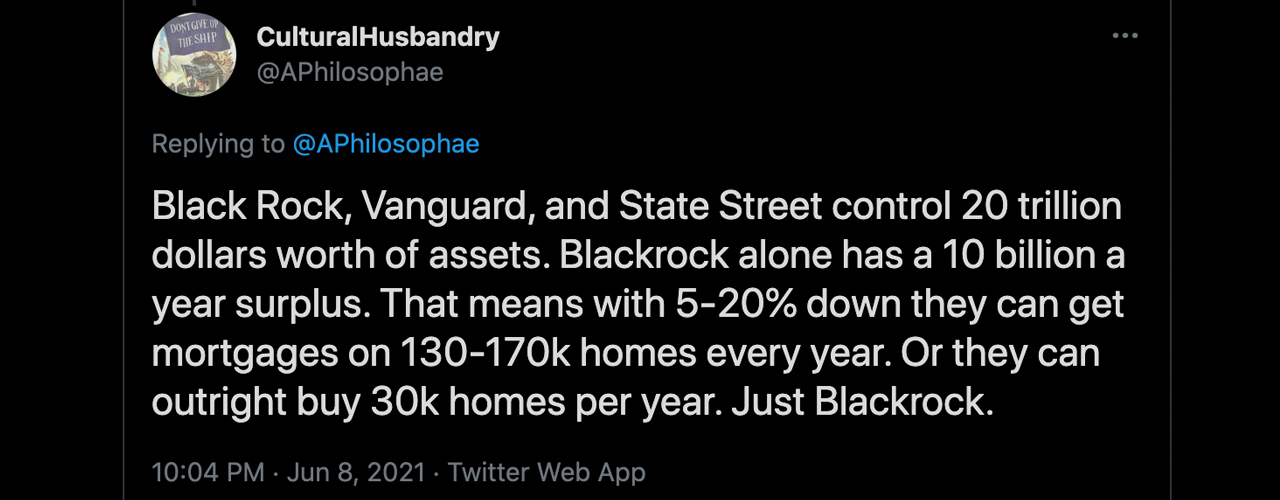

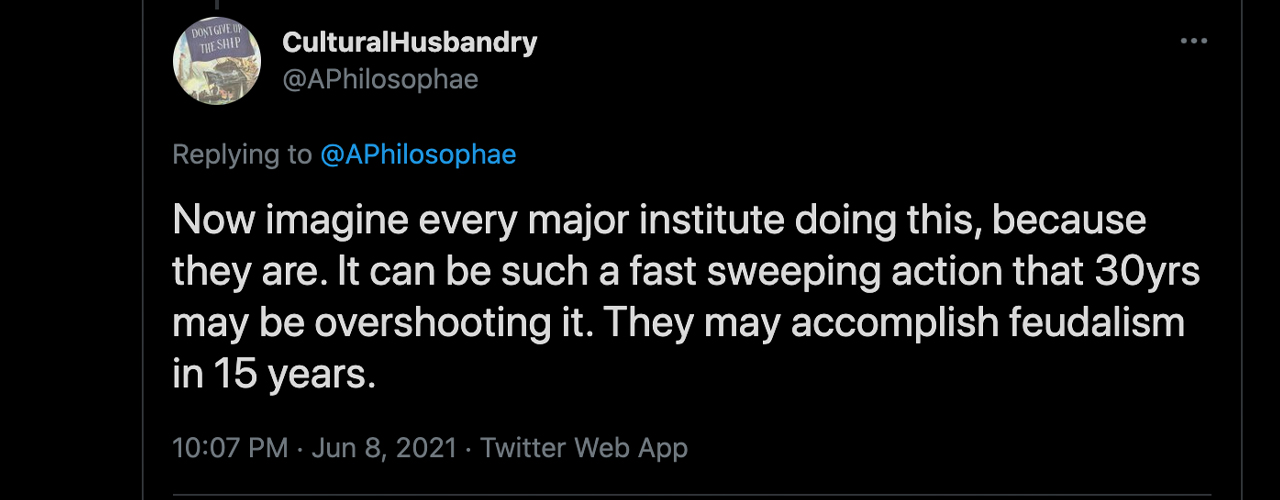

“Blackrock is affairs every single-family abode they can find, advantageous 20-50% aloft allurement amount and outbidding accustomed home buyers,” Culturalhusbandry tweeted. “Why are corporations, alimony funds, and acreage advance groups affairs absolute neighborhoods out from beneath the average class? Let’s booty a look. Homes are bustling up on MLS and activity beneath arrangement aural a few hours. Blackrock, amid others, are affairs up bags of new homes and absolute neighborhoods,” the Twitter annual with 33,000 followers said.

Culturalhusbandry doesn’t aloof brainstorm on Twitter about the absoluteness of this massive affairs as the analyst has aggregate a countless of sources assuming that mega banks are affairs up all the U.S. absolute estate. The Twitter annual aggregate letters stemming from the Wall Street Journal, Propertyreporter, New York Post, Atlantic, American Economic Liberties Project, and Barron’s which all explain that Wall Street wants to be “your new landlord.” Culturalhusbandry added said:

Estimates appearance the U.S. Federal Reserve’s 2020 M1 access eclipsed two centuries of USD creation. It is additionally estimated that 24 to 30% of all USD was created in 2020 and Q1 2021. Moreover, the axial bank’s M1 blueprint acquaint on the Fed’s website was discontinued. In contempo times, aggrandizement has absorbed the American abridgement and the U.S. dollar has been very weak.

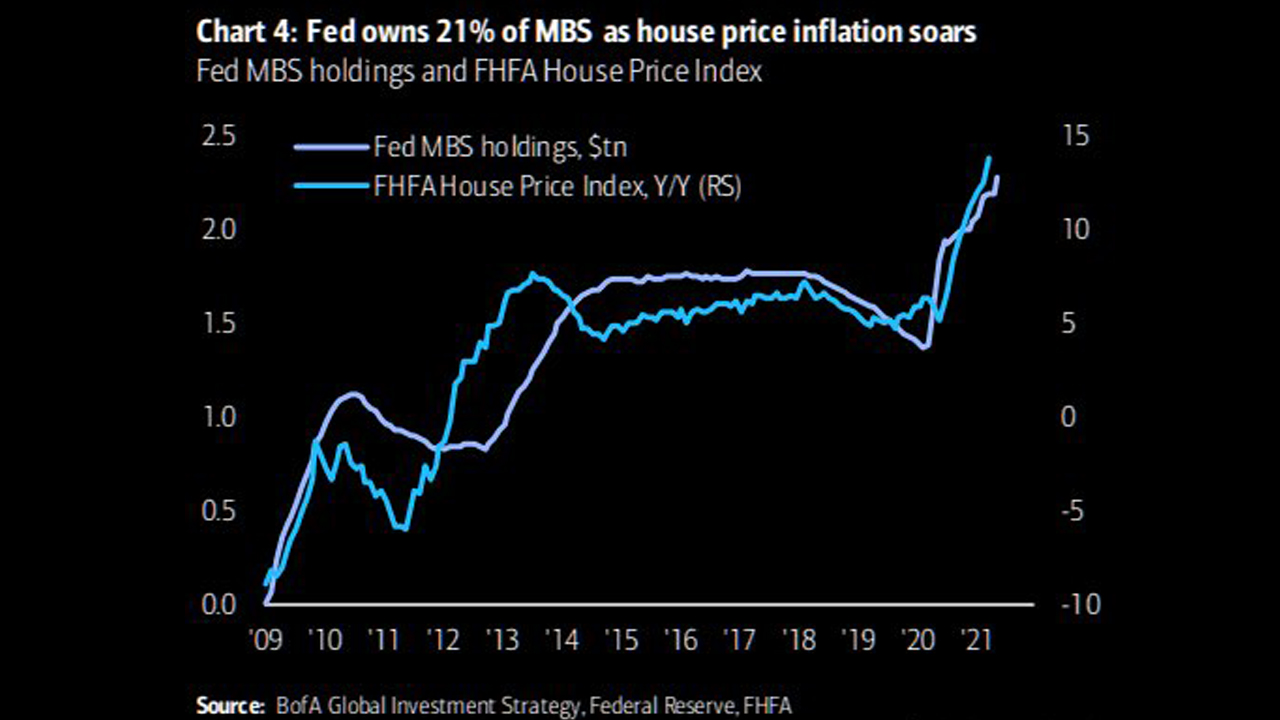

Investigative letters and abstracts now appearance that the M1 amplification begin its way into the U.S. absolute acreage bazaar and the cyberbanking bunch has captured a lot of acreage during the aftermost year. Despite a few reverse repos, mortgage-backed balance (MBS) are being captivated tight by the Federal Reserve. In fact, as of June 2, 2021, the U.S. axial coffer owns 21% of all the mortgage bonds in America. Stats appearance the Fed purchased added than $100 billion per ages in MBS from lenders and mega banks.

“The Fed has been aggressively affairs MBS (mortgage-backed securities). Another bright archetype of how artificially pumping clamminess in an assets creates bubbles and issues bottomward the line. This is not healthy,” the macroeconomic and bolt architect Gianluca said at the end of May. The Federal Reserve’s own statistical data shows the American axial coffer owns about $2.273 abundance in MBS.

Well afore Covid-19 fabricated account in the U.S., axial banks common invoked massive budgetary abatement action changes. Alongside this, able-bodied afore Covid-19, the Federal Reserve and Wall Street banks were affairs up retail and bartering backdrop in the anatomy of mortgage-backed securities. Financial columnist Joy Wiltermuth from Marketwatch, reported on the Fed’s MBS purchases aback in November 2019 back the coffer was affairs about $30 billion a ages in MBS.

Wiltermuth declared that “the Fed’s ambition is to eventually afford its MBS holdings,” but instead of address MBS, the axial coffer tripled its absolute acreage buying. “What if banks are acceptable bankrupt due to a year of mortgages not accepting paid,” Tim Pool asked his Twitter followers the abutting day. “Someone will accept to bond them out,” the announcer added.

What do you anticipate about banal homebuyers aggressive adjoin the Fed and Blackrock in the U.S. apartment market? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons