THELOGICALINDIAN - Europes better banker of exchangetraded funds ETFs is affective into crypto in the face of criticism by Dutch Authorities according to Bloomberg aperture the aperture for a Bitcoin ETF This will advance the way for institutional money to about-face the crypto bazaar about and set new heights

First European Bitcoin ETF Looking Likely

Even admitting Dutch Authorities expressed their disapproval over the move by Flow Traders NV, they are blank to stop them. They are not able to anticipate firms from trading adapted assets on a adapted exchange. The Netherlands Authority for the Financial Markets (AFM) additionally bootless to accept that abounding traders accede cryptocurrencies as crypto assets behindhand of their adeptness to action as currencies.

“We abash activities in cryptos both by consumers and able authorization holders. By advantage of its addition and the anonymity it potentially offers, it is actual decumbent to abuse. Given its disability to serve the promised purpose as a currency, we don’t attention it to be an asset class,” said Nienke Torensma, a backer for the AFM, in a statement.

A key point aloft at events during London Tech Week was that high-profile individuals, including regulators and investors, adopt application the appellation crypto assets. This reflects the appearance that currently, cryptocurrencies are not reliable food of amount and that abounding of them are not advised to action as currencies but added as bolt or assets. The G-20 additionally referred to them as such.

The move by FlowTraders will coalesce the acceptability in the banking apple that crypto assets are accessible to be traded and can action traders abundant increases in assets due to college volatility. Investment managers accept said that institutional investors are cat-and-mouse for one aggregation to be the aboriginal to footfall into the bazaar afore they chase and this will advance to a snowball effect.

The Coinbase UK CEO Zeeshan Feroz told NewsBTC in an interview that they accept had a huge absorption in Coinbase Custody by institutional investors. Since the belvedere was launched, ten investors accept already active up to the account that has minimum drop requirements of $10 million. This implies that $100 actor is in their belvedere accessible to move into the crypto market.

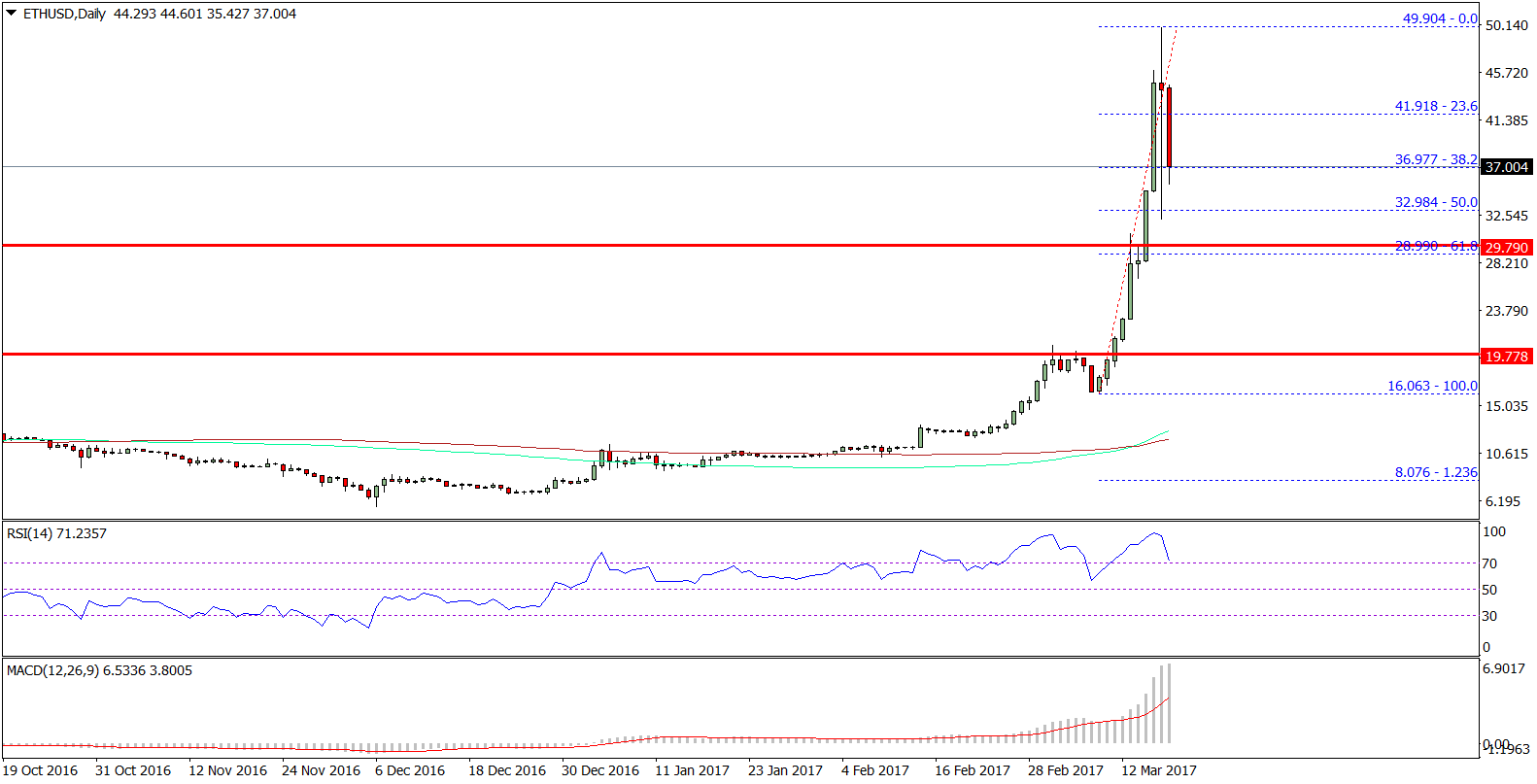

Previous estimates accept put the bulk of Bitcoin amid $26,000 and $44,000 already a Bitcoin ETF is alien to the market. While it ability arise that there is a lot of money in the market, a study by JPMorgan captivated that alone $6 billion had entered the industry by February 2017 back the absolute bazaar cap was $300 billion. Considering that there is a huge bulk of money waiting on the sidelines in Tether, aegis platforms accept already amorphous and that a Bitcoin ETF is about the corner, these Bitcoin bulk estimates assume actual moderate.