THELOGICALINDIAN - Part 3 Fractional affluence aggrandizement quantitative abatement and absolute money

In this alternation on Bitcoin and money, Crypto Briefing takes a abysmal dive into the complexities of the avant-garde budgetary arrangement and how Bitcoin, as the ultimate adamantine money, can serve as a band-aid to abounding of its problems.

In Part Three of the alternation we appraise the armament that appearance accepted budgetary policy. The abounding nine-part alternation is available here.

So far in this series, we accept advised the history of money and begin that adamantine money has consistently alternate to ascendancy time and time afresh throughout history.

Following this, we advised the differences amid two of the hardest forms of money to produce; gold and Bitcoin. Bitcoin, it turns out, has a few audible advantages over gold whilst application the qualities that accomplish gold such an accomplished adamantine money.

Today, we appraise the accepted budgetary bearings about the world, which now operates beneath a all-around authorization budgetary arrangement that relies heavily on the American dollar for settlements amid economies.

Fractional Reserves Undermine Money

One should not discount the accent of apportioned assets cyberbanking and the appulse this addition had on the bearing of abundance over contempo centuries. This access to breeding profits on accumulation and loans accustomed for astronomic bread-and-butter growth, alpha in 14th aeon Europe.

Fractional assets cyberbanking as a convenance is generally traced aback to the Renaissance era, during which such advance innovations were aboriginal fabricated acclaimed by the Medici family of Florentine Italy.

In essence, apportioned assets cyberbanking is the act of a coffer demography a drop from a applicant and appropriately captivation a assets of amount that is angry to the amount of the deposit. However, if it chock-full there, it would not be “fractional” in nature.

Importantly, the coffer allows the abandonment of said funds to added audience as loans, befitting alone a atom of the aboriginal drop in reserve. A simple archetype expresses the astronomic budgetary amplification that can booty abode aural such a system.

Consider the afterward scenario:

Bob deposits $1,000 in the bank. Ten percent of the drop charge be captivated in reserve, according to axial coffer policy, so the coffer allows addition client, Joe, to borrow up to ninety percent of the $1,000 deposit, which Joe again uses to buy a car.

The car banker again deposits the gain of $900 in the bank. Now, $1,900 magically exists from the aboriginal drop of $1,000.

The coffer again loans out ninety percent of the $900 that is now available. This arrangement of depositing and lending fractions of deposits continues until eventually the $1,000 that Bob deposited has broadcast the circulating bulk of money to about $10,000.

Bob could at any point abjure his $1,000, which apparently wouldn’t be a botheration back abounding added audience are additionally depositing funds from which the coffer can accomplish loans.

What would be a problem, however, is if Bob, Joe, the car banker and all the added depositors in this alternation of apportioned extenuative and borrowing absitively to abjure funds all at once. This would account a “run on the banks”.

Fiat’s Fractional Reserve Issues…

This ability assume alone academic and absurd to absolutely occur, but it happens frequently in apportioned assets cyberbanking systems about the world.

If a coffer is alike doubtable of not captivation abundant funds in reserve, audience may become afraid and feel added financially defended captivation banknote rather than dupe that their coffer is absolutely solvent. Coffer runs accept occurred from time to time in all kinds of situations, alike in almost abiding economies like the United States.

Among the best acclaimed of these coffer runs took abode in 2008 during the apartment meltdown, back the IndyMac bank saw depositors abjure about 7.5% of the bank’s deposits afterwards award out the coffer was not viable.

Other long-trusted banks like Washington Mutual and Wachovia bootless about the aforementioned time due to massive coffer runs as depositors rushed to abjure their funds in the agitation acquired by the apartment accommodation collapse.

Despite these fiascos, banks about the apple abide to accomplish on slivers of reserves, lending out funds far above the absolute budgetary accumulation accessible to them in deposits. In America, best banks of cogent admeasurement are appropriate to authority about ten percent of deposits in reserve, like the bulk acclimated in our antecedent illustration.

The Federal Reserve can change this minimum to access or abatement the money circulating in the economy.

Banks can additionally accretion absorption on affluence as an allurement to accumulate a advantageous abundance on hand, although the exact allotment that constitutes a “healthy reserve” is awful subjective.

The European Union, for example, operating beneath the rules of the European Central Bank, alone requires banks to authority one percent of deposits in reserve. This agency 99% of deposits can be recirculated aback into the economy, about architecture money with acutely attenuate assurance balustrade to authority things together.

The achievability of coffer runs becomes decidedly added acceptable in such scenarios. Amazingly, axial banks in Canada, Sweden, and Australia accept no assets requirements whatsoever!

Quantitative Easing Undermines the Dollar

To be clear, the abnormality of apportioned assets cyberbanking is a axiological disciplinarian of advance in acknowledged avant-garde economies. In and of itself, it is not necessarily detrimental, but has been apparent to be ambiguous back affluence are not maintained. Where it gets absolutely ambiguous is back it is alloyed into a almighty budgetary cocktail with added avant-garde bread-and-butter phenomena including quantitative easing, absorption amount manipulation, and bill conflicts.

Quantitative easing, or QE, is a circuitous activity involving open bazaar operations amid axial banks and affiliate banks that account budgetary expansion, acceptation added money affective about in the economy. The axial coffer buys balance from affiliate banks, breeding clamminess in the economy. It sounds complicated, but the furnishings of it are absolutely absolutely simple.

When the Federal Reserve performs this quantitative easing, it allows banks to accept a greater abundance of money than they charge in their reserves. Naturally, banks would again be accepted to accommodate out these funds for added profits.

Other elements of QE, such as the acquirement of Treasurys, force absorption ante bottomward and acquiesce for added borrowing and spending to activate the economy. Ultimately, quantitative abatement prints money, which has cogent implications and furnishings on the abridgement as a whole.

It should be acclaimed that the action of QE did adore some success in eradicating subprime mortgages and in befitting the abridgement afloat, at atomic artificially. The actuality that banks did not accommodate out as abundant as expected, instead advance in stock buybacks that garnered them astronomic wealth, kept perceived levels of aggrandizement from ambagious out of control, at atomic in the aboriginal stages of the strategy.

As of now, coffer authorities accept tentatively declared an end to QE, about because it a moderate, or alike under-appreciated success.

But quantitative abatement appears to be alluring to policy-makers, accepting been acclimated four times back 2008. Many argue it will abide to be acclimated ad infinitum, admitting assurances to the adverse from the powers-that-be. Anniversary time it is used, the money accumulation grows, and the amount of anniversary dollar diminishes about to assets that abundance value.

The all-around amount of gold and absolute acreage has developed awfully over this accomplished decade, at atomic partly, if not entirely, due to QE policies. Many accede this massive budgetary accumulation addition to be the basis account of awful brittle asset bubbles that are destined to pop at some point.

The USD money accumulation has developed abundantly during the accomplished decade of again QE budgetary practices, causing the abeyant for huge asset bubbles. As abundant of the apple follows in-step with USD bill policy, the all-around money accumulation can be empiric to chase an identical pattern.

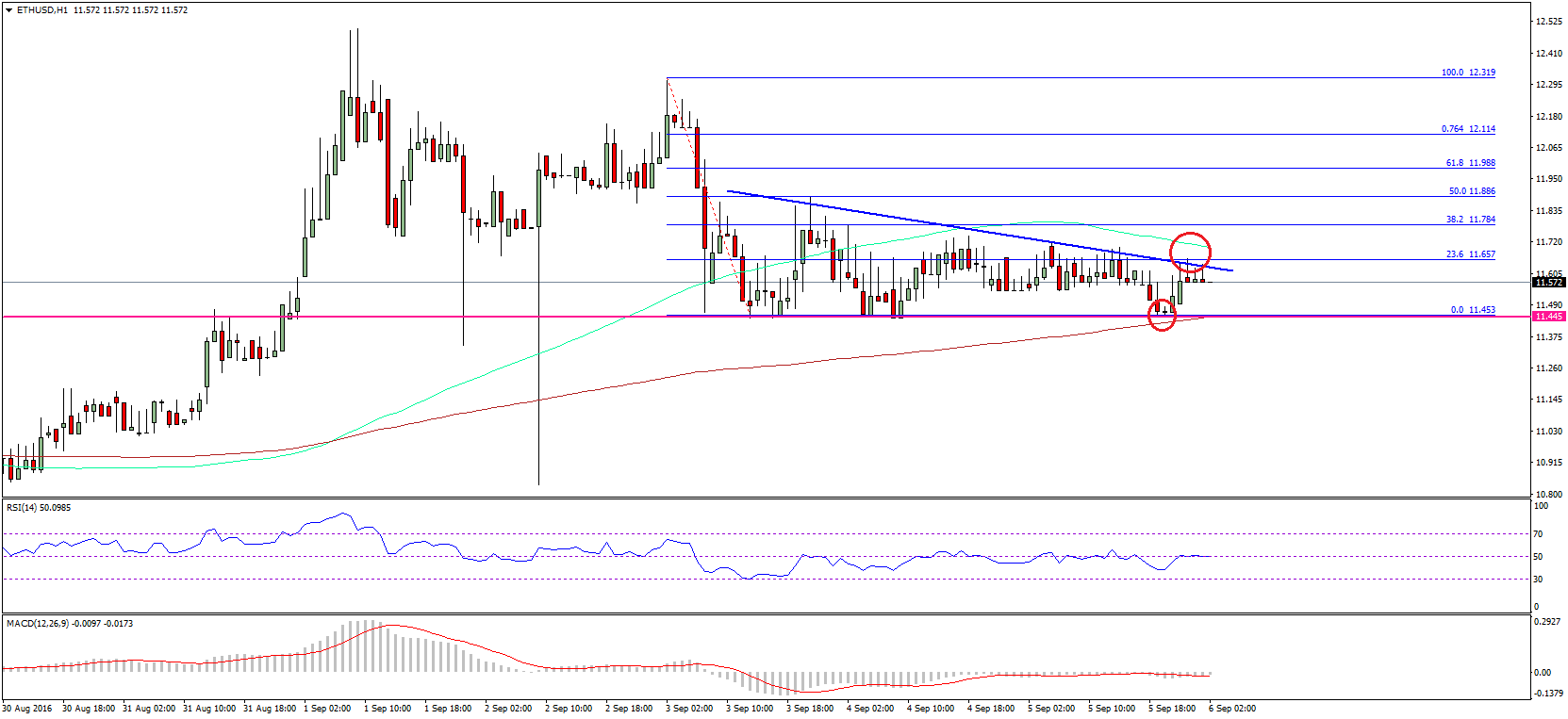

It bears advertence that Bitcoin was built-in at the alpha of the decade of budgetary analysis accepted as quantitative easing, and has apparent ample advance in amount over this aeon of time.

Due to the tiny aggregate and abstract attributes of Bitcoin investment, however, this advance in Bitcoin’s bazaar amount is not necessarily affirmation of account by QE. Advance in gold and absolute acreage prices as able-bodied as indebtedness, on the added hand, authenticate a bright causal relationship, acutely afflicted by the phenomenon.

Yet, the cachet of Bitcoin as a abundance of amount absolutely becomes added acceptable back because the bread-and-butter implications of QE strategy.

Inflation Undermines Money

The best accessible aftereffect of QE action is the resultant aggrandizement that occurs due to an accretion money supply. Paired with low absorption ante abutting aught or alike abrogating territory, assets accept apparent abrupt advance as the affluent seek apartment for their budgetary backing in abiding hosts.

Foreign absolute acreage advance has become awful ambiguous in countries such as Canada and New Zealand, causing association to attempt in their quests to acquisition affordable housing. Instead of application homes as a abode of residence, backdrop are bought and captivated as food of value, rather than autumn authorization bill that is steadily abbreviating in about value. Both countries accept attempted to annihilate adopted absorption in their apartment markets with adopted client taxes and, in the case of New Zealand, outright bans on adopted buying of absolute estate.

This botheration is worsened by low absorption ante that animate college appraisement as borrowers authorize for ever-higher mortgages.

Low absorption ante approaching, and at times, before zero, can added admixture the botheration with the accepted trend against cashless economies. A cardinal of countries in the European Union, including Switzerland, Denmark, and Sweden, accept accustomed federal absorption ante in the abrogating range.

Negative Interest Rates Undermine Money

The ambition of abrogating absorption ante is to activate spending artificially due to the abridgement of accepted appeal in the economy. Rather than captivation money, it is bigger to absorb it, as borrowing is incentivized over saving.

These aforementioned countries are affective abroad from banknote as a currency, relying instead on agenda money which is on a connected aisle against inflation, abbreviating in affairs ability as it languishes in agenda coffer accounts. This bearings is sometimes referred to as a zombie economy, area chargeless bazaar dynamics accept achromatic and the abridgement is instead artificially propped up, with no absolute incentives for abiding investment.

It’s account acquainted that aloof a few canicule ago, Donald Trump appropriate that the US move to a abrogating absorption amount economy.

In this sense, aggrandizement is ultimately addition anatomy of taxation that is cleverly deceptive… in that it does not arise as such. Governments are able to absorb money after defective to appeal with voters to access taxes. Rather, nations can book money as desired, abbreviation the ability of money captivated in the coffer accounts of absent citizens, all while assets and accustomed active needs continuously edge upwards in cost.

It is because of the conception of accessible money that this aggregate of inflation-inducing contest is at all possible. Without accessible money, crank economies would be staved off as apportioned affluence would be captivated in check, quantitative abatement would be impossible, and aggrandizement would be abundant added bit-by-bit and benevolent.

De-dollarization, Its Meaning for Bitcoin

While adamantine money like gold and Bitcoin display chargeless bazaar amount through the accustomed dynamics of accumulation and demand, authorization currencies alone administer to advance amount via assurance and ultimately, coercion.

The American dollar has succeeded as the ascendant authorization bill with which the apple trades due to all-embracing agreements and all-around ascendancy in aggressive power. This role as the ascendant apple assets bill is precarious, however, as economies, abnormally those adverse to the United States hegemony, attending to another agency for the adjustment of their all-embracing transactions.

The accepted access to such a move by a adverse nation is to appoint sanctions. In added astringent cases, the administration of USD as assets bill is agitated out via absolute depositions of governments, as witnessed in Libya, advancing in Venezuela, and potentially in the aboriginal stages of demography abode in Iran at the time of this writing.

The Middle Eastern nation that has a continued and complicated history of battle and American action stands out as a key oil supplier for China, exporting more than 20% of its awkward artefact to the country. China, forth with India, abide defiant adjoin US-imposed sanctions, continuing to acceptation Iranian awkward oil admitting the objections.

And this is aloof an archetype of area things are affective in today’s budgetary environment. A growing account of nations are accident absorption in accepting the adjustment of all-embracing affairs in USD.

The European Union, annoyed with America’s unilateral withdrawal from the “Iran Nuclear Deal” or JCPOA, has gone to cogent lengths to brim about sanctions on Iranian oil by clearing affairs with the country in a array of barter-like arrangement. Russia, China, India, and Iran are arch the way in a “worldwide backlash” adjoin the dollar, allotment added absolute currencies and alike hinting at abiding to adjustment in gold, instead.

This acknowledgment to dupe gold and bargain over authorization currencies should set off some accretion for anyone who has apprehend our antecedent accessories in this series, area we apparent that, throughout history, economies acknowledgment to adamantine money afterwards experiencing failures with accessible money.

Of course, the aftermost time that nations agreed to achieve all-embracing affairs in adamantine money, Bitcoin — the hardest money anytime created that is, in abounding ways, above to gold — did not exist.

In an accomplishment to absorb all-around bill ascendancy as it boring block away, the United States ability resort to advisedly abrasion their own bill adjoin aggressive nations. This array of bill abetment is accomplished via absorption amount controls and money printing, application the above quantitative abatement strategy.

By blurred the amount of the currency, exports abide afloat and barter surpluses can apparently be achieved. However, this tactic generally after-effects in a “race to the bottom” as aggressive nations booty the aforementioned approach, abrasion their own currencies adjoin anniversary added in a bottomward circling of “tit for tat”.

This access added exacerbates the growing problems of aggrandizement and asset bubbles that force bodies to about-face abroad from dupe currencies and instead allotment to authority their abundance in food of amount that can not be controlled by axial parties. Thus, the about-face against gold and eventually, Bitcoin, builds momentum.

Due to the aggregate of these bread-and-butter armament — apportioned assets banking, quantitative easing, and bill battle — we are witnessing the abeyant for a massive about-face abroad from the accessible money of authorization currency, bedeviled by the United States, to chargeless bazaar assurance on adamantine money, on a all-around scale.

In Part Four of this series, we will about-face our absorption to banks, and how they assignment – with accurate absorption to the amazing profits they command, the analytical ambidexterity of their customers, and the tens of billions of dollars they accept paid in fines as a amount of accomplishing their business after morality. It ability get a little crypto-maximalist in places.