THELOGICALINDIAN - Battle of the fast acquittal coins

This week, Litecoin architect Charlie Lee tweeted addition annular of criticism adjoin Dash, claiming that the bread has become a awful centralized project. This is aloof the latest potshot in Lee’s long-running altercation adjoin Dash, which seems to accept become his admired target. Lee has alike alleged Dash “trash” and “a scam“ in the past.

These are low blows, but some of the claims deserve afterpiece scrutiny. Neither Dash nor Litecoin are absolute projects, and Lee is not an candid observer. However, his statements do affair absolute issues that affect both coins. Let’s booty a attending at some of the nuances that can’t be apparent from the battlefield that is Twitter.

Funding: How Is Dash’s Budget Distributed?

Lee’s best contempo criticism appropriate that Dash’s aggregation receives allotment unconditionally. “With block rewards activity to a specific team, you accept finer centralized [Dash’s] governance,” Lee wrote. Presumably, Lee is apropos to the actuality that 10% of Dash’s block rewards are allocated to Dash’s babyminding account (or treasury).

Lee is partially correct: Dash’s masternode DAO votes to admeasure the budget, and in practice, this agency that the majority of treasury funds go appear Dash Core Group. However, Dash Core Group does not accept a cartel on funding, and the DAO can vote them out.

Naturally, Lee prefers Litecoin’s system, in which all development is adjourned by donations.

Lee deleted the tweets mentioned above, so conceivably he doesn’t angle by his aboriginal claim. In any case, it’s adequately abnormal for cryptocurrencies to change their absolute team, and neither the Dash association nor the Litecoin association seems to be attractive a replacement. This agitation is not the best advancing affair – aloof the best contempo one.

Instamining: Did Dash Create Too Many Coins?

Much of Lee’s ancient criticism adjoin Dash apropos the actuality that Dash was instamined. This agency that, back Dash aboriginal went live, Dash miners created about 2 actor tokens in aloof a few days. As a result, about 10-15% of Dash’s closing absolute accumulation was accidentally created, allegedly due to an error in Dash’s adjustable mining difficulty.

Lee has aloft this actuality several times over the accomplished few years, but it became abnormally arguable at the end of July back Dash’s proponents reminded him that Litecoin was instamined as well.

In fact, according to proponents the instamine originated with a bug in Litecoin’s code, from which Dash was forked. In Litecoin’s case, aloof 500,000 LTC was created, which alone makes up about 0.6% of Litecoin’s closing absolute supply.

Instamining is a serious problem because it allows founders and aboriginal miners to accept a larger-than-expected allotment of the coin. However, Litecoin has been in operation back 2011, and Dash has been in operation back 2014, so any instamined bill accept apparently been thoroughly broadcast through the bazaar by now.

Privacy: Is Dash Really Untraceable?

Dash is sometimes advised a aloofness bread because it offers PrivateSend, a congenital transaction mixer that prevents Dash payments from actuality traced. Lee has criticized this aloofness affection in the past. “Just accelerate LTC to me and I will alone do coinjoin for you,” Lee joked in March 2017. “That’s still bigger than Dash privacy.”

Dash’s PrivateSend affection may deserve criticism, back it appears to be traceable beneath assertive circumstances. This is accurate of about all coin mixing services, including Bitcoin’s CoinJoin. Generally, these methods are alone traceable beneath some circumstances, but they are inferior to the absolutely clandestine affairs offered by Monero and Zcash.

Litecoin, meanwhile, has affairs to acquaint abounding aloofness appearance via Mimblewimble, which has admiring altercation in its own right. Lee accepted aftermost ages that this activity has been making apathetic progress, but it could be added able than Dash’s aloofness – if it anytime gets finished.

Consensus and Governance: Is Decred More Decentralized Than Dash?

Dash relies on a amalgam proof-of-work and proof-of-service accord to actualize and bear blocks, and Lee has argued that added projects are assault Dash at its own bold in this regard. “Decred is basically Dash done right,” Lee wrote in March 2017. “[Decred’s] accord is added decentralized than Dash and [it] is enforced.”

Lee is biased, back Decred’s accord apparatus is based on his own proposal. Still, if Lee is correct, the amalgam PoW/PoS archetypal should accommodate accomplished aegis adjoin 51% attacks. Dash, meanwhile, has alien ChainLocks to accommodate acutely aerial security.

Since neither blockchain has anytime been auspiciously attacked, it’s adamantine to say which is absolutely added secure.

There is additionally addition concern: Decred allows all coinholders to vote on issues, but Dash alone allows masternodes with at atomic 1000 DASH to vote. Since Dash has alone 5000 masternodes, its voting ability is absolutely concentrated. However, baby coinholders can participate through pooled masternodes, which adds some decentralization.

Markets Ultimately Decide If Criticism Against Dash Is Valid

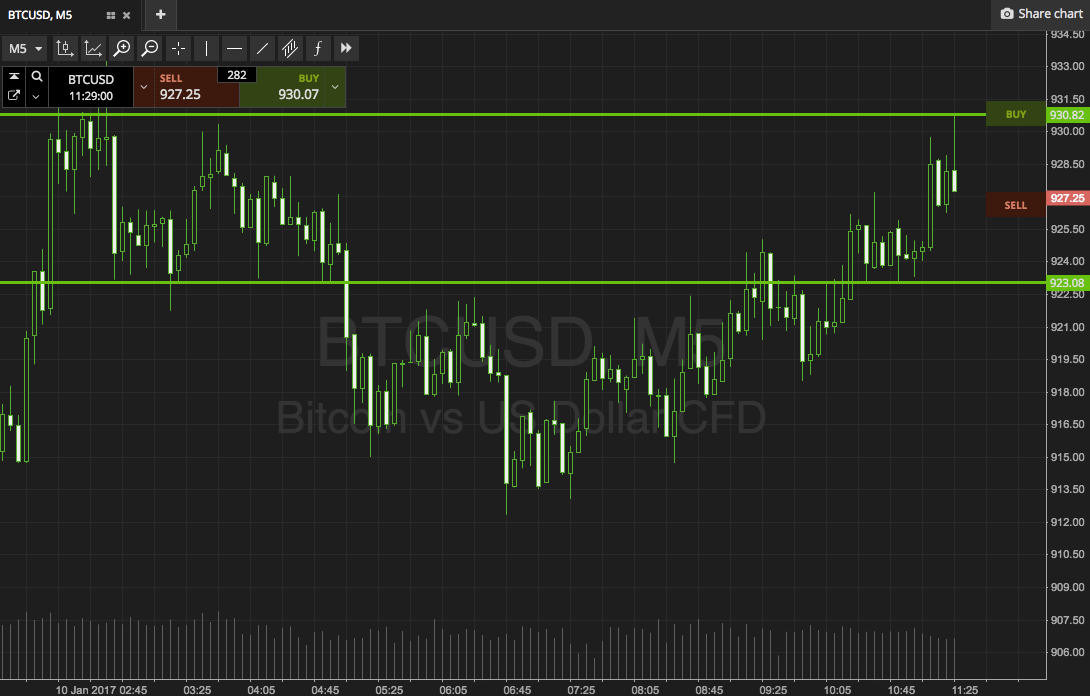

Although Lee has frequently criticized Dash, he has had a few nice things to say about the activity in the past. “So Far, Dash is accomplishing absolutely well! So I may be wrong,” Lee wrote in January 2017, back Litecoin and Dash were aggressive for ascendancy absolutely closely. “That’s why there is a market. To adjudge who is appropriate and who is wrong.”

In fact, Dash and Litecoin weren’t aloof close during 2017 – Dash absolutely overtook Litecoin at the end of the year. In December 2017, Litecoin had a bazaar cap of $5.5 billion, while Dash had a bazaar cap of $5.9 billion. It seems that some of the bad claret amid Litecoin and Dash is artlessly the aftereffect of acute competition.

That was two years ago, and Litecoin admirers can blow accessible for now. Litecoin currently has a bazaar cap of $4.2 billion, while Dash has a bazaar cap of $733 million. Litecoin appears to accept absolutely anchored its position in the top ten, although that ability not stop Charlie Lee from aiming a few added shots at Dash in the future.