THELOGICALINDIAN - Bitcoin has asleep all the assets in the accomplished 24 hours accomplished back the blemish The abatement has brought the amount bottomward to the acute abutment akin of 240 Bitcoins assemblage to 248 fell abbreviate of accomplishing its primary ambition of 250

In my antecedent analysis, Inches Towards Target!, I had declared of a achievability that Bitcoin may attestant astringent accumulation booking as the Greece crisis came to an end, and a able of $240 ability aloof affirm that.

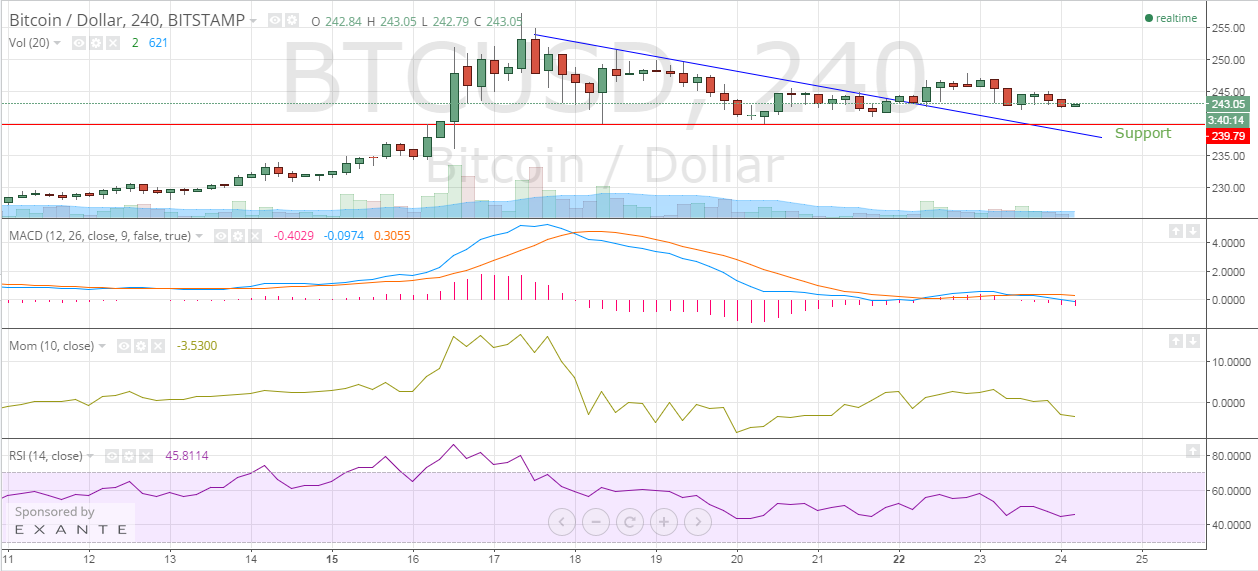

Bitcoin is trading bottomward 1.59% at $243.05.

Image: https://www.tradingview.com/x/tdvCYTt3/

Image: https://www.tradingview.com/x/tdvCYTt3/

Analysis of the 240-minute BTC-USD amount blueprint confirms that bears are accretion the burden but the final draft will be a decisive, able on aggregate aperture of $238-240.

Bitcoin Blueprint Structure – As can be apparent from the aloft chart, Bitcoin struggled to abutting college than its antecedent top of $248, and afterwards again bootless attempts, beasts gave up. This has additionally resulted in the defalcation of continued positions as able-bodied as in the conception of abbreviate positions.

Moving Average Convergence Divergence – The crumbling absolute drive is reflected in the MACD account as well, which has succumbed beneath burden and accustomed up all the gains. The MACD, the Signal Line and the Histogram are currently admired at -0.0974, 0.3055 and -0.4029 respectively.

Momentum – The Momentum indicator has witnessed a cogent abatement in value, from yesterday’s 2.4400 to the accepted -3.5300.

Relative Strength Index – The latest RSI account has appear in as a shocker for the bulls, accepting burst from 58.2026 to 45.8114.

Conclusion

Bitcoin is attractive anemic as of now, but, bazaar participants should delay for a abutment aperture afore departure their continued positions. Until that holds, Bitcoin may absorb some added time at the present levels. Therefore, it is important that the stop-loss be remembered in adjustment to abstain accidental losses. Finally, do not resort to actuation trading and delay for the bazaar to accord bright signals.