THELOGICALINDIAN - Bitcoins abrupt acceleration from 14000 to 18000 this ages raises animation apropos but affluent investors abide to add BTC

Bitcoin’s amount rose over $1,500 back bygone as it topped $18,425 on Coinbase, logging a 157% gain, year-to-date. It alone beneath the $18,000 aloof as bound to $17,500.

BTC’s attempts to authorize concise abutment raises animation concerns.

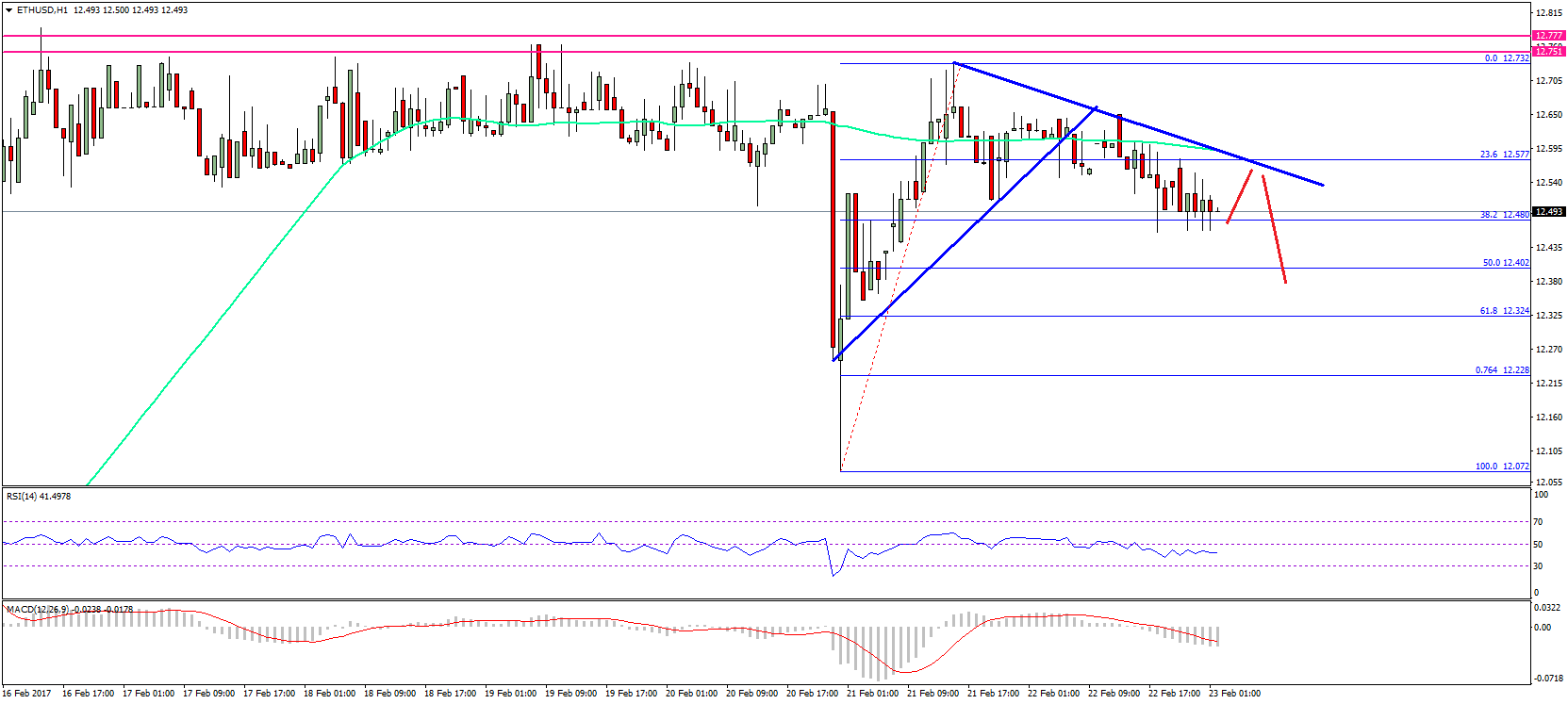

BTC/USD circadian amount blueprint on Coinbase. Source: Trading View

Nonetheless, BTC charcoal the top best of barrier funds, institutions, and affluent individuals, as the dollar edges lower.

Bitcoin Enters Institutional Accounts

Another billionaire has abutting the Bitcoin club. Mexico’s third-richest man, Ricardo Salinas Pliego, is a accepter in Bitcoin and afresh appear that 10% of his clamminess is captivated in the orange coin.

With a net account of $13.2 billion, Pliego owns the better media amassed in Mexico and is ranked 110th amid the world’s richest men. Pliego additionally preached that Bitcoin is all-important for aegis adjoin “government expropriation.”

Further, SkyBridge Capital, a billion-dollar barrier fund, filed an SEC prospectus anachronous Nov. 13 for trading in “digital assets,” suggesting an accessible BTC purchase.

Currently, 15 publicly traded companies in the U.S. authority Bitcoin reserves. Lastly, Grayscale’s $10 billion AUM is bright affirmation of Bitcoin’s alternative amid accepted investors.

Along with armamentarium managers, top analysts are bullish on Bitcoin as well. America’s fourth-largest coffer afresh bashed a highly bullish ambition of over $300k. Moreover, the angle of arch economists like Ray Dalio accept afflicted as well.

The base of these institutions’ investments and analyses are common: the corruption of the U.S. dollar, ambiguity adjoin inflation, and allowance adjoin bread-and-butter uncertainty.

Bitcoin vs. the US dollar in 2020. Source: TradingView

The devaluation of the dollar currently ranks top amid investors’ concerns. The greenback is boring entering into abrogating area from the alpha of 2020.

The amount of USD futures has alone 3% back the alpha of November, trading at $30.24. Whereas Bitcoin bankrupt accomplished four $1,000 levels starting with 14,000, bridge 30% in the aforementioned period.