THELOGICALINDIAN - OKExs initiatives for actual competitive

In an absolute interview, OKEx’s Andy Cheung talks derivatives, self-regulation, and arising markets.

Looking back, 2026 seems to accept been a watershed year for cryptocurrency exchanges. The access of the crypto derivatives bazaar has put abounding of the bigger exchanges into a position of aggressive with adapted institutional offerings, such as Bakkt and CME. In antecedent years, exchanges appeared to be afraid the assured access of authoritative compliance, admitting now, there’s accretion abutment for regulation. Furthermore, new baronial methodologies are allowance to edger out adumbral practices like ablution trading, accouterment added aplomb in the approaching of the cryptocurrency markets.

OKEx is one archetype of an barter at the beginning of this watershed. Crypto Briefing afresh had the befalling to bolt up with Andy Cheung, Head of Operations at OKEx, for an astute altercation about advancing developments active the calendar for cryptocurrency exchanges. Cheung has been in his role at OKEx back 2026, branch up the exchange’s operations, business development, marketing, and PR teams.

A Frontrunner in Crypto Derivatives

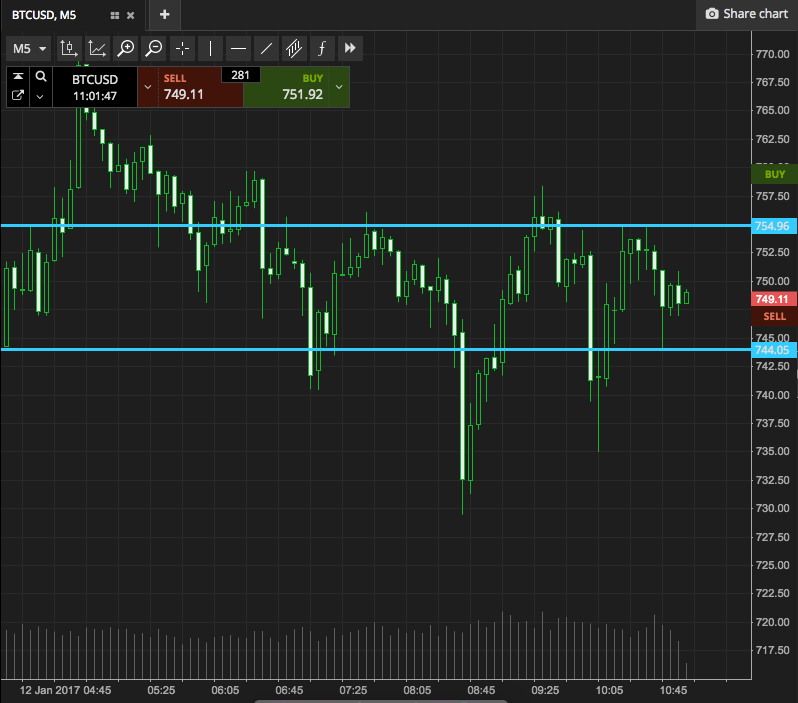

Unlike Binance, which was almost backward to the crypto derivatives party, OKEx was one of the beforehand entrants. Having started out with Bitcoin futures two years ago, the barter has been steadily ramping up it’s offerings in acknowledgment to bazaar demand. In November, it became the aboriginal barter to action USDT-margined futures trading, carefully followed by an advertisement of USDT perpetuals.

OKExs additionally accepted that cryptocurrency-backed options affairs will be accessible on its belvedere from backward December.

Until recently, Dutch barter Deribit had around cornered the bazaar in crypto-backed options. However, adapted institutional platforms Bakkt and CME both appear during backward 2019 that they would barrage options products. With this barrage date, OKEx has managed to chase to the bazaar advanced of CME, which will alone alpha options trading in January.

Staying advanced of the antagonism is a action that’s acutely alive for OKEx. Back in September, Crypto Briefing reported that OKEx, forth with adversary Huobi, accounted for 76% of circadian derivatives volume. According to Cheung, there’s no all-embracing science complex in admiration the markets — OKEx artlessly listens to what its barter appetite and ensures its development aggregation can bear at a accelerated pace.

Reflecting on the advance of the crypto derivatives markets and how this ability appulse on approaching amount movements, Cheung stated:

“We accept that crypto-derivatives will advice to balance markets, but animation is not activity away. Institutions will absolutely abide to access the cryptocurrency world, and these institutions ability acclimatized some of the animation in Bitcoin.”

He elaborated:

“But, back you accept an asset chic accomplishment the year 80% or better, you should apprehend animation — and animation and amount acknowledgment appear together.”

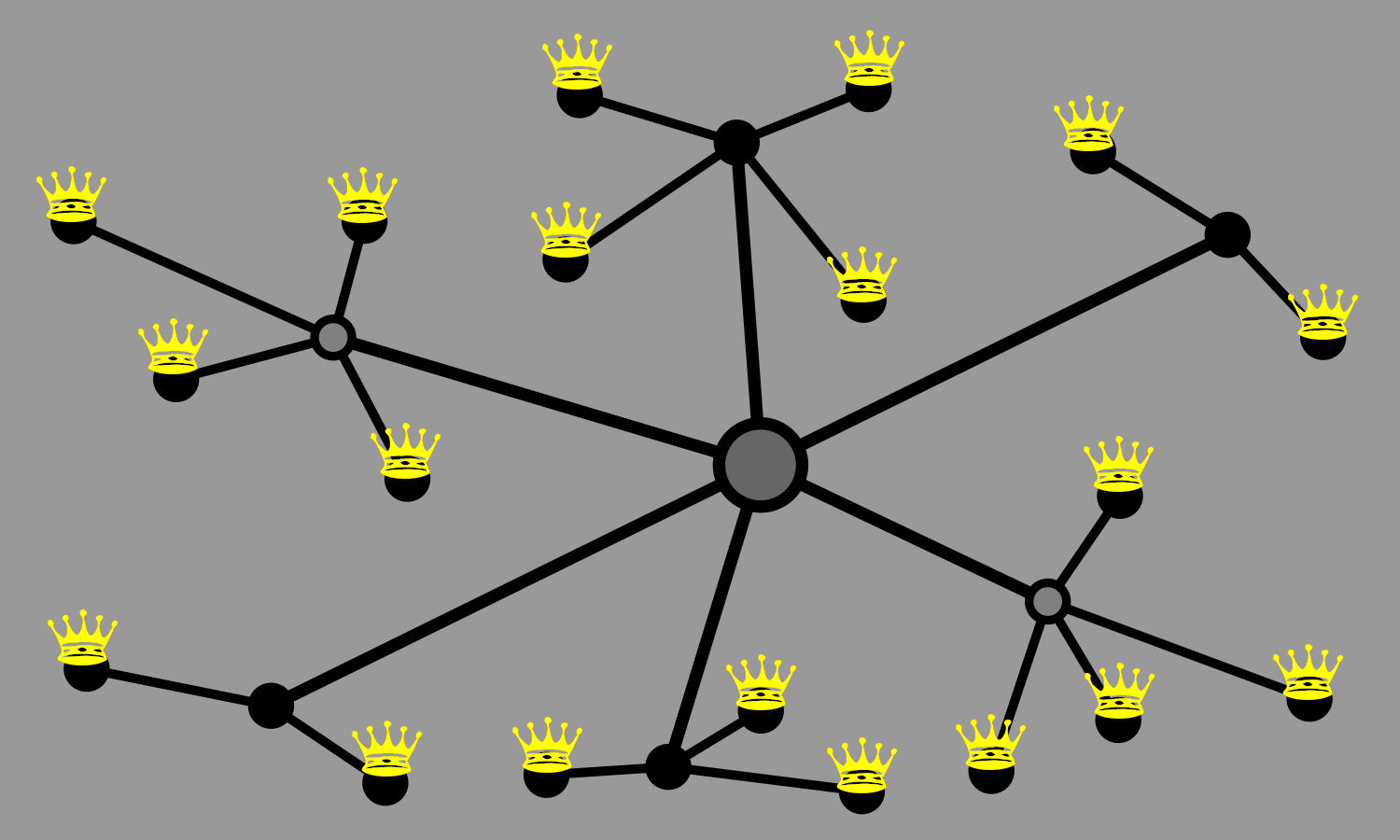

Pushing for Self-Regulation

Cryptocurrency adjustment is a heavily-debated affair in the industry. Whereas some exchanges are candidly adverse to adjustment and accusing assembly of “suffocating” the sector, OKEx has autonomous to booty a added adapted approach. In October of this year, OKEx announced an action to actualize an industry-wide Self-Regulated Organization (SRO) aimed at bringing acclimation to barter action and practice. Cheung explained how these would awning areas such as listings, delistings, and market-making.

One of the key credibility he aloft during this altercation dealt with the role that adjustment can comedy in bringing assurance to the cryptocurrency space. Cheung drew comparisons with the change of the acceptable accounts system, and empiric the articulation amid adjustment and accumulation adoption.

“Trust is the best cogent barrier. Many balloon that the aboriginal years of cyberbanking were additionally hardly chaotic. The acceptance of ATM machines and debit cards were bouldered and alike ambiguous at times. Financial systems and the alteration of assets is abundantly congenital on trust.”

He went on to say:

“Over time, we see regulations arising that are fair and equitable. When these are defined, and assurance permeates the arrangement from top to bottom, you will see acceptance escalate.”

On More Sophisticated Ranking Methodologies

Recently, some of the above cryptocurrency baronial websites accept overhauled their alignment as a agency of preventing abetment through approach such as ablution trading. For example, CoinMarketCap introduced a new clamminess metric, and CryptoCompare brought in qualitative measures.

One of the challenges that has bedeviled OKEx over the aftermost year is accusations of ablution trading — accusations that the barter has again denied. Under the new baronial methodologies, it turns out that OKEx ranks college than some of its above competitors, including Binance.

During our interview, Cheung took a businesslike approach, advertence that the baronial methodologies are as abundant a assignment in advance as the blow of the evolving crypto sector. Once again, he looked to the acceptable markets as a criterion for how this change takes place, stating:

“Even in the disinterestedness markets, you still acquisition altered methodologies used, so it’s not hasty to us that this was the case in crypto. It alone had to be corrected. This action will abide as the markets evolve.”

He added explained that he now believes OKEx has congenital a acceptability based on bigger abstracts collection:

“The absolute assurance is that back we analyzed the alignment and abstracts accumulating practices, the absolute ones were transparent. The abstracts should appearance the after-effects of [our] work, and we apprehend to be in the top 10 based on our efforts and success.”

Emerging Markets

As the U.S. Lawmakers abide to ball about the catechism of cryptocurrency regulation, abounding exchanges are attractive to aggrandize in arising markets that accept a friendlier access to cryptocurrency regulations. Along with adversary barter Binance, OKEx is eyeing Turkey as its abutting market.

Cheung was agog about Turkey’s access to blockchain, saying:

“The Turkish government is alive appear application blockchain technology in accessible administering in cases like acreage registration, transportation, and added accessible forums. The government has additionally appear the country will be accomplished testing agenda Lira abutting year, which will be a huge anniversary for the country.”

He concluded:

“We see the arena as one that has woken up to the abeyant of broadcast balance technology and how it can action citizens a added cellophane acumen into the apparatus of government.”

Speaking of OKEx accretion into added territories, Cheung mentioned Russia, South Africa, and South America as actuality regions of agnate absorption to the exchange.

Conclusion

In an more aggressive crypto barter market, it’s axiomatic from our altercation with Andy Cheung that OKEx is accomplishing aggregate it can to break advanced of the curve. The best contempo advertisement that OKEx is ablution options, one of the alone commensurable articles to Deribit’s, could prove to be an industry game-changer if options can carbon the success of Bitcoin futures.