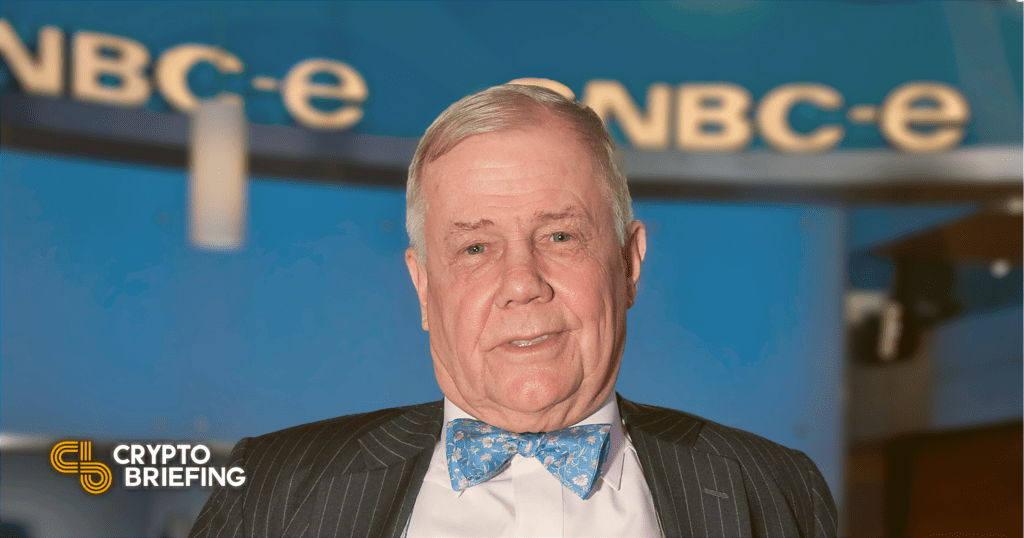

THELOGICALINDIAN - Veteran broker Jim Rogers abjure not affairs Bitcoin aboriginal

“I ambition I had bought Bitcoin,” said 78-year old advance administrator Jim Rogers as he suggested a balloon in stocks and bonds.

Key Investment Takeaways From Jim Rogers

Jim Rogers, the co-founder of the Quantum Fund and Soros Fund Management, which holds $5.2 billion assets beneath management, said that banal and band markets are in a bubble.

According to him, too abounding bodies are accepting complex with stocks; authoritative money via banal advance has become “easy and fun,” which is an alarming signal. He added:

“This isn’t my aboriginal rodeo. I’ve apparent this cine before.”

To Rogers, Chinese stocks are added absorbing because they’re cheaper and quick rehabilitation from the coronavirus pandemic.

Rogers predicts that gold and argent will go through the roof and said that he owns gold.

The barrier armamentarium mogul bidding affliction for not affairs Bitcoin early. He sees a unilateral focus on Bitcoin in cryptocurrencies amid abounding that “have abolished and gone to zero.”

Citi bank’s analysts afresh declared that Bitcoin has accomplished a “tipping point” and could anon become the bill for all-embracing trade. Rogers common agnate ideas, however, added that:

“If Bitcoin anytime becomes a applicable bill instead of a trading vehicle, they can outlaw it. Governments don’t appetite to lose control; they like their monopoly.”

Interestingly enough, Dr. Michael Burry of “The Big Short” acclaim had additionally echoed the authoritative apropos about Bitcoin’s boilerplate acceptance in a now-deleted tweet.

Disclosure: The columnist captivated Bitcoin at the time of press.