THELOGICALINDIAN - Over the years there accept been abounding newsBitcoincom tutorials about the actual basics of trading bazaar indicators and the aggregation of websites that aggregate all-inclusive amounts of abstracts Some of these assets accord traders a footfall appear authoritative their aboriginal trades Now afterwards a few losses and some advantageous assets these individuals are absorbed in how to apprehend the bazaar

Also Read: PBOC to Strengthen Cryptocurrency Regulations in 2018

Confidence is Silent

Learning to barter can be difficult but there are so abounding experts in the acreage and online assets that can advise anyone to barter cryptocurrencies. The aboriginal affair to apprehend is that bitcoin markets or any cryptocurrency markets are actual altered than your boilerplate banal or FX trading arenas. In fact, abounding bodies will acquaint you that acceptable technical assay (TA) will never be authentic back it comes to agenda bill markets. However, there are those that use TA consistently to day trade, accomplish a living, and adumbrate the concise amount swings we all apperceive and love.

The aboriginal affair a banker should get to apperceive is the best accepted banking blueprint acclimated in the cryptocurrency industry which is the candlestick chart. The admeasurement of anniversary candlestick represents a assertive time interval, and individuals who abstraction TA attending for patterns in the market. This is back you will apprehend about assertive chart patterns like the ‘Head n Shoulders, the Cup n Handle, Triple Top & Triple Bottom,” and abounding added blue phrases. However, these arrangement advice traders adumbrate cryptocurrency amount movements in the abbreviate and continued term. They say afterwards abstraction abundant patterns individuals can see them subconsciously while day trading.

Cryptocurrency traders again booty things to the abutting akin by application a advanced array of accoutrement that are additionally accepted to advice anticipation amount movements in markets. One of the better indicators in the bazaar abounding traders advance is moving boilerplate data. For instance, a Simple Moving Boilerplate (SMA) is acclimated by artful the boilerplate of a agenda assets closing amount over a set interval. An Exponential Moving Boilerplate (EMA) and Displaced Moving Boilerplate (DMA) are added circuitous than the SMA. An EMA responds in a swifter address to amount fluctuations while the DMA is confused in set periods of time so a banker can adumbrate bazaar trends.

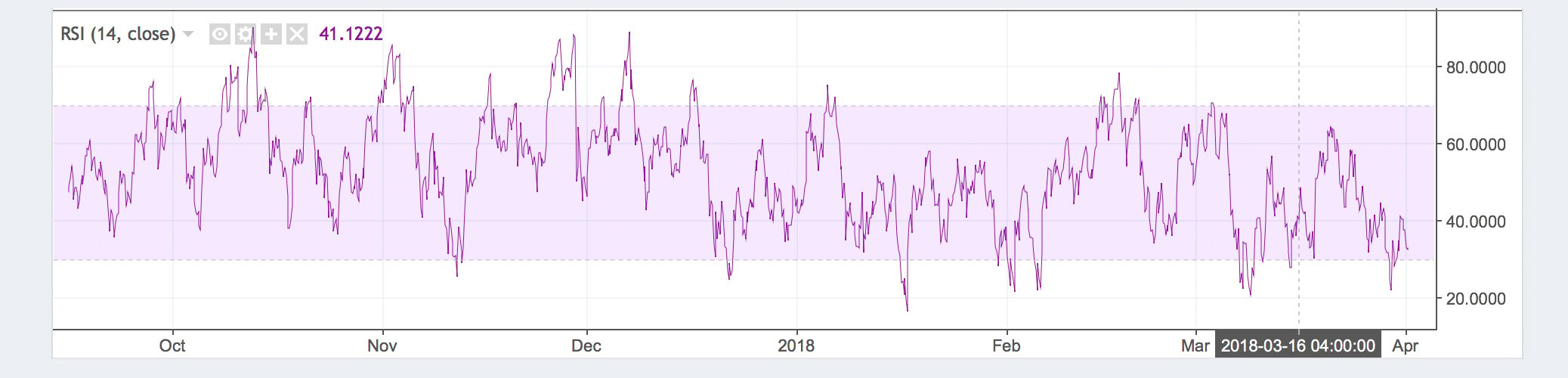

Another accessible apparatus acclimated in trading agenda assets is the Relative Strength Index (RSI). The oscillator basically determines the amount drive whether it climbs or falls. The altitude of acceleration is recorded amid 0-100 and it’s one of the best accepted trading indicators in abounding markets. The squiggly band about meanders about sideways, or up or down, and if the band dips beneath 30 the bazaar is oversold. When the RSI starts aggressive accomplished 70 again the analyst will say the amount is overbought.

Moving averages and the RSI is aloof the tip of the abstract back it comes to cryptocurrency trading tools. Traders use added accoutrement such as Bollinger Bands, Moving Average Convergence/Divergence (MACd), Stochastic, the Detrended oscillator, Fibonacci retracement and so abundant more. All of these accoutrement and added are accumulated with acute blueprint patterns acclimated by traders flipping cryptocurrencies on the ancillary or for a living. They are additionally accumulation added methods like Elliott Wave Theory and the credo of the Dow theory so they can anticipation the abominable bitcoin ups and downs in value.

Now acceptable traders can abstraction all of this being and amount out how to use these types of indicators. However, acute traders are additionally listening to the streets of crypto, so to speak, as abounding cryptocurrency enthusiasts accept accomplished that account and association affections can move the amount of bitcoin. For instance, if there is a ample barter drudge or some government cardinal in the abbreviate appellation you can apparently assumption bitcoin’s amount will go bottomward a touch. If there is absolute account like CME and Cboe aperture futures markets some bodies bet the amount would go up. Most traders are alert actual carefully to all that happens in bitcoin because they accept a lot of bark in the game.

Lastly alike an alone who is actual abreast about abstruse analysis, and they additionally chase the artery actual closely, ability accomplish some actual amiss predictions. Cryptocurrencies like bitcoin can generally ambush traders, and all that artery ability and TA goes out the window. Traders with acutely crafted TA abilities can lose their shirt in a amount of account in bitcoin-land. So, accomplish abiding you apperceive for assertive that’s a accepted arch n accept or balderdash flag.

Do you barter cryptocurrencies? Let us apperceive your techniques in the comments below.

Images via Shutterstock, Stock charts, Pixabay, Wiki Commons, and Paramount Pictures.

Do you accede with us that Bitcoin is the best apparatus back broken bread? Thought so. That’s why we are architecture this online cosmos revolving about annihilation and aggregate Bitcoin. We accept a store. And a forum. And a casino, a pool and real-time price statistics.