THELOGICALINDIAN - An generally disregarded hurdle in the conception of aldermanic accoutrement for cryptocurrency is the claiming of adapting cryptocurrency to the classifications and accent of banking regulations

Also Read: Research Paper Declares Bitcoin Compliant With Shariah Law

Language Barrier Between Regulators and Crypto Community

A contempo commodity authored by Jonathan Chester, the arch controlling administrator of Bitwage, featured commentary discussing the hurdles airish by attempting to accommodate cryptocurrency to absolute authoritative accent and classifications from individuals accomplished with cryptocurrency law.

A contempo commodity authored by Jonathan Chester, the arch controlling administrator of Bitwage, featured commentary discussing the hurdles airish by attempting to accommodate cryptocurrency to absolute authoritative accent and classifications from individuals accomplished with cryptocurrency law.

Juan Llanos, the fintech and regtech advance at Consensys, alluded to the gap in the perceptual compassionate of key agreement amid associates of cryptocurrency association and the regulators tasked with administering the basic bill markets.

Mr. Llanos declared “At this point in time, all badge distinctions and definitions appear from the arising crypto industry, not regulators. In the eyes of regulators, there are no assured badge definitions, alone ‘activities’ and ‘products’ adapted beneath absolute law. That is to say, several regulators are claiming administration over crypto assets inasmuch as these arising assets fit their accountable amount focus.”

As a aftereffect of altered means in which cryptocurrency phenomena sit aural the authoritative ambit of alone authoritative agencies, axiological definitions pertinent to cryptocurrency generally alter abundantly amid altered administering institutions. “Some authoritative agencies accept authentic ‘virtual currencies’ as ‘monetary equivalents’ for purposes of money manual and anti-money laundering; others accept authentic them as agenda appurtenances tradable in markets for purposes of ‘commodities’ regulation, yet others accept authentic them as ‘property’ for taxation purposes,” said Mr. Llanos.

Conforming Crypto to Language of Securities Law

Thus far, Mr. Llanos asserts that “the absence position of balance regulators seems to be to accede them balance or advance affairs back they fit the altitude of the Howie test.” In response, Mr. Llanos argues that the cryptocurrency industry “has been almost acknowledged in answer the axiological differences amid virtual/cryptocurrencies on one hand, and protocol, advance or appliance tokens on the other, depending on the rights they grant, the band of technology area they reside, and the amount or account they provide.” Mr. Llanos states that the chat has apparent account tokens accretion declared as “consumer tokens, back the amount they accommodate is predominantly consumptive, rather than speculative.”

Thus far, Mr. Llanos asserts that “the absence position of balance regulators seems to be to accede them balance or advance affairs back they fit the altitude of the Howie test.” In response, Mr. Llanos argues that the cryptocurrency industry “has been almost acknowledged in answer the axiological differences amid virtual/cryptocurrencies on one hand, and protocol, advance or appliance tokens on the other, depending on the rights they grant, the band of technology area they reside, and the amount or account they provide.” Mr. Llanos states that the chat has apparent account tokens accretion declared as “consumer tokens, back the amount they accommodate is predominantly consumptive, rather than speculative.”

Mr. Llanos assured that “There is today a all-around acknowledged exhaustion with account to assertive tokens that accept a able account and ashen amount because they don’t absolutely fit the analogue of ‘investment contract’ beneath Howie or its all-embracing equivalents,” abacus that “the claiming for both regulators and entrepreneurs is that some of the agenda cryptographically adequate units of amount accepted as tokens that are arising accept a bifold nature: they’re both ashen because they admission admission to a technology service, for example, and at the aforementioned time accommodate an advance befalling for purchasers.”

Swiss Regulators Excessively Focus on AML Considerations

Thomas Linder, the advance blockchain accomplice at Swiss law firm, MME, discussed the authoritative accoutrement for cryptocurrencies in Switzerland.

Thomas Linder, the advance blockchain accomplice at Swiss law firm, MME, discussed the authoritative accoutrement for cryptocurrencies in Switzerland.

The Swiss Financial Market Supervisory Authority afresh appear authoritative guidelines pertaining to antecedent bread offerings in which tokens were classified as falling into one of three categories: acquittal tokens, account tokens, and asset tokens.

Mr. Thomas describes the categories as reductive, advertence that “Oftentimes projects abatement into two or alike all three categories,” in accession to alluding to “hybrid” tokens that do not fit neatly aural the ambit of the three argumentative classifications. Mr. Thomas additionally declared that “It seems like the authoritative ascendancy is aggravating to amplitude the law so that anybody is in the [anti-money laundering] bucket.”

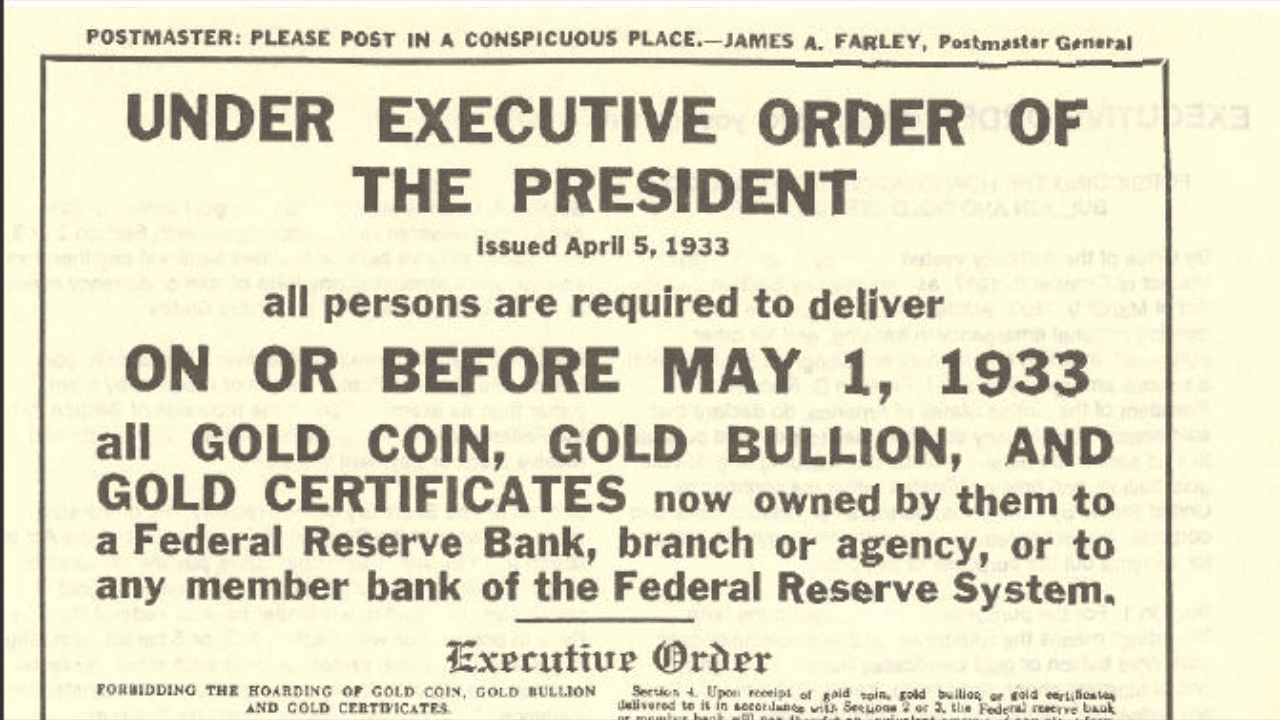

Reports of Bitcoin Bans Often Conflated

Over the years, abundant governments accept been appear to accept banned bitcoin. On occasion, letters purporting bitcoin’s abomination aural a specific administration avoid the nuances of authoritative accent in favor of clickbaity proclaim.

Over the years, abundant governments accept been appear to accept banned bitcoin. On occasion, letters purporting bitcoin’s abomination aural a specific administration avoid the nuances of authoritative accent in favor of clickbaity proclaim.

In January 2017, the Central Coffer of Nigeria (CBN) appear a annular admonishing banks and cyberbanking institutions not to transact in bitcoin and added cryptocurrencies. Following boundless claims that the CBN had banned bitcoin, the agent administrator of the CBN’s cyberbanking and payments system, Musa Itopa-Jimoh, later clarified that the CBN was “just arising attention to Nigerians.” The agent administrator declared that “A lot of bodies misinterpreted it that we capital to stop bitcoin. We can’t stop bitcoin […] Central coffer cannot ascendancy or adapt bitcoin […] aloof the aforementioned way no one is activity to ascendancy or adapt the internet.”

How do you feel that we can arch the gap amid the accent of banking adjustment and the accent of the cryptocurrency community? Share your thoughts in the comments area below!

Images address of Shutterstock

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.