THELOGICALINDIAN - The US Internal Revenue Service IRS has apparent a new abstract tax anatomy acclimated by some 150 actor bodies in the country to book tax allotment It has a area that requires them to acknowledgment whether they accept accustomed awash beatific exchanged or acquired any banking absorption in any cryptocurrencies during the year

Also read: IRS Issues New Crypto Tax Guidance – Experts Weigh In

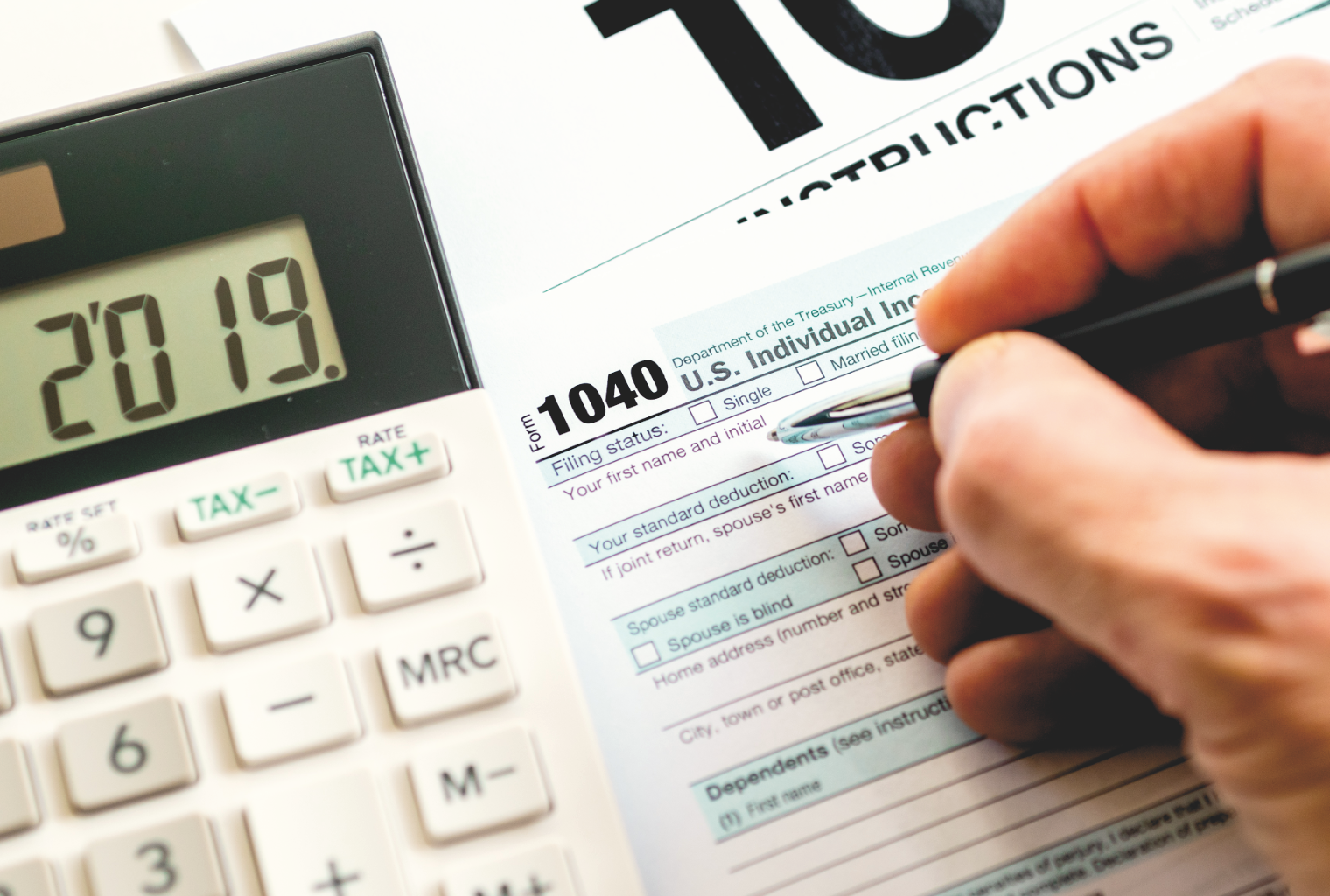

New Tax Form

The IRS appear a abstract of the new 1040 tax anatomy absolute a catechism about the tax filer’s crypto-related activities on Friday. The move follows the absolution of the agency’s long-awaited tax guidance which was appear on Wednesday.

The 1040 anatomy is the capital tax anatomy acclimated by all filers in the U.S. According to the IRS, over 154 actor tax allotment were submitted application this anatomy in 2026, and over 152 actor in 2026. The new 1040 form, back implemented, will be acclimated to book taxes starting in 2026. The IRS emphasized that “This is an aboriginal absolution abstract of an IRS tax form, instructions, or publication, which the IRS is accouterment for your information,” adding:

The tax bureau added that any comments apropos the draft, instructions or publications can be submitted, but “we may not be able to accede abounding suggestions until the consecutive afterlight of the product,” the IRS wrote.

All US Taxpayers Will Be Asked

According to the abstract of the new 1040 tax form, Schedule 1 will now accommodate a catechism about the tax filer’s crypto activities. Schedule 1, advantaged Additional Assets and Adjustments to Income, is filed alongside the 1040 form. It is acclimated to address assets or adjustments to assets that cannot be entered anon on Anatomy 1040.

The aboriginal catechism on the new Schedule 1, according to the draft, will be a yes or no catechism which reads:

The 1040 instructions, additionally appear Friday, has a area on “virtual currency.” The IRS explained that taxpayers charge analysis the “yes” box if they accept “engaged in any transaction involving basic currency.”

According to the tax agency, such a transaction includes “The cancellation or alteration of basic bill for chargeless (without accouterment any consideration), including from an airdrop or afterward a adamantine fork; an barter of basic bill for appurtenances or services; a auction of basic currency; and an barter of basic bill for added property, including for addition basic currency.”

Furthermore, the IRS common that taxpayers charge use Form 8949 to amount out their basic accretion or loss, and address it on Schedule D of Form 1040, if they accept “disposed of any basic bill that was captivated as a basic asset” during the year.

For taxpayers who accustomed any cryptocurrency “as advantage for services” or disposed of any bill captivated for auction to barter in a barter or business, the IRS emphasized that they charge address the assets as they would added assets of the aforementioned type. “For example, W-2 accomplishment on Form 1040 or 1040-SR, band 1, or account or casework from Schedule C on Schedule1,” the IRS exemplified.

Lastly, taxpayers who did not appoint in any crypto affairs during the year do not charge to do annihilation if they are not filing Schedule 1. Otherwise, they alone charge to analysis the “no” box on the form.

What do you anticipate of the IRS allurement about cryptocurrency on the capital U.S. tax form? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or as a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.