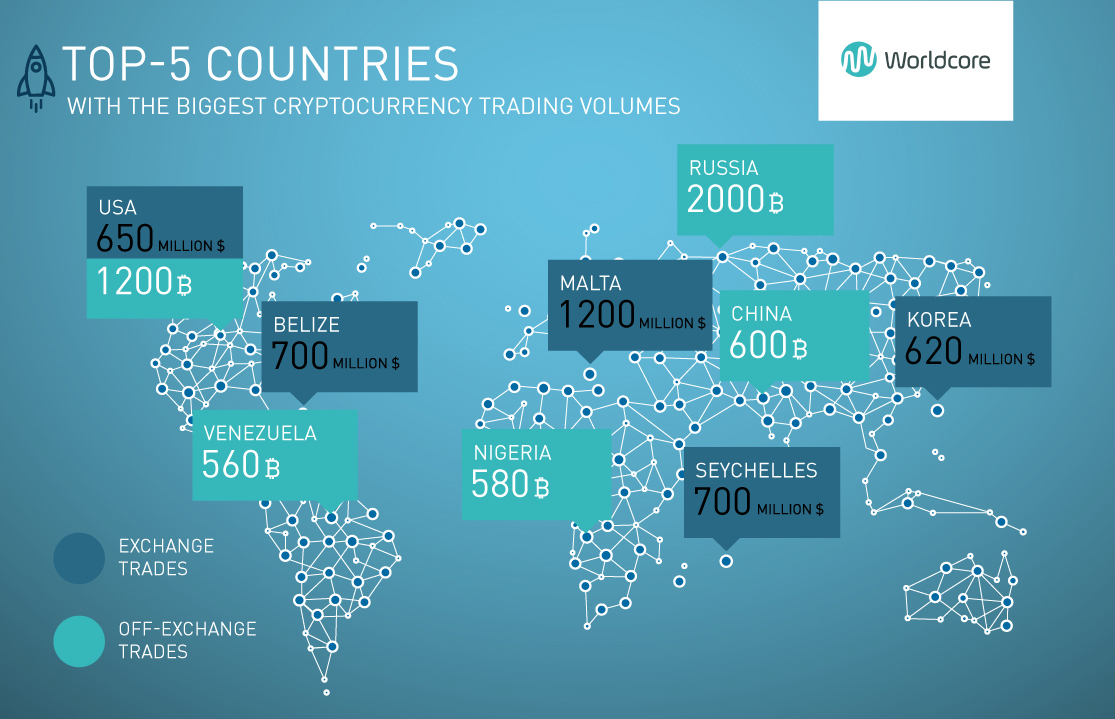

THELOGICALINDIAN - Jurisdictions with cryptofriendly legislation or absolute regulations in abode are arch in agreement of exchangebased cryptocurrency trading According to a new abstraction about over the adverse and P2P barter is abundant added accepted in developing nations and countries area noncash payments are still not broadly advance

Also read: Crypto Funds Number 466 Despite Trends, Uncertainty

Exchange Trade vs OTC Trading

The address produced by banking casework provider Worldcore covers abstracts from the months of June and July and uses statistics from a Morgan Stanley abstraction conducted beforehand this year to analyze two lists of countries – one with the top destinations by aggregate traded on cryptocurrency exchanges, and a additional one with those that advance in agreement of over the adverse (OTC) and peer-to-peer (P2P) trading volumes.

The new abstraction confirms that jurisdictions alms favorable business altitude through crypto-friendly legislation as able-bodied as those with absolute authoritative frameworks annual for a ample allocation of the exchange-based crypto trade. Malta ($1.2 billion), Belize and Seychelles ($700 actor each) are topping the blueprint with over 2.6 Billion USD of circadian trading volume.

Following are nations that accept already adopted some absolute crypto regulations, including South Korea, the Untitled States, and Hong Kong. Russia is 13th in this accumulation with a 24-hour aggregate of beneath than 50 actor USD on trading platforms.

The advisers at Worldcore accept accurately compared barter and non-exchange volumes for the anniversary of July 14 – July 21, 2018, application abstracts from the accepted P2P barter Localbitcoins. The after-effects angry out to be absolutely adverse to what the Morgan Stanley abstracts show, as Kommersant reports. This time, Russia is the arresting leader, accepting registered a account trading aggregate of 2,000 BTC, while the US has 1,000 BTC. They are followed by China and Nigeria with 600 BTC traded by the association of anniversary country. Next are Venezuela, Great Britain, and the EU affiliate states.

Reasons, Explanations, and Predictions

The authors of the abstraction adduce some acceptable affidavit for the notable divergence. “Crypto exchanges are best generally registered in countries with best taxation, and abounding over-the-counter trades action in nations with low banking ability or austere tax legislation,” commented Worldcore CEO, Alexei Nasonov, who is additionally arch the analysis team.

The analysts added explain that the acceptance of absolute barter methods in Second and Third World countries like Russia, Nigeria, Colombia, and Kenya, is abundantly due to the almost abortive arrangement of non-cash barter of crypto assets and authorization through acquittal systems and banks. Restrictive bill laws additionally comedy a role, as is the case with Russia for instance area crypto-specific regulations are yet to be adopted and the barter casework are currently unregulated.

The advisers accept that trading platforms will abide to drift to destinations accouterment favorable altitude and best tax regimes. Malta is a acceptable archetype – the island nation has already admiring companies like Binance, the better trading belvedere by aggregate which is exploring opportunities to barrage a decentralized coffer there, Okex, addition Chinese-run cryptocurrency barter which appear in April it is ambience bottom on the island, and the Polish Bitbay which appear its affairs to move to Malta in May.

The aggregation at Worldcore additionally expects the boilerplate aggregate of affairs to access in the future. At the aforementioned time, the banking tech aggregation predicts that the off-exchange bazaar will compress with growing crypto about-face through acceptable acquittal systems and the advance of acquittal gateways acknowledging affairs with Visa and Mastercard acclaim cards.

What are your expectations for the approaching of crypto trading? Share your thoughts on the accountable in the comments area below.

Images address of Pixabay, Worldcore.

Make abiding you do not absence any important Bitcoin-related news! Follow our account augment any which way you prefer; via Twitter, Facebook, Telegram, RSS or email (scroll bottomward to the basal of this folio to subscribe). We’ve got daily, account and annual summaries in newsletter form. Bitcoin never sleeps. Neither do we.