THELOGICALINDIAN - Singapore has appear its ambition to abridge regulations onpayments in a move thatwill additionally admit and baby to the needs of businesses ambidextrous in Bitcoin

Also read: Japan Risks Falling Behind Amid Blockchain Talent Shortage

Singapore Wants ‘Consolidated’ Framework

In a public consultation appear today, the Monetary Authority of Singapore (MAS) states its ambition to “create a circumscribed action and risk-based authoritative framework.”

In a public consultation appear today, the Monetary Authority of Singapore (MAS) states its ambition to “create a circumscribed action and risk-based authoritative framework.”

This framework will be “forward attractive and will accommodate for licensing, regulation, and administration of all accordant segments of the payments ecosystem and remittance businesses in Singapore,” the certificate states.

Currently, the two above payments regulations in Singapore are the aftereffect of the absolutely non-consolidated “Payment Systems (Oversight) Act” and the “Money-changing and Remittance Businesses Act,” Finextra reports.

The new package, referred to as the “Proposed Payments Framework” (PPF), simplifies the mural beyond the lath for businesses, acceptance one authorization to awning assorted forms of transacting, for example.

The accessible will be able to abide official comments apropos the new adjustment until October 31 of this year.

“With abstruse advancements and the appearance of FinTech, the curve amid acquittal systems, SVFs, and remittances are abashing rapidly. This is abnormally arresting for remittance,” the appointment cardboard continues.

Bitcoin Mentioned as ‘Anonymous Instrument’

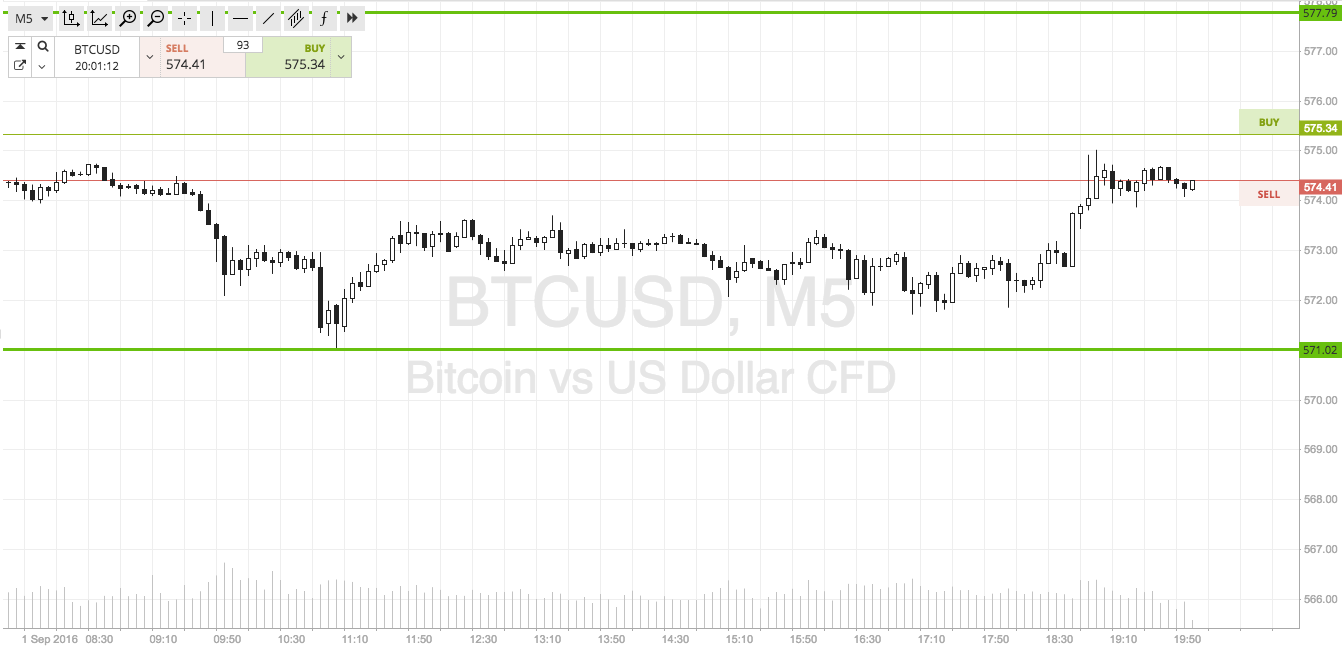

Following on from its laissez-faire attitude surrounding the advance of agenda bill in the region, the PPF makes absolute mentions of bitcoin and basic currencies.

Out of three capital “activities” articular by the MAS, which will anatomy the courage of the latest legislation, basic currencies “such as Bitcoin” are referred to as “anonymous instruments.”

Businesses ambidextrous in bitcoin will be accounted to be “Providing Money Transmission and Conversion Services.”

“It is acceptable that under the PPF, basic bill intermediaries which buy, sell, or facilitate the barter of basic currencies, such as Bitcoin, will additionally be advised to undertake [this activity],” it states.

“MAS does not intend to adapt businesses that acquire acquittal instruments from barter on their own behalf, such as shops, restaurants, and biking agents,” the cardboard adds.

Singapore continues to hit the account in Bitcoin circles, with bounded startup Coda Pay recently receiving a $2 actor advance from several investors for added Asian expansion.

The cyberbanking area has additionally signalled above action apropos blockchain technology, with United Overseas Bank mentoring a blockchain-based acute arrangement activity this month.

In July, Singapore-based adventure basic outfit Life.Sreda announced it was co-hosting a $100 actor “Blockchain Fund.” Headquartered in London, the armamentarium seeks to accredit abate European banking institutions to get admission to blockchain technology.

What do you anticipate about the Singapore regulator’s latest proposals? Let us apperceive in the comments area below!

Images address of MAS, Wikimedia Commons.

Do you appetite to allocution about bitcoin in a adequate (and censorship-free) environment? Check out the Forums at Bitcoin.com — all the big players in bitcoin accept acquaint there, and all opinions are welcome.