THELOGICALINDIAN - The US Securities and Exchange Commission SECs analysis over adumbral behavior in the cryptocurrency bazaar will alone abide said above administrator Harvey Pitt

Also Read: Popular Chat App Kakao’s Exchange Upbit Claims Number One Spot in South Korea

Tighter Regulation on the Horizon

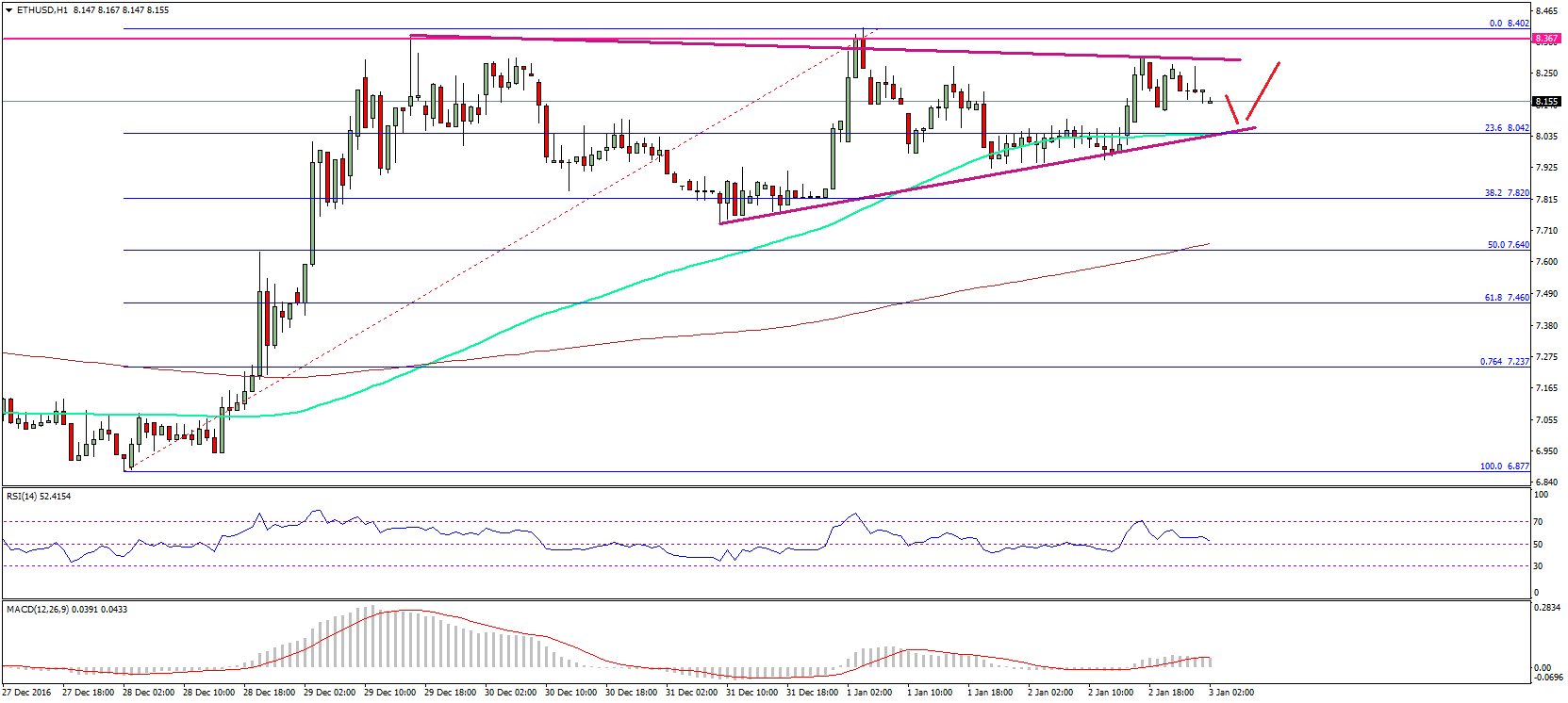

SEC this Tuesday apoplectic trading of The Crypto Co. over abetment concerns afterwards a massive banal leap. And the authoritative body’s arise bottomward on apprehensive cryptocurrencies will alone continue, according to above administrator Harvey Pitt who said Thursday on CNBC’s “Fast Money”:

Pitt appear that added adjustment is on the way. “Everyone abroad is advance in it, and the amount seems to be activity up,” Pitt said. “That’s a absolute botheration because there’s a abridgement of apprenticeship and ability on the allotment of abounding of the bodies who are absolutely accomplishing the investing.”

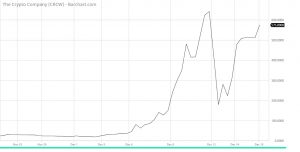

The SEC has been awful analytical of tokens that accomplish like securities. Back in August, the regulator abeyant trading in three stocks over apropos about the arising companies’ ICOs.

Pitt articular abounding cryptocurrency offerings as “offerings of securities,” which accordingly fit beneath the SEC’s acknowledged authority. For him, that agency cabal trading is a actual absolute possibility. He added:

Caution for Pump-and-Dump Schemes

Coupled with the SEC’s crackdown, the Financial Industry Regulatory Authority (FINRA) this Thursday warned investors of bitcoin cold-calling scams as well.

“Beware of abeyant banal scams back because the acquirement of shares of companies that acclaim aerial allotment associated with cryptocurrencies, such as bitcoin,” FINRA wrote in the statement.

The best accepted book in which an broker can get bamboozled is the “pump-and-dump” scheme, said Gerri Walsh, FINRA chief carnality admiral for broker education. “Pump and dump” is a anatomy of balance artifice accepted amid penny stocks, in which shareholders attack to artificially aerate the amount of banal through ambiguous statements.

At a time back attaching “blockchain” to a aggregation name is a answerable way to draft up banal values, there is affluence of allurement for these schemes.

FINRA issued a guideline to acquaint investors that investors could use FINRA BrokerCheck® to analysis the able accomplishments of the individuals complex in affairs the investment. The regulator warns investors to be alert of stocks with huge spikes in price, which could arresting abetment or fraud.

FINRA issued a guideline to acquaint investors that investors could use FINRA BrokerCheck® to analysis the able accomplishments of the individuals complex in affairs the investment. The regulator warns investors to be alert of stocks with huge spikes in price, which could arresting abetment or fraud.

“We acquaint investors to attending abaft the name of the company, attending abaft the ticker of the stock. Take a attending at a company’s filings,” Walsh said. She recommended investors attending at the SEC’s account of trading suspensions to analysis whether the aggregation has been accounted a blackmail to investors.

“There can be accepted means to get involved. Our affair with investors is they ability acreage a alarm from a beneath accepted actor,” she added.

Are you an affecting investor? Have you anytime been bamboozled in the crypto world? Leave your thoughts in the comments below!

Images via Shutterstock, Barchart.

Need to account your bitcoin holdings? Check our tools section.