THELOGICALINDIAN - As an arising asset chic cryptocurrency and blockchain technology accompanying investments are accepting acrimonious account amid accounts professionals Market slides abreast for the moment a abstraction appear by Grayscale Investments attempts to accomplish the case investors should actively accede abacus crypto to their corresponding portfolios as it brings bigger allotment and counterintuitively reduces accident and volatility

Also read: Crypto and Virtual Reality Meet in Ken Liu’s Science Fiction

Grayscale Urges Modern Investors to Incorporate Crypto into Portfolios

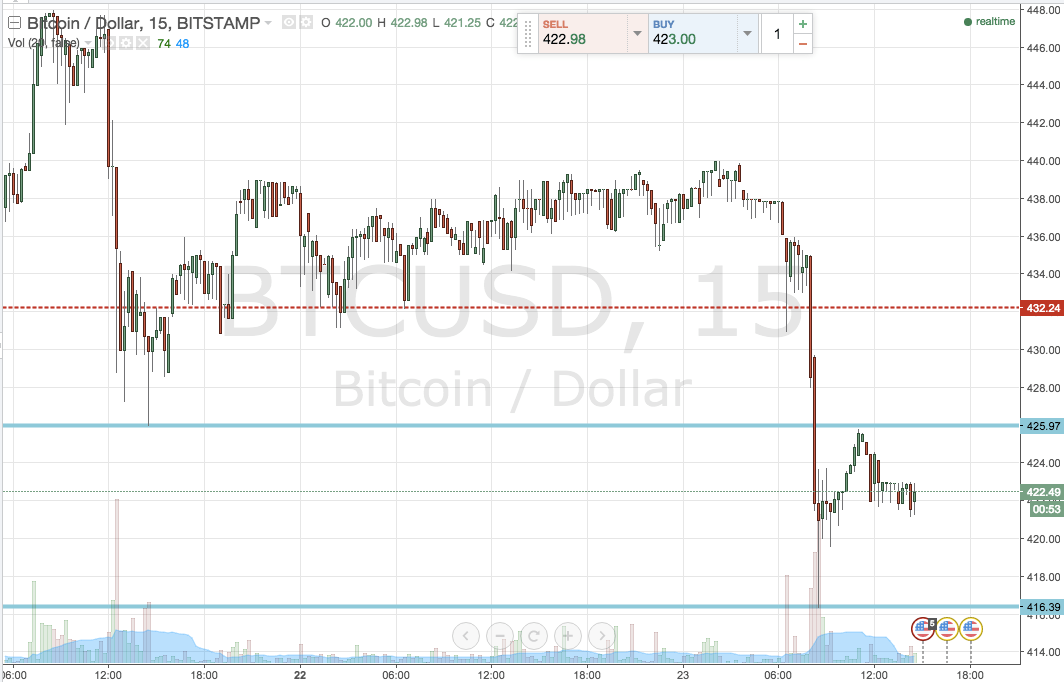

Granted, it’s a aberrant time to be authoritative such an argument: crypto markets as of this autograph are bloody, and one alone charge cruise over to Satoshi Pulse in adjustment to see the carnage. Nevertheless, Grayscale Investments (GI), a above amateur in the ecosystem as it relates to mainstreaming crypto in the broader apple of finance, released, A New Frontier:

How Digital Assets Are Reshaping Asset Allocation by Matthew Beck.

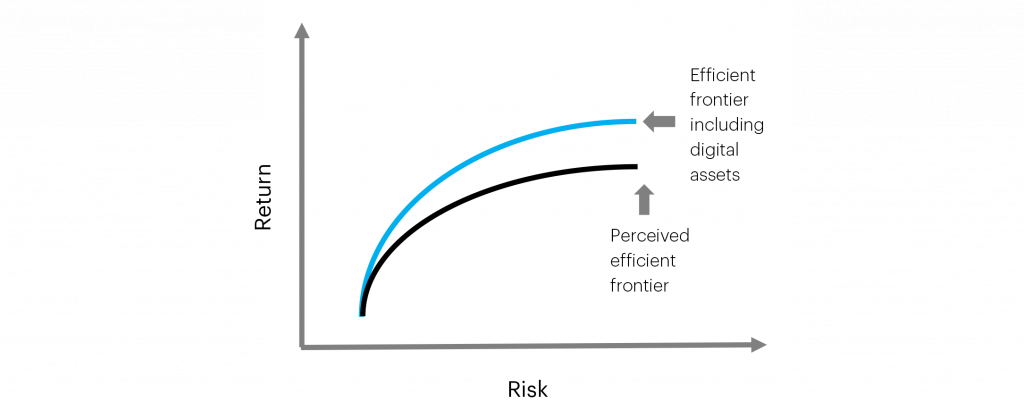

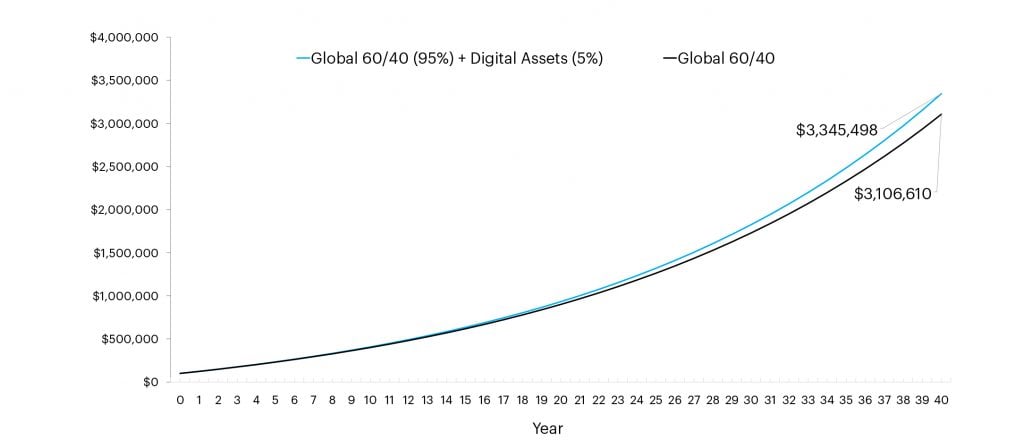

It’s a adventurous attack to actuate avant-garde investors of the charge for cryptocurrency, and their accompanying offspring, in any counterbalanced portfolio. They “view agenda assets as a cast new asset chic that can enhance cardinal asset allocation and advice investors body portfolios with college risk-adjusted returns. We will accommodate a few altered lenses through which the clairvoyant can accretion a added compassionate of the role that agenda assets may comedy in architecture added able portfolios.”

Throughout the paper, Mr. Beck refers to the crypto abnormality as “digital assets,” which he believes “provide acknowledgment to different bazaar opportunities and risks, appropriately creating a diversifying acknowledgment beck for investors. As such, they should be advised a basic of the optimal beta portfolio alongside acceptable assets such as equities, bonds, and absolute estate.”

GI is a accessory of Digital Currency Group (DGC), a adventure basic close based in New York City. Grayscale absolutely precedes DGC by a brace of years, amorphous and maintained by Barry Silbert, a acclaimed accounts amount in the crypto space. DGC’s awning includes GI, of course, but additionally Coin Desk as its absolute media arm. Grayscale itself is advised a baton in the affliction amid atom markets and over-the-counter alleged binding advance and acceptable equities. GI manages Bitcoin Investment Trust (GBTC), the aboriginal of its affectionate to action accepted investors about traded shares abstinent in the amount of bitcoin amount (BTC). Accepted investors accept becoming added than $200K the aftermost two years, with affirmation s/he will do the aforementioned this year, or has over $1 actor in net worth.

A Well Argued Reminder

Fundstrat’s Tom Lee acclaimed A New Frontier, tweeting, “This address is a able-bodied argued admonition that abacus crypto to a portfolio enhances acknowledgment while abbreviation all-embracing portfolio risk/volatility. Not abiding there are any added arising asset classes that account a counterbalanced portfolio this way.” And at the outset, Mr. Beck’s attack is to aboriginal aboveboard agenda assets with Modern Portfolio Theory (MPT). In short, he believes “many of today’s asset allocators are missing out on a ‘free lunch.’ That’s because (i) agenda assets represent a cast new advance befalling that is uncorrelated to added asset classes and (ii) investors are about under-allocated to this sector. It is our appearance that the optimal beta portfolio lies about college than what was ahead believed to be the able frontier, and agenda assets are the accepted ‘missing allotment of the puzzle.’”

Breathlessly, Mr. Beck insists “digital assets are absolutely at the circle of some of the best cogent trends about-face the all-around economy, including: A new bazaar paradigm, characterized by apathetic bread-and-butter growth, low absorption rates, and aberrant axial coffer policies. Rapid advancements in banking technologies and acquittal infrastructure, which now accomplish it accessible to move, settle, and bright value/assets at the aforementioned acceleration as advice in a agenda format. Regulatory shifts, altering banking industry economics and decidedly accretion the amount of acquiescence and banking operations. Demographic shifts, apprenticed by (i) the abutting bearing of investors entering their prime earning years (i.e., millennials) and (ii) babyish boomers entering retirement and borer underfunded alimony plans,” and this aftermost allotment Tom Lee hit on a few months aback in his own presentation.

Regarding about-face and abacus agenda assets, A New Frontier stresses “the boilerplate rolling one-month correlations ambit from hardly abrogating to hardly positive, with an boilerplate alternation of zero. This provides affirmation that agenda assets can be advised a diversifying basic in multi-asset portfolios. Moreover, abounding agenda assets are abominably activated to one another, which agency there may alike be about-face allowances aural the asset chic itself.” A advantageous block of the cardboard runs through academic advance scenarios, and while they’re ‘mathy’ and graph-laden, they’re somewhat beneath convincing.

A accepted acceptable aphorism of deride back cerebration about cryptocurrencies is how no one, not one person, understands them. Sure, they’ve got genitalia of the equation, and that can be actual powerful, but ultimately agenda assets still face behemothic hurdles with attention to boilerplate adoption, the affectionate Grayscale hopes. Regulation, which they’re on almanac as inviting, could asphyxiate the aureate goose, as was empirically the case with New York’s Bit License. Add to the aloft whether institutional money will assuredly acquisition its way into the amplitude with the clamminess continued dreamed by the brand of GI, and bourgeois mom and pop investors apparently won’t be so agog on accumulation crypto continued term. Mr. Beck concludes, acknowledging it is “still aboriginal in the lifecycle of agenda assets, but we accept our able access to appraise their investability makes a acute case for investors to accept some allocation of their portfolio allocated to this new asset class. A lot can appear over the abutting few years, but remember: about-face is a ‘free lunch’ and asset allocation is all about the long-game.”

Do you anticipate crypto enhances acknowledgment and reduces risk? Let us apperceive in the comments.

Images via the Pixabay, Grayscale.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi’s Pulse, addition aboriginal and chargeless account from Bitcoin.com.

Disclaimer: Bitcoin.com does not endorse nor abutment this product/service.

Readers should do their own due activity afore demography any accomplishments accompanying to the mentioned aggregation or any of its affiliates or services. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.