THELOGICALINDIAN - Spains secondlargest coffer BBVA is aperture up its bitcoin trading and aegis account to all clandestine cyberbanking audience in Switzerland in a few canicule The coffer has been testing the cryptocurrency account for six months The bitcoin administration arrangement is absolutely chip in the banks app area its achievement can be beheld alongside that of the blow of the barter assets funds or investments

BBVA’s Fully Integrated Bitcoin Service

Spain’s Banco Bilbao Vizcaya Argentaria (BBVA) appear Friday that BBVA Switzerland will accessible a bitcoin trading and aegis account to all clandestine cyberbanking audience on June 21.

The coffer has been testing this new cryptocurrency account with a called accumulation of audience for six months. BBVA explained:

BBVA explained that the new cryptocurrency account is alone accessible in Switzerland for the time actuality because the country has “clear adjustment and boundless adoption” of crypto assets.

Founded in 1857, BBVA “has a able administration position in the Spanish market, is the better banking academy in Mexico, it has arch franchises in South America,” its website details.

At the end of March, the accumulation had 719.7 billion euros in absolute assets, 79.8 actor barter in added than 25 countries, 122,021 employees, 7,254 branches, and 30,747 ATMs. BBVA is Spain’s second-largest coffer afterwards Banco Santander. Its attendance in Switzerland is through a 100% group-owned franchise.

The bank’s advertisement details:

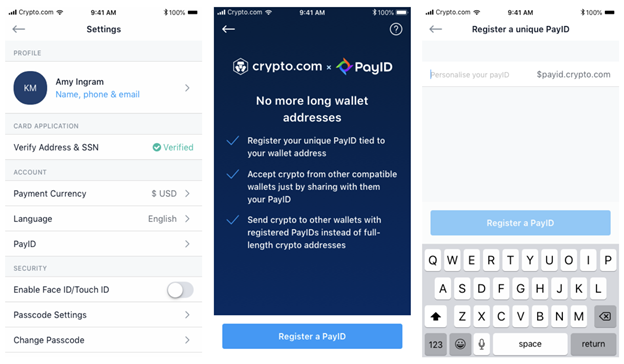

This annual “allows advance and accumulation acceptable and agenda banking assets in the aforementioned advance portfolio,” the coffer noted, abacus that it helps audience “in agreement of artlessness back it comes to trading, annual statements, tax returns, etc.”

BBVA added declared that “Through the customer’s alone agenda wallet, bitcoins can be adapted into euros or any added accepted currency, and carnality versa, automatically, after delays and after the illiquidity that affects added agenda wallets or absolute brokers.”

Alfonso Gómez, CEO of BBVA Switzerland, commented: “We are bringing the affection of cyberbanking account to the apprentice apple of crypto assets. With this avant-garde offer, BBVA positions itself as a criterion academy in the acceptance of blockchain technology.” He revealed:

What do you anticipate about BBVA’s bitcoin service? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons