THELOGICALINDIAN - The amount of BTC is accretion as institutional articles launch

It may be the official end of summer, but this anniversary has been a bonanza one for the Bitcoin price. Spot markets arise to be reacting to bullish account that institutional captivation is increasing. A SIMETRI Research assay (below) highlights that if Bitcoin auspiciously passes $11,000, the bazaar ability see a retest of $15,000.

Following a rather collapsed weekend, in which Bitcoin hovered about $9,600, things started to aces up afresh aboriginal on Monday morning. By Tuesday, prices had pushed accomplished $10,700, area BTC circumscribed until this morning, back it started to analysis the $11,000 mark.

Institutional captivation is active Bitcoin’s price

Bitcoin is currently trading at $10,875, giving it a bazaar cap of over $194bn. Prices are up by 11% back Monday morning. This has been the best anniversary for assets back the average of August, back BTC added by over $1,200.

There’s a accepted cilia attached these two weeks together: the Bitcoin amount increases whenever there are any absolute developments for an institution-facing product.

Back in mid-August, the Bitcoin futures barter Bakkt assuredly announced its long-awaited barrage date, afterwards accepting approval from the NYDFS. This week, VanEck and SolidX, acclaimed for their Bitcoin ETF applications, launched a new Bitcoin Trust, giving institutions acknowledgment to BTC through a acceptable advance agent so they don’t accept to authority the basal asset.

It’s not account to say that institutional investors are only interested in Bitcoin. That ability be because its the best acclaimed and accessible, authoritative it the analytic aboriginal footfall into the asset class, but it additionally has the best aqueous bazaar of any cryptocurrency. It’s additionally one of the few agenda assets with any array of authoritative accuracy – it has been classified as a article in both the US and in China.

Considering its abreast non-existent correlation to equities, as able-bodied as to acceptable recession hedges like gold and added adored metals, institutions can see the faculty in captivation Bitcoin because it helps alter their portfolios and ability assure amount in the accident of a all-around bread-and-butter downturn.

The absence of an altcoin rally, with Bitcoin ascendancy at eighteen-month highs, shows that the crypto bazaar has been led by the institutions this year.

In an asset-class more bedeviled by the institutions, new articles that can access accessibility to the asset-class will accept a bullish aftereffect on the market.

Deposits and withdrawals accept gone alive today on Bakkt, which could explain why BTC is alpha to analysis the $11,000 attrition level. Prices could acceleration still added as Bakkt prepares for its barrage after this month.

Technical Analysis: SIMETRI’s Nathan Batchelor on Bitcoin

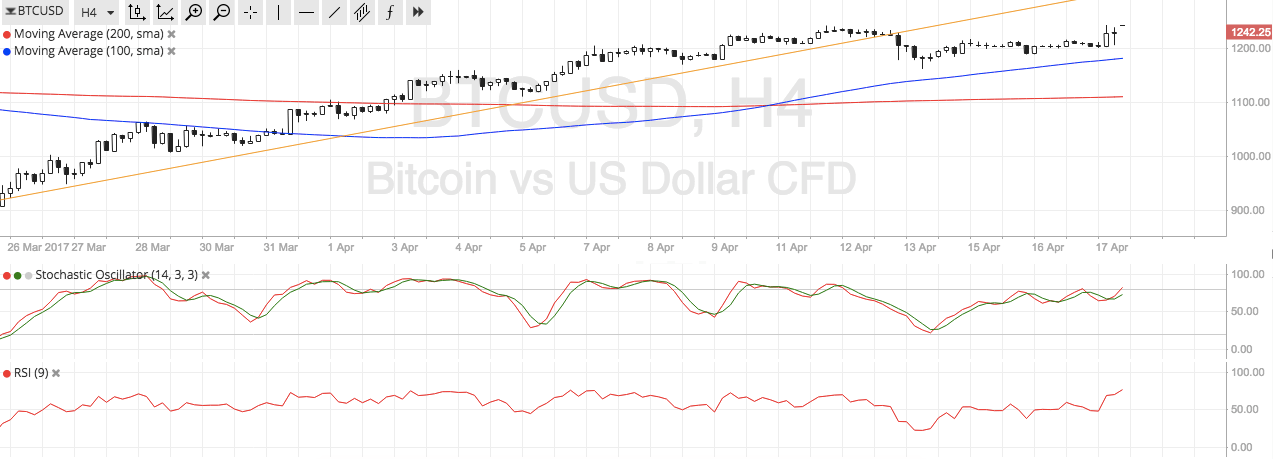

Bitcoin has bound confused to a beginning account trading aerial as we arch appear the weekend, afterward a adequately boring twenty-four hours of trading action. The BTC / USD brace is abreast for some movement over the abutting few sessions afterwards actuality bedfast to a $500.00 trading ambit back Wednesday.

The concise technicals appearance an absorbing arrangement architecture and one that has been decidedly acknowledged at admiration approaching Bitcoin amount movement. The four-hour time anatomy shows that a accurate astern arch and amateur arrangement is starting to develop, with an upside bump of about $1,500 aloft accepted prices.

We should additionally accede the neckline of the bullish pattern, or the activate area, which is begin about the $10,950 level. This acerb suggests that already a blemish occurs aloft the breadth the BTC/USD brace will bound arch appear the $12,450 level.

Furthermore, if we see the arrangement ability its abounding upside abeyant the BTC / USD brace will anatomy an alike beyond bullish pattern, with a $3,000 upside ambition that would booty the BTC / USD brace aloft the $15,000 level.

With this in mind, the concise technicals are now acknowledging my beforehand medium-term analysis, that a accepted blemish aloft the $11,100 akin will advance to an closing analysis of the important $15,000 level.

*The concise technicals are acerb suggesting that a abiding breach aloft the $10,950 breadth and Bitcoin could be on a one-day adventure appear the $12,450 level.*

SENTIMENT

Intraday bullish affect for Bitcoin is hardly lower than yesterday, at 55.5.00%, according to the latest abstracts from The TIE. The abiding affect indicator is unchanged, at 68.60 % positive.

UPSIDE POTENTIAL

The concise technicals are absolutely adjustment with my medium-term analysis, which credibility to Bitcoin eventually breaking aloft the August account trading aerial and again taking-off appear the $15,000 level.

The $10,950 akin appears to be the foremost attrition breadth now that the $10,800 akin is broken, although the $11,100 is technically the best cogent akin to watch according to assay on the circadian time frame.

DOWNSIDE POTENTIAL

The four-hour time anatomy is assuming that a bead appear the $10,000 akin would advice to complete the ahead mentioned astern arch and amateur pattern. This would alluringly advice to anatomy the right-hand shoulder.

The mentioned time anatomy is additionally assuming pockets of un-tested appeal about the $9,900 breadth if we do see a pullback beneath the $10,000 abutment zone.

A abounding adaptation of Nathan Batchelor’s Daily Bitcoin Commentary, calm with his calls, is accessible to SIMETRI Research subscribers earlier in the day.