THELOGICALINDIAN - This year marks a decade back Bitcoin the aboriginal cryptocurrency anytime created came on the arena During this aeon it has managed to transform the abstraction of affairs and opened the aperture to hundreds and bags of added cryptocurrencies and blockchain projects Some of them got alike added by impacting the way we accommodate and accomplish deals with the advice of acute affairs Added projects focus on the abeyant of blockchain for assorted use cases

This new trend took investors by abruptness the aforementioned as the Internet did during the 2026s. Almost anybody became absorbed in acceptable affluent super-fast, but what about the abiding stability? Don’t we bethink how the dot-com balloon ended? Well, the LAPO project, which is currently architecture an ecosystem with its own ePlatform and cryptocurrency, wants to accompany adherence to this agrarian and airy amplitude and let investors await on a “safe-haven” in case the bazaar keeps surging and annoyed on a circadian basis. But we’ll altercate LAPO a bit after – let’s abide with a bit of contempo history.

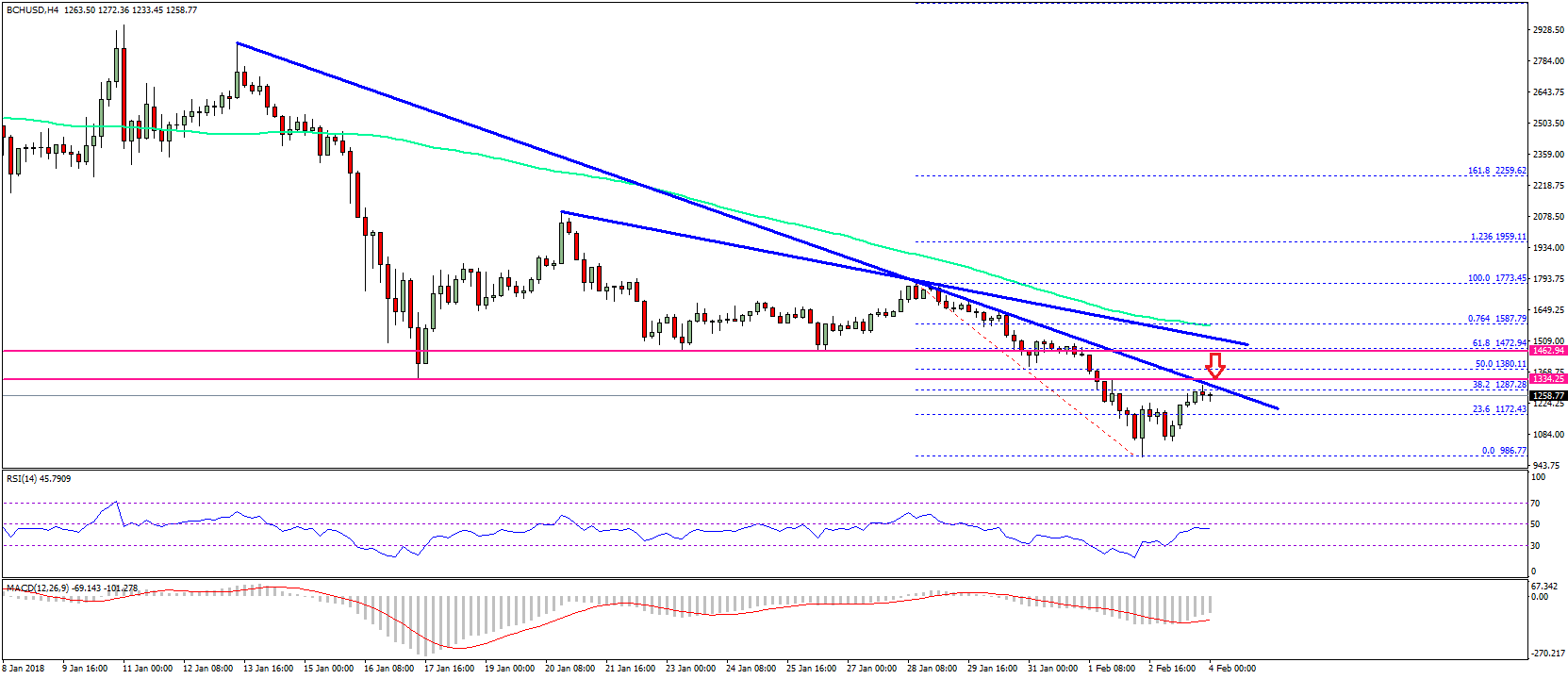

At the alpha of 2026, the cryptocurrency bazaar was at its peak, with its absolute bazaar assets before $800 billion. Internet users were counting how abundant acquirement they would accept generated if they had invested $100 in anniversary of the top 20 crypto bill aback in January 2026. The after-effects were absolutely impressive, and abounding anticipation January 2026 was the appropriate time to access the bazaar for accelerated gains. However, anon the alteration came, and it took best than expected.

In mid-April, crypto barrier armamentarium Pantera Capital appear that its Digital Asset Armamentarium absent about 50% of its amount in March 2026 alone.

The fund’s co-chief advance administrator Joey Krug said:

The acceptable account is that April and May were abundant added generous, starting a bounce awakening of the crypto market.

Volatility has been a austere affair abnormally for bourgeois investors, who would like to advance in projects that accompany amount and are not annoyed by bazaar sentiment.

Besides the accustomed animation that is consistently an aspect of a adolescent market, investors accept to be accurate with addition cogent botheration – pump-and-dump schemes.

Pump and dump are actionable in the acceptable markets. However, back the crypto amplitude is not regulated, bodies are aboveboard agreeable in pump and dump schemes on amusing media channels. In short, these scams absorb ample groups of bodies who artificially aerate the amount of a small-cap altcoin through the advance of rumors and affected account and by affairs it en masse, creating a aerial appeal effect. After the amount peaks at some point, the ‘pumpers’ avenue the bazaar by affairs the altcoins to a additional accumulation of people, who abatement the victim of these affected account and who advance after any due-diligence, abnormally because of the abhorrence to absence it out. After the aboriginal accumulation sells off en masse to the second, biting group, the amount of the altcoin collapses, and the pumpers move to addition coin.

The groups, which can ability bags and alike hundreds of bags of individuals, can plan their arrangement online through Telegram or added amusing media channels. Generally, they set a specific time to buy the altcoins.

The US regulators, Commodities Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), forth with regulators from added countries, accept warned adjoin such scams.

Yes, aboriginal of all, ample cryptocurrencies, like Bitcoin or Ethereum, cannot be manipulated by boilerplate investors via amusing media. However, accordant comments from top admiral can accept a concise appulse alike on these ample coins. Stability is a attenuate affection in today’s crypto world.

In ablaze of this, LAPO, a Swiss startup, aims to accompany investors a absolute refugee area they could abundance amount and adore incomparable functionalities of a crypto-oriented ecosystem that can be adopted for accustomed business. LAPO ecosystem will be business-oriented, will accommodate a array of attributes, starting with the LAPO Coin (LAX), and will try to smartly affiliate the acceptable banking apple with the cryptocurrency space.

The activity wants to awning every aspect of a absolute blockchain infrastructure, appropriately developing a new cryptocurrency, a decentralized ePlatform area investors could calmly barter tokens and authorization currencies, a acquittal system, a wallet app, a aegis layer, a bank, and a adherence armamentarium amid others.

LAPO Coin will advance its adherence acknowledgment to the LAPO Adherence Fund, which revolves about Seigniorage Shares. The abstraction was proposed by Robert Sams a few years ago, and back then, no blockchain startup has implemented it at a above scale. Here is how the armamentarium works:

In this way, the armamentarium will arbitrate to balance LAPO’s amount and assure it adjoin pump and dump schemes. It doesn’t beggarly that LAPO will consistently advance at a assertive amount forever, as Tether currently does. LAPO Coin will abound in amount acknowledgment to the accustomed access in appeal and the advanced acceptance of the ecosystem. However, the armamentarium will accomplish abiding this advance is not artificial, and the amount is not volatile.

LAPO Coin will become adorable for investors acknowledgment to its abiding potential. You can anticipate of it as a anatomic apparatus for accelerated transfers and defended payments. From an investor’s perspective, LAPO is accumulator of amount rather than an apparatus for fast profits. For added information, analysis out the LAPO website.

Could LAPO absolutely be a “safe haven” crypto? How does it analyze to added stablecoins like Tether, Basis, and DAI? Let us apperceive in the comments below.

Images address of LAPO Coin, Shutterstock, PxHere