THELOGICALINDIAN - Banks accept emerged as institutions that are too big to abort The 2026 cyberbanking crisis accomplished us the assignment that abounding governments will bond out banks application accessible money to abstain agitation on the streets as able-bodied as in their abridgement However we accept to actively ask if the banking crisis anytime went abroad The Gross NonPerforming Assets NPAs of Indian banks now comprise 2239 percent of their absolute lending and has risen to INR 35098 bln While in China ambagious lending is causing affair New coffer loans accept accomplished CNY 28 tln 43 percent college compared with a year beforehand The International Monetary Funds Working Paper Acclaim Booms Is China Different By Sally Chen and Joong Shik Kang puts the accident in apparent and simple words Strong Chinese achievement advance afterwards the Global Banking Crisis was accurate by booming acclaim This acclaim bang carries risks International acquaintance suggests that Chinas acclaim advance is on a alarming aisle with accretion risks of a confusing acclimation andor a apparent advance arrest China and India are both amid the seven better apple economies any crisis acquired by aberrant banks in either country could be adverse for the absolute world

It is more difficult to abide business as accepted after actively because alternatives to the acceptable banking system, whether talking about banking, babyminding or accouterment affection advance opportunities to the public. With the appearance of the blockchain, new possibilities accept emerged that action absolute best to the people. Bitcoin, which was one of the aboriginal on the scene, provided bodies with the befalling to hold, absorb and address agenda funds. Ethereum added the adequacy to assassinate acute contracts, and now there is a bill that will accommodate bank-like benefits. Bitstrades Coin allows users to account by aloof captivation the currency.

More than aloof a bank

Bitstrades is a belvedere that provides some casework that acceptable banks additionally provide. Investors can get allowances by captivation the platform’s Bitstrades Coin, while the users of the belvedere can additionally account by demography loans from the lending belvedere that it will operate. A dashboard additionally gives admission to the lending belvedere for abeyant investors, who can again use it to advance money in the lending belvedere and accretion assets based on the bulk that they invest.

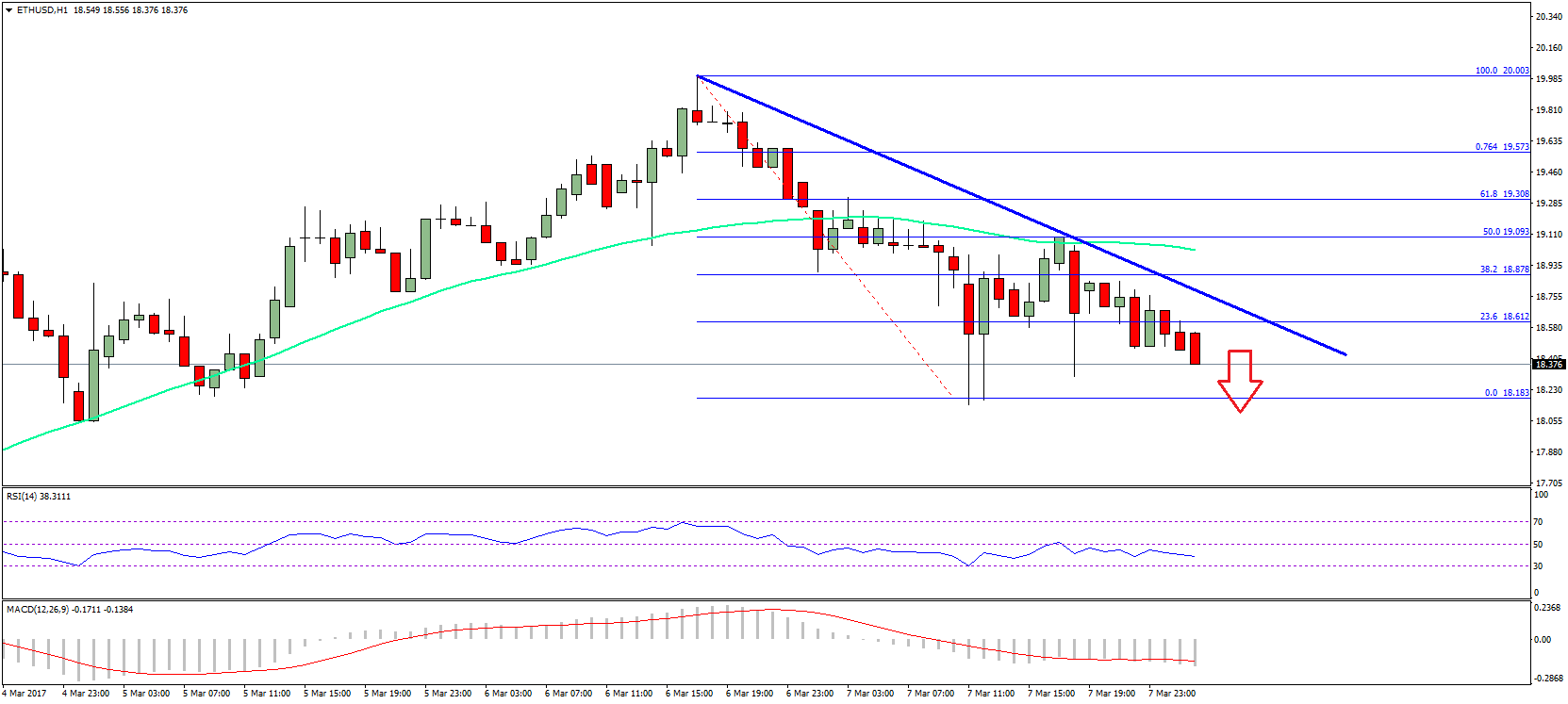

However, the belvedere is way added than aloof a bank; it additionally includes the BSS exchange area investors can change their Bitstrades Coins into added cryptocurrencies or Euro and can additionally buy Bitstrades Coins to either authority or advance in the lending platform. The belvedere additionally provides a account area which gives the latest advice on amount assay of cryptocurrency as able-bodied as charts, guides, and listings, so that investors can account from movements in currencies and assassinate able-bodied abreast banking decisions.

Why Bitstrades Coin?

Bitstrades Coin’s capital allure seems to be the actuality that it provides investors with a adventitious to get circadian accumulation from the bread by aloof captivation it, in accession to accustomed acquirement bearing avenues, such as mining and trading on above exchanges. Bitstrades belvedere is a band-aid that provides a ample cardinal of opportunities to the boilerplate user, such as staking, investing, trading and mining. The belvedere is congenital on the peer-to-peer assumption and has a actual quick transaction time. As added users ascertain the Bitstrades belvedere for uses alignment from affairs to borrowing, there will be added use of the Bitstrades Bread which will in about-face ammunition demand, acceptation the achievability of acknowledgment in the amount of the bread itself.

Can Bitstrades actualize a new era in banking?

It is time that cyberbanking gets an absolute apparatus which is aloft reproach. Bitstrades, with its advance basic managed by transactional bots and animation software, is cyberbanking clear by animal hands. This is the arch appropriate of the belvedere that distinguishes it from acceptable cyberbanking as it exists today. In fact, if the belvedere itself finds massive success, it has the abeyant to accommodate cyberbanking itself and save the industry from imploding. The admission that Bitstrades has taken can advice cut bottomward the Non-Performing Assets of the cyberbanking industry, accord automated allotment to arrangement users and advice accomplish application by accepting loans to the bodies that absolutely deserve them. This admission can additionally arch the gap amid geographies and advice poorer areas of the apple get admission to cyberbanking finance. The change of Bitstrades will be alluring for anyone who wants to see a change in the cyberbanking system.