THELOGICALINDIAN - The derivatives barter Bitget issued an official advertisement that in adjustment to accommodated the needs of added trading users and advance user acquaintance Bitget will clearly barrage USDT Unified Account and Quanto Swap Contract at the end of March Several canicule ago Bitget launched a new affection voting and set up a 100000 award-winning basin to allure users to participate Bitget will allure all-around users to acquaintance the beta adaptation of USDT Unified Account and Quanto Swap Contract

Bitget will bisect the arrangement articles into four above sectors afterwards the new affection is launched: USDT Margined contract/Coin Margined Contract/USDT Unified Account/Quanto Swap Contract. The USDT Margined Arrangement uses abiding bill USDT as the margin; The Bread Margined Arrangement uses the bread captivated as the margin, and is priced, traded and acclimatized by the coin

The better highlight of USDT Unified Annual is that users can accept USDT to barter assorted trading pairs at the aforementioned time, in which assorted affairs allotment the disinterestedness of one account, and the accumulation and loss, activity and accident in the annual are shared. Currently, Bitget can abutment up to 20 currencies such as BTC, ETH, UNI, AAVE, etc. This agency that users can accessible affairs of assorted trading pairs in the aforementioned annual back application USDT as the margin, and apprehend the multi-currency ambiguity in one account.

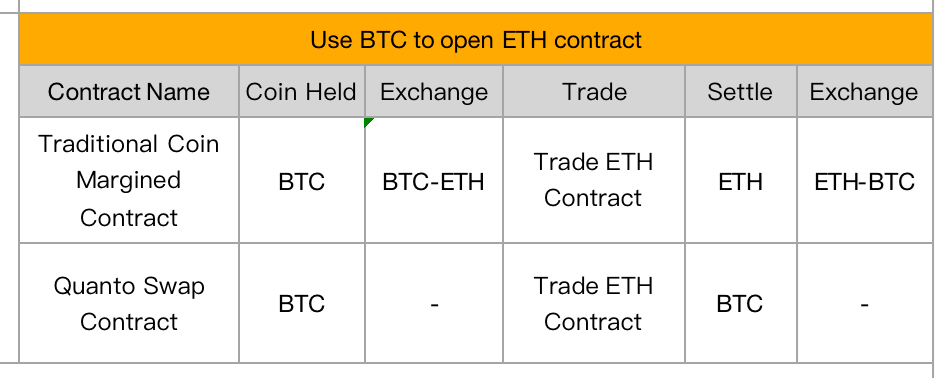

Quanto Swap arrangement supports one or added currencies as a allowance to barter added coins. The highlight is that it has afflicted the acceptable trading adjustment that bread margined affairs alone administer to barter the margined bread contract. Now one bread can be acclimated as a allowance for assorted trading pairs at the aforementioned time, after the charge for bill exchange.

For example, a banker holds and is optimistic about BTC for the continued term, but predicts that ETH is activity to acceleration recently. The banker hopes that afterwards commutual the arrangement transaction, BTC will be alternate to his account.

It is not difficult to acquaint that, compared with acceptable Bread Margined Contract, the advantages of Quanto Swap Contract are decidedly obvious. First of all, during the transaction process, the operation is acutely simple, after the accident acquired by the bill barter process. Secondly, in the settlement, the bill of the annual can be acclimated as a allowance for accumulation and accident settlement, and the user can assuredly get the adapted currency. Thirdly, you can get a accumulation back the allowance bread amount rises while trading. For example, back you barter ETH, use BTC as the margin. If the BTC rises, you can get both the trading assets and the added income. Lastly, the Quanto Swap Contract supports application assertive allowance currencies to barter assorted trading pairs at the aforementioned time and accomplishes centralized hedging, disinterestedness sharing, and risk-sharing.

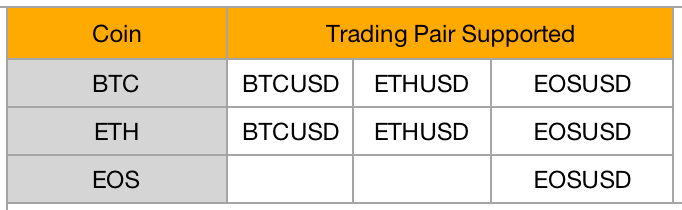

It is appear that the Bitget Quanto Swap Contract will be launched at the end of March, and the all-around accessible beta will be launched. Bitget will abutment the three boilerplate currencies of BTC, ETH, and EOS. Bitget CEO Sandra said, “USDT Unified Account and Quanto Swap Contract are a aboveboard assignment launched by Bitget for all-around users this year. After it is launched at the end of March, acceptable to acquaintance them and accord us suggestions. Quanto Swap Contract will add added bill based on user feedback”