THELOGICALINDIAN - Coinchanges CEO discusses the firms mission to accompany DeFi to the masses

Coinchange leverages DeFi to action aerial crop to retail investors. Crypto Briefing batten to the firm’s CEO, Maxim Galash, to apprehend about the allowances and challenges of alms DeFi opportunities to new crypto entrants.

Yield Farming Through Banking-Like Apps

Coinchange is a consumer fintech company accouterment retail investors with seamless, bland admission to low-risk and high-yield acquiescent assets opportunities in DeFi. They initially launched as a crypto allowance belvedere in 2017, until the access of the DeFi amplitude in 2020 led to a axis against abundance administration strategies leveraging crop farming.

Today, Coinchange offers two amount products: a barter annual that acts as a authorization on and off-ramp, and a crop annual alms low-risk, aerial acknowledgment activating absorption on stablecoin deposits.

The trading annual allows Coinchange users to drop and abjure authorization through wire transfers, ACH, and debit cards, accomplish crypto transfers to and from their non-custodial wallets, and buy cryptocurrencies like Bitcoin, Ethereum, USDT, and USDC.

The aerial crop account, meanwhile, is Coinchange’s flagship product. From a user’s point of view, it may attending agnate to added interest-bearing articles like Celsius, Nexo, and BlockFi. However, it works actual differently. Rather than lending out the customers’ crypto deposits to institutions, Coinchange leverages a market-neutral crop agriculture action to accomplish certain acquiescent assets for its stablecoin depositors. Explaining the firm’s approach, Coinchange CEO Maxim Galash says:

“In the background, we booty in USDT and USDC deposits and augment that clamminess into assorted DeFi protocols and pools, including Uniswap, Sushi, and PancakeSwap, based on a absolute risk-analysis approach, and again we administer a allocation of the crop we accomplish to our customers.”

In simple terms, Galash adds, the action is “similar to a loan, but actuality you own that loan—you ascendancy that money, and based on the behavior of the counterparty, you can cull that money any time you want.”

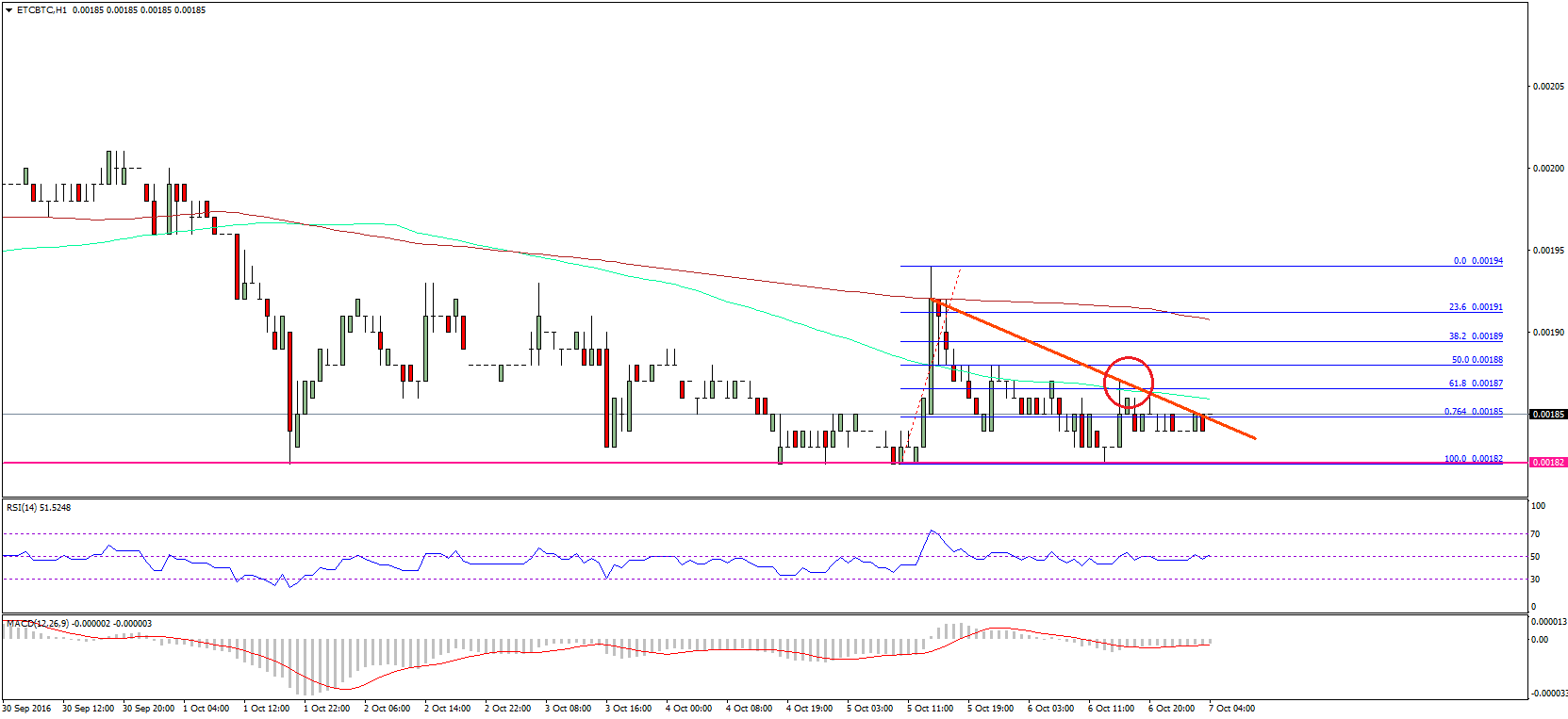

Coinchange uses abstracts to accomplish its results; all processes are automatic and accomplished by adult algorithms that adviser price, volume, liquidity, slippage, fees, and several added abstracts credibility to acclimatize and optimize the action in real-time.

Coinchange’s accepted crop agriculture action is based on stablecoins and accouterment clamminess to stablecoin pools. However, in the future, the close affairs to add riskier strategies based on added airy assets like Bitcoin and Ethereum.

Fund assurance is a above point of affair for careful abundance administration crypto platforms. Galash says that risk administration is Coinchange’s top priority, which is why its crop agriculture artefact uses circuitous automatic models to abate bazaar risks and chiral processing to abate agreement risks. Coinchange additionally insures customers’ deposits by allocating a allocation of its profits into a abstracted wallet custodied by Fireblocks. “If annihilation goes wrong,” Galash says, “we’ll be able to awning the losses.”

As a crypto abundance manager, Coinchange’s mission is to accommodate barter with accessible admission to almost risk-free, passive, and awful assisting advance opportunities through a artefact that looks and feels like the archetypal cyberbanking appliance anybody is already acclimatized to. “People are already authoritative 10 to 20% in the acceptable markets,” says Galash, “but it’s not approved bodies like us. It’s able money managers who go to golf clubs, clandestine clubs, and alive in assertive neighborhoods.”

According to Galash, Coinchange is aggravating to “provide the aforementioned advance opportunities and abundance administration casework to approved people, with approved jobs, and approved incomes.” Unlike added agnate products, the belvedere doesn’t crave lockups or minimum deposits, and there are no hidden fees.

Democratizing DeFi advance is not an accessible task, however. Aside from the accepted abridgement of authoritative accuracy apropos agnate products, the U.S. Securities and Exchange Commission (SEC) has afresh accomplished a crackdown on aggressive firms like BlockFi and Celsius. On this topic, Galash says that Coinchange is a fully adapted business in Canada with an MSB authorization alive until 2023. The close is additionally alive with U.S. regulators to ensure acquiescence in altered states. Galash says that the aggregation wrote to the accordant regulators in anniversary accompaniment and accustomed alloyed responses. “Right now, we’re focused on accepting money manual licenses (MTL) to be able to accurately accomplish alike in the states that didn’t acknowledge agreeably to our letters,” he explains. “The abutting footfall is acceptable a adapted advance adviser (RIA) which would finer characterization our articles as alone managed accounts (SPA) and accomplish us absolutely adjustable to accomplish in the U.S.”

Coinchange’s aerial crop annual currently averages about 16% APY on USDC and USDT deposits, which is amid the best ante offered beyond CeDeFi competitors and the DeFi space. Already one of the arch options on the bazaar for crypto users attractive to abduction yield, the close is well-positioned to see accelerated advance as the amplitude starts to access accumulation adoption.