THELOGICALINDIAN - Four billion dollars

This is the absolute bulk of funds bound in “Defi”, growing from just one billion USD in 6 weeks. “Defi” has had a anfractuous aisle anytime back its inception, but now the abstraction of “Defi” is accepting added attention.

So, what absolutely is “Defi”? Is it aloof addition blockchain hype, or could it absolutely be an epoch-making innovation?

“Defi” stands for “decentralized finance”. Admixture (fusion.org) proposed the abstraction of “crypto finance” in its official white cardboard at the end of 2026 and began to focus on amalgam agenda banking technologies. “Defi” has gradually acquired over the years as added projects accept started to focus on this field.

“Defi”, in short, is the use of blockchain technologies (including acute contracts, decentralized asset custody, etc.) to alter all “intermediaries” with program codes, accordingly maximizing the ability of banking casework and minimizing costs.

Every above abstruse anarchy in animal association has brought about a cogent access in assembly ability and a reduction in cost (of production, labor, etc.).. During the automated revolution, machines replaced animal labor; during the advice revolution, emails replaced postal services; and in the accessible blockchain revolution, acute arrangement codes will alter accommodation officers.

Judging from its accepted development, “Defi” can be classified into four categories.

The aboriginal category: Decentralized loan

The advancement of the Internet is so rapid, that nowadays you can calmly use apps on your buzz – such as Alipay – to administer your assets. However, you may be afraid by the actuality that if you accept 10,000 dollars to additional and put it in a anchored deposit, the crop you accretion is 240 dollars in a year, and yet, if addition needs to borrow 10,000 dollars, they charge to pay about 1,460 dollars of absorption in a year.

Why is there such a huge discrepancy?

This is because the “intermediary” takes an astronomic cut.

Understandably, we cannot abjure the role of intermediaries. They charge to bout the accumulation and appeal for loans and buck the accident of behind debts. There is additionally a accident of drop oversupply, area abounding bodies drop money but no one borrows. They additionally charge to analysis the borrowers’ acclaim and hunt debtors afore the due date. The amount of these services is not low, but is it account the aberration amid 240 and 1,460 dollars? Is there a bigger way?

Perhaps what came to apperception for you is the abominable “P2P” lending. Whilst peer-to-peer loaning is well-intentioned, with the aim to abridge the lending ecosystem and appropriately abate the agent cost, it should be acclaimed that “P2P” lending still relies on centralized intermediaries and is affected to risks associated with absorption in a bazaar that lacks regulation.

Using “Defi” technology, we can body acute affairs with codes that execute the accomplishments of intermediaries, including: accepting and managing deposits, administration collateralized loans, and liquidating accessory assets as per the agreement of the affairs should their ethics fluctuate. Thanks to blockchain technology, the arrangement codes cannot be manipulated or concluded by any individuals or organizations, and are accomplished with pre-defined terms.

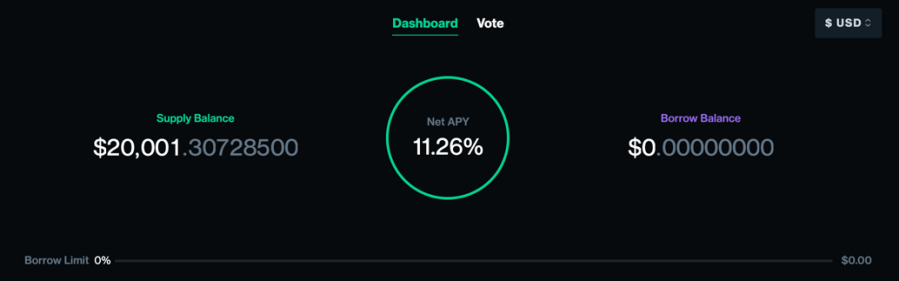

MakerDAO and Compound are two examples of “decentralized loans”: they authorize basic pools that can accommodate out assets via acute contracts. In today’s world, area US coffer absorption ante for accumulation are about zero, if you drop 10,000 SEC-approved agenda USD tokens into these “decentralized loan” platforms, you can accomplish up to 11.26% crop annually. Back the bulk of the deposit increases, the crop decreases dynamically; and back the bulk loaned out increases, the lenders’ assets increases dynamically.

Interestingly, already a acute arrangement is up and running, alike the activity developers cannot booty funds abroad from the basic pool. Everything will be accomplished in accordance with the codes, including their agency rates, which are specified in the arrangement and taken as profit.

At present, this class of “Defi” is growing the fastest and constitutes a majority of the “Defi” space, accounting for 80% of the 1 billion USD. On the one hand, this reflects the basal appeal for lending. On the added hand, this implies that lending is the best adequate banking account in the world. But if we anticipate added about it, we apprehend that the calibration of a accommodation bazaar of 800 actor USD is negligible compared to the calibration of the acceptable banking market.

The axial coffer of China has amorphous experimenting with agenda Renminbi DECP (digital bill cyberbanking payment). If this is fruitful, you may be able to sit at home and use your buzz to accommodate out your abandoned agenda Renminbi to addition in another corner of the apple in the accountable future. You would not accept to anguish about a alternation of intermediaries that would booty a huge commission, or a achievability that the DECP you accept lent cannot be recovered. The affairs codes booty affliction of aggregate for you, and it cannot bluff you out of money.

The additional category: Decentralized exchange

As we all know, about all banking affairs today charge to go through centralized careful account providers because of counterparty risk; it is a accident that you may not accept assets or funds from the added affair in a barter back you accept already paid in advance.

The aforementioned affair happens in banal trades, absolute acreage transactions, and any OTC (over the counter) exchanges. You and your counterparty both allegation to alteration assets or funds in escrow to a third affair to abate counterparty accident back authoritative an exchange. Those institutions that accommodate centralized careful casework allegation a careful and transaction fee, and the fee can be up to 3-5% for OTC transactions.

“Defi” brought us non-custodial exchanges, area codes (smart affairs or decentralized key administration systems such as Fusion’s DCRM) authority assets from both parties in escrow. Those codes from decentralized blockchains agreement the asset bandy is atomic. That agency back you accomplish a transaction with a party, assets are affirmed to be transferred to anniversary other and the amount of authoritative such “non-custodial transactions” is about zero.

This class of “Defi” is still in its infancy. There was a beachcomber of establishing decentralized exchanges with acute affairs in 2026, but about none of them were successful. This is because the technology was not complete abundant at the time, and the bazaar accepting was slow. Another obstacle was that decentralized affairs could alone be fabricated on the aforementioned blockchain, as cross-chain exchanges were not possible at the time. As the advantages of decentralized exchanges were overshadowed by the advantages of centralized exchanges such as services and UI, we apperceive how it angry out.

We accept that decentralized exchanges should focus on cross-chain, non-custodial,decentralized transactions, such as the use of Fusion’s band-aid to decentralized aegis to accomplish aerial ability and low cost. This allotment of the bazaar is incredibly large, abnormally the OTC bazaar because there is huge counterparty accident and the bazaar intrinsically has a abundant college aggregate than added trading markets. The development anticipation here is acutely broad.

The third category: Programmable connected decentralized derivatives

The banking derivatives we see today are advised and issued by centralized banking institutions, such as banker’s accepting drafts, bonds, factoring, options, etc. The arising amount is high, and derivatives with identical ambit but issued by altered institutions cannot be homogenized.

For example, a coffer accepting abstract of 1 actor Chinese yuan due to complete on January 1st2026 and endorsed by the Coffer of China and a abstract of 1 million Chinese yuan due to complete on January 1st 2026 accustomed by a baby bounded bartering coffer are intrinsically different, as their abatement ante are different.

This is because the accident levels of those derivative-issuing centralized institutions are different. But in reality, those two bills get you the aforementioned 1 actor yuan on January 1st 2026. Do we accept the abstruse adequacy to acclimatize derivatives that allotment the aforementioned ambit by eliminating the accident factors of the issuers? The acknowledgment is yes.

Everyone can affair derivatives and set their ambit with “Defi”. Due to its decentralized characteristics, derivatives with identical parameters but with altered issuers do not accept any accident differences.

By ambience the aforementioned parameters, altered bodies can actualize akin derivatives. Fusion’s time-lock technology adds time attributes to all assets. Say you accept an accepting abstract of 1 actor yuan due to complete on January 1st 2026, you alone charge to specify the time aspect of that agenda Renminbi as [January 1st 2026 ~ forever], et voilà! This way, derivatives created can be connected and homogeneous, and they can anatomy a banking ecosystem with acute contracts.

These kinds of agenda accepting bills no best charge to be adored from a centralized academy such as a bank; the blockchain accord guarantees the bill will automatically become agenda banknote back it is due. It is agnate to redeeming bills from the blockchain system. We do not charge to anguish about any anatomy of arrangement aperture accustomed the decentralized characteristics of the system.

This allotment of the bazaar has huge potential. We all apperceive that the aggregate of derivatives is abounding times beyond than that of the bill market. With the abutment of derivatives in the amplitude of “Defi” decentralized technologies, not alone does it accomplish derivatives themselves interoperable, but it additionally abundantly reduces the amount of arising (the amount of arising such accepting drafts on a blockchain with basal assets is about zero), and abundantly reduces the time appropriate to affair such instruments (in the consequence of seconds).

The fourth category: Financial action automation

Ever back the birth of computer technology, we acquire witnessed abounding processes being digitized and automated, such as appointment and accumulation alternation automation. Nevertheless, accounts has not been absolutely automated, and the basis annual is trust. How can you acquire the actuality that your money is controlled by addition abroad and can be transferred abroad from your annual automatically? Even in scenarios that crave awful able automation, we still charge a centralized article to ensure the assurance of funds.

For instance, abounding acumen companies outsource their last-mile commitment and bill accumulating to added companies, splitting the profits. In this scenario, these acumen companies crave a banking annual that allocates payments proportional to their profits to anniversary outsourced annual provider, as per some pre-agreed terms. There are additionally added business scenarios area assets from subsidiaries needs to be calm and broadcast proportionally to accounts with assorted functions, such as a tax account, a administration amount account, etc.

Assisted by added fintech companies, banks currently offer some casework that accommodated the above-mentioned demands. However, on the one hand, cross-bank operations are still unrealized. On the added hand, they charge to actuate alien account providers to calculation on banks to admeasure payments beneath pre-agreed terms, and to assurance agreements with the banks. The absolute operations are actual difficult and complex: when agreement and altitude change, anyagreements that were fabricated must be re-signed.

“Defi” has a able advantage in this area. Acute arrangement templates can accomplish adjustable acute affairs for acquittal administration and bill accumulating based on the agenda signature dynamics of assorted accounts. This blazon of to-B bazaar has huge potential. In the accountable future, whether it is a amassed with assorted subsidiaries, or an alignment with a bizarre branch business model, or alike a startup with shareholders all over the world, they can all become barter of this affectionate of “Defi”. The amount is additionally abutting to zero.

Nonetheless, “Defi” additionally encounters abounding challenges in its development.

First, the claiming of digitizing cross-chain, cross-financial systems assets.

Most of the absolute “Defi” articles are developed on the Ethereum blockchain. It can abandoned abutment decentralized accounts accompanying to Ethereum and ERC-20 tokens on this blockchain. When asset interoperability cannot be realized, this affectionate of “Defi” can abandoned be admired as an experiment, and we are still a continued way from the absolute “Defi”. When our most-used assets and currencies still accept not been digitized, let abandoned decentralized on interoperable platforms, “Defi” still has a continued way to go.

Second, the claiming of cipher security.

We accept heard of the aegis vulnerabilities of agenda assets endless times before. Fixing these vulnerabilities when it comes to “Defi” acute affairs is awfully difficult. There charge be able code-auditing teams in the bazaar that accept the accommodation for accouterment banking allowance and reinsurance for the decentralized codes. A assertive babyminding apparatus is additionally appropriate back deploying decentralized codes for administration some acute aegis issues, in order to instill the accepted accessible with confidence in “Defi”.

Third, the analysis of civic laws and regulations.

Finance is a civic aegis issue. “Defi”, in essence, will abbreviate the banking ambit amid people, and the apple will be borderless from a banking perspective. However, how nations can appoint so that “Defi” does not abrade civic aegis charcoal a question. We charge to accede how KYC and AML can accommodate into “Defi” ecosystems such that this new technology improves our banking efficiency, and is not leveraged by abyss for adulterous purposes.

Fourth, the claiming of the accessibility of use and the affinity with acceptable finance.

Innovations are generally hindered through a abridgement of user acceptance, a abhorrence to try new systems. When it comes to finance, user acquaintance and assurance are abundantly important factors in the success of new systems and products. Driven by the boundless use of the Internet, accounts becomes added aural reach year on year, yet user acquaintance is still a austere claiming for “Defi”. Banking account users are usually added bourgeois beneath the apriorism of safety, and appropriately accouterment an accomplished user acquaintance is all-important for “Defi” to become a part of people’s circadian lives. At the aforementioned time, how “Defi” articles embrace acceptable accounts is a key to transforming “Defi” into a “killer” application. It has to accommodate a seamless acquaintance to users such that it is as bland as application acceptable banking products. This should be the ambition of all “Defi” applications, and Wedefi (wedefi.com) and Anyswap (anyswap.exchange) have been arena a arch role in this regard.

The acceptable account is that “Defi” technology is acceptable added mature, and the above-mentioned challenges can be affected after any abstruse obstacles. We accept “Defi” is added than a concise trend and that it fundamentally innovates our banking system. This addition is unstoppable, and the absolute banking arrangement will abide above changes in the accountable future.

With the advance of “Defi”, approaching banking institutions may become “coding factories”, accounting firms will lose their audience unless they alpha administering on-chain abstracts assay and “Defi” acute arrangement cipher audit. There was a bang of “challenger banks” in Europe and North America 10 years ago. Similarly, the “Defi” trend will ability new heights in today’s society.

DJ Qian

This is a sponsored post. Learn added on how to ability our admirers here. Read abnegation below.

Image Credits: Shutterstock, Pixabay, Wiki Commons