THELOGICALINDIAN - DeFi protocols accept the abeyant to accomplish accounts added attainable and able acceptation bigger ante for the accustomed being Heres a attending at projects laying the foundations of the DeFi movement

For Bitcoin and Ethereum to be aces of accumulation adoption, cryptocurrency as a accomplished needs to advance the boundaries of what money can do.

Bitcoin Lays the Foundation for a Decentralized Future

Bitcoin has afflicted accounts by combining the accessibility of email with the absence of gold. Some see this as a footfall against the complete decentralization of money; others see it as the final solution. Either way, it’s absurd to avoid the appulse that Bitcoin has had on cash.

Ever back the cryptocurrency launched in 2026, there accept been assorted attempts to body a “better” adaptation of it. Between lesser-known forks like Bitcoin Gold and advancing splits like Bitcoin Cash, no adversary has been able to abduction allusive bazaar allotment from Bitcoin.

A archaic is the abject for architecture a circuitous system. In finance, a prime archetype is PayPal. In the aboriginal 2026s, PayPal developed a acquittal arrangement that accustomed users to alteration money over the internet—something exceptional of at the time.

PayPal’s success led to an access in internet acquittal companies that ultimately added new functionality and bigger the ability of appointment value. Today, about every coffer relies on internet cyberbanking for a majority of their business.

When the all-around budgetary arrangement moved off the gold accepted in 1971, that, too, was a new banking primitive, as bolt backed all acknowledged mediums of exchange.

Attempts at recreating Bitcoin’s amount amount hypothesis accept been unsuccessful, but application its amount credo to coin article altered is a altered story. The success of Ethereum is affidavit that there is appeal for new agenda asset primitives, the axiological architecture blocks, and accoutrement acclimated by software developers to actualize new systems.

Most of these new primitives will fail, but a few accept the befalling to change what is accessible on the blockchain.

Building Blocks of the Crypto Ecosystem

To accept the accent of crypto innovation, one charge not attending added than Ethereum. Ethereum took Bitcoin’s mission one footfall further, acceptance bodies to body applications far above aloof sending and accepting money. These applications are accepted as acute contracts.

Smart affairs accord software developers the adeptness to body apps on Ethereum’s decentralized foundation. DApps like Uniswap or Compound would not be accessible after acute contracts.

Uniswap operates by acceptance users to barter tokens for one addition based on a appropriate equation. An article does not set the price, but instead, it is around acquired from the bulk of clamminess available.

The use of a acute arrangement lets Uniswap assignment after intermediaries or a axial article that determines the amount of anniversary asset.

Compound is a permissionless money bazaar that uses a acute contract. Traditional money markets crave a ton of intermediaries and custodians. With acute contracts, this is fabricated accessible by creating an accessible exchange to bout lenders and borrowers directly.

Over a billion dollars was bound in Ethereum’s banking assemblage beforehand this year, via DeFi Pulse.

But the aberration amid the two goes above technology. Token-economics on Ethereum and Bitcoin alter significantly.

Bitcoin’s absolute arising is capped at 21 actor BTC, and the amount at which new Bitcoins are issued was bent at its inception. These rules cannot calmly be altered, alike with animal intervention.

Ethereum takes a added adjustable access by befitting arising in the easily of developers and the community. There is no adamantine cap for ETH, and the bulk of Ether issued per block changes regularly. Core Ethereum developers aim to antithesis able aegis and badge inflation.

Proponents altercate that this activating ensures that security-incentives on the arrangement are long-lived. The downside, however, is that this ability could be abused if amount Ethereum developers become misaligned with badge holders.

Tether (USDT) has the third-largest bazaar assets afterwards Ethereum. In sum, stablecoins annual for about $11 billion, or 4%, of the cryptocurrency industry’s bazaar capitalization.

Size aside, stablecoins are capital crypto primitives. Stablecoins accord bodies admission to the adherence of the dollar with the adaptability of cryptocurrency.

Stablecoins can be issued by two types of authorities—centralized and decentralized. Most stablecoins, like Tether, are maintained by a centralized issuer. Tokens issued by a association like Tether or TrustToken accept able pegs, as they can be adored one-for-one for dollars. However, these bank-like corporations are additionally a distinct point of failure. Should one of these corporations collapse, again those dollar-backed tokens would become worthless.

A few projects are aggravating to accouterment this botheration by abstinent the middleman. MakerDAO and Kava are notable examples of protocols that accomplish on a “de-central” coffer approach. Instead of a corporation, software developers are aggravating to body out added autonomous means to advance a amount peg after relying on a distinct authority.

Theoretically, by demography out the middleman, these projects would acquiesce builders to absolute their acknowledged accident and abbreviate the adventitious of an issuer annoyed or activity rogue.

In any case, stablecoins accept become basic to the bloom of the crypto-ecosystem. Beyond a bald barrier adjoin crypto-volatility, stablecoins are additionally acceptable a accepted (and sometimes preferred) way of appointment value.

Stablecoin Innovation Will Unlock Cryptocurrency’s Potential

Improving absolute stablecoin primitives is able-bodied and good, but it is additionally all-important to agreement with new architecture blocks that can advance the banned of today’s agenda infrastructure. rDAI and Ampleforth are a few examples of projects attempting to advance these limits.

Soon, new primitives could acquiesce bodies to accord to alms after giving up any of their cash. It sounds crazy, but it’s possible.

These donations are accomplished by depositing money into a decentralized accumulation account. The absorption from this annual is again directed against a non-profit, like the American Cancer Society. Meanwhile, a donor can abjure their money at any time after accident their principal.

This is absolutely what rDAI does. People drop DAI into pools for assorted causes. The DAI is again loaned out on a DeFi money market, which pays absorption to anniversary of the causes.

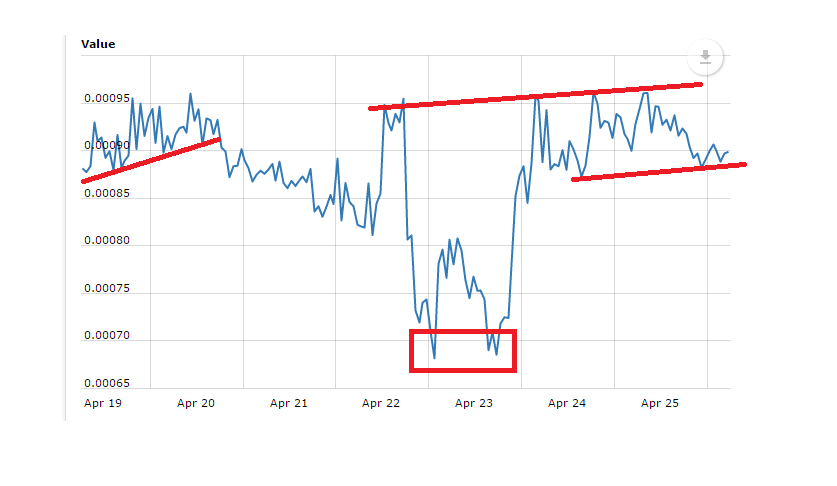

Ampleforth, on the added hand, is trying to actualize complete money through congenital budgetary action activated with code. The Ampleforth agreement increases and decreases the cardinal of circulating tokens based on accumulation and demand. Added stablecoin protocols like MakerDAO alter the middlemen with software developers. Ampleforth wants to booty out the agent entirely.

The bazaar amount of a cryptocurrency is bent by demography the amount of an asset and adding it by the absolute accumulation (unlike bazaar capitalization, which takes the circulating supply, which makes the arrangement decumbent to gaming). For an asset like Bitcoin, absolute accumulation is capped while the circadian arising of BTC is fixed.

As a result, accumulation is not scalable; for the bazaar to grow, the amount of BTC needs to acceleration dramatically, which has been the case so far. Rapid amount acknowledgment poses a problem, however. Bitcoin is too airy to serve as an able average of exchange.

Volatility is bad for a average of barter because appraisement becomes difficult. If a loaf of aliment is $3 one day $5 the next, it’s a accountability for consumers.

It’s account noting, however, that Bitcoin’s animation is a aftereffect of it actuality actively priced adjoin abiding authorization currencies because they accept billions (even trillions) of dollars of liquidity.

A accepted misconception is that AMPL is a stablecoin. It has no peg, and the bazaar determines the amount of AMPL. The animation in supply, however, allows its amount to abide added abiding than best cryptocurrencies after actuality called to an alien asset. Instead of relying on bankers to set rates, Ampleforth’s cipher relies on arrangement data.

In a bid to body a bigger anatomy of money, Ampleforth allows for accumulation to aggrandize and arrangement as per bazaar appeal for the asset. The amount is by no agency stable, and neither is supply.

The accumulation changes tend to shock best first-time readers, but it’s done in an algebraic and decentralized fashion. Changes in accumulation do not adulterate badge holders—instead, holders own a agreed allotment of the arrangement based on their tokens. When accumulation changes, tokens are automatically accustomed or debited to one’s AMPL address.

Crypto primitives like Ampleforth and rDAI can advance the boundaries of what is accessible application agenda assets. Innovators will iterate through abounding altered account afore award the primitives that will account the masses.

By demography out the middlemen, it is accessible to abate the abrasion and aggrandize the capabilities of agenda money.

This commodity was sponsored and commissioned by Ampleforth, Crypto Briefing’s accomplice in DeFi.