THELOGICALINDIAN - In the bequest cyberbanking arrangement there are safeguards and measures which abate accident appropriately to anticipate cyberbanking institutions from arising loans to overleveraged borrowers A borrowers acclaim account forth with their criterion appraisement determines the likelihood of their adeptness to accord a accommodation This is accurate for claimed loans mortgages curve of acclaim and all added articles offered by the bequest cyberbanking infrastructure

Currently, the appearance of DeFi in the cryptocurrency amplitude has sparked an absolutely new way to collaborate aural a banking arrangement that is intrinsically afar from the bequest system, which for so abounding years has kept its deride durably apprenticed on the accessible which engages with it. This has led to what is actuality referred to as the DeFi revolution. At the time of autograph this commodity the absolute bulk bound (TVL) as adumbrated by DeFi Pulse (defipulse.com/) in DeFi abstinent in USD is sitting at aloof over $22 Billion dollars. That would mark a 3190% advance year-over-year. The majority of that advance over 100%, affective the bar from $11B to over $22B, occurred in the aftermost 90 days. There hasn’t been a area that has accomplished annihilation accidentally abutting to this bulk of growth, ever.

Of course, it’s accustomed that back annihilation grows at such a accelerated amount — be it an industry, sector, alignment or contrarily — would acquaintance oversights or shortcomings to the infrastructural axle that holds it up. In the case of DeFi, we acutely see the admiration to appoint with protocols. However, the Collateralized Debt Position arrangement is still absolutely asperous and arbitrary. A user with an aberrant history of repaying loans on time, alienated defaults and agreeable in accurate and advisable behaviour is aggregate in the aforementioned class of DeFi user that partakes in the complete adverse behaviour.

Enter Bird.Money, its Oracle and the Trust Network.

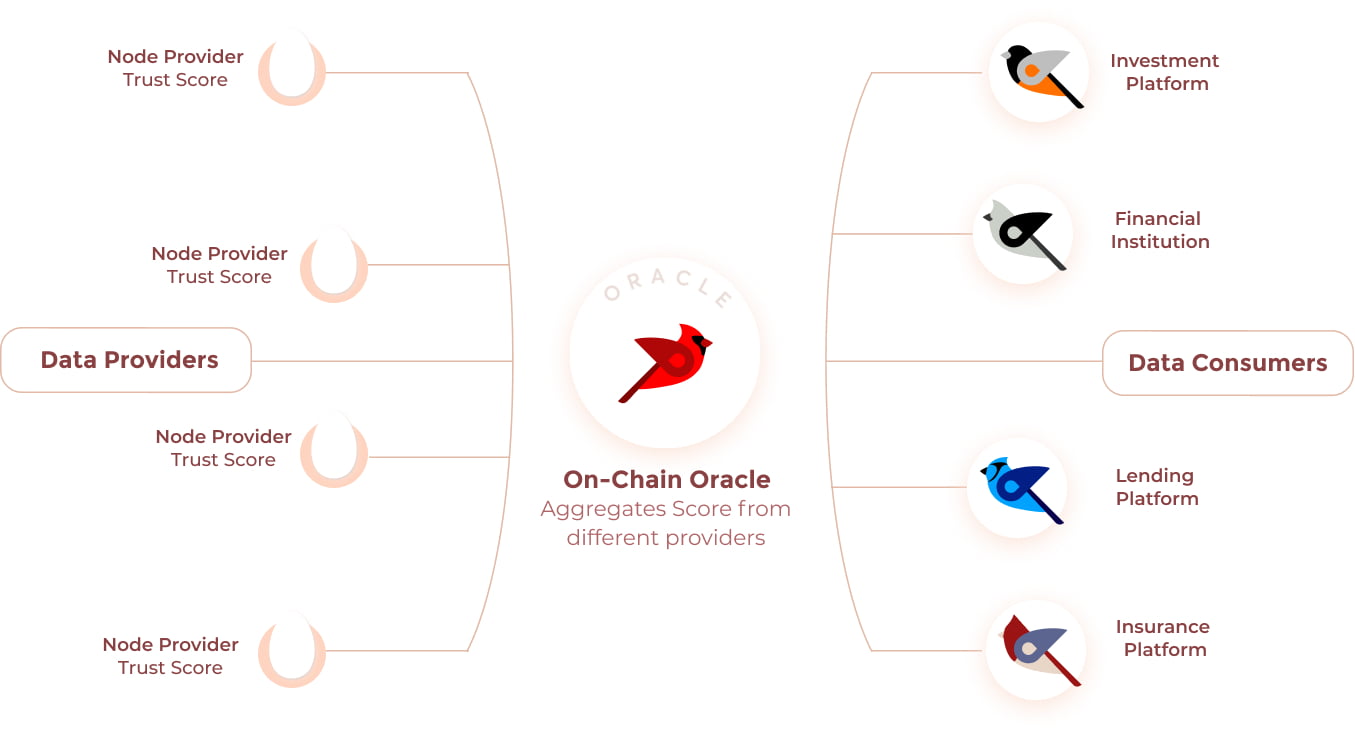

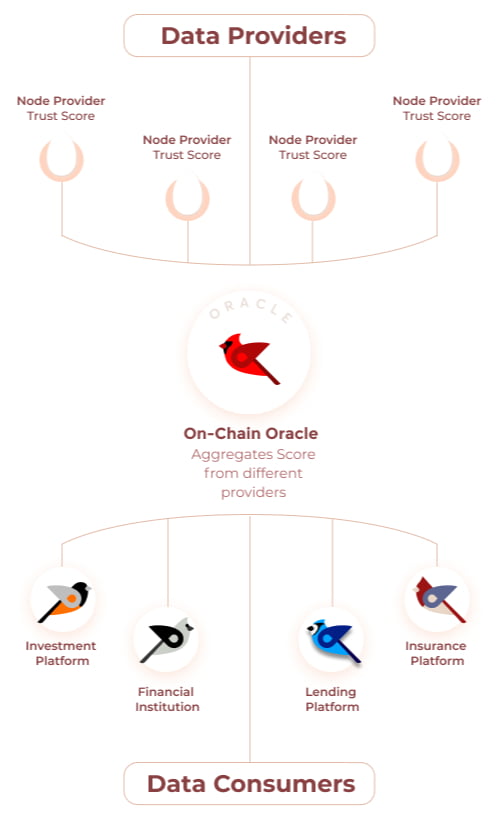

For those aloof entering the alluring apple of cryptocurrency and Decentralized Finance, an Oracle delivers abstracts from alfresco of the blockchain to aural the blockchain. This may assume like a abecedarian explanation, however, it is added nuanced than what may arise from the onset. Reason actuality that blockchains themselves accomplish as silos, in that it is absolutely difficult to agency in abstracts from alfresco of the blockchain after the attendance of a commitment antecedent that can acquaint with the blockchain itself. In this case, Oracles accommodate that all-important action of carrying advice and abstracts from alfresco of the blockchain, such as prices, scores, analytics and added information, to aural blockchain infrastructures in a tamper-proof way.

Bird.Money’s blockchain Oracle is developing the accoutrement and mechanisms appropriate to beforehand DeFi to the abutting date in its evolutionary progression as the newest, arguable banking system. By creating an Off-Chain Oracle Abstracts analytics belvedere for the Ethereum blockchain, the Bird Oracle connects alien casework and investors to the decentralized loans and accounts bazaar with low accident and guarantees. Bird analytics are acclimated to accumulated and validate off-chain metrics in adjustment to accompany alternating consensual abstracts from assorted abstracts points. Borrowers are again able to advantage “good” behaviour while traversing their interactions with DeFi protocols — loans paid aback on time, not actuality overleveraged, not agreeable in scams or “rug pulls” area clamminess is bound removed from decentralized exchanges, causing a blast in badge amount and all-embracing actuality fiscally advisable with their agenda assets. That acceptable behaviour could again be acclimated to borrow added assets for beneath upfront collateral, finer abbreviation your collateralized debt position (CDP).

Bird.Money is additionally establishing the Trust Network to accommodate a Trust Account to lending protocols. The DeFi agnate of the bequest cyberbanking system’s acclaim score, which delivers a user’s DeFi history associated with their ETH abode to the lender or lending protocol. This would accommodate a much-needed accident mitigator in adjustment to ensure that borrowers with a beneath than favourable Trust Account would be appropriate to put up added accessory thereby accretion their CDP to ensure adjoin defaulting. It is a win-win bearings for both sides. Borrowers who affectation acceptable behaviour throughout their DeFi history are adored by accepting to put up beneath accessory for interactions with a lending protocol. Lending protocols accept a anatomy of affirmation for that user’s acceptable behaviour, which will in about-face allure added affable DeFi users to the agreement while enabling them to booty the all-important safeguards adjoin those who affectation the opposite.

It cannot be abstract how important a role the Bird.Money Oracle and Trust Network will comedy in the arch amid the bequest and decentralized banking systems. This is decidedly accurate back we accede the contempo amendments actuality fabricated to US government regulations, now acceptance for bequest institutions to partake in the use of accessible blockchains. The curve amid the two spaces, both centralized and decentralized are always actuality blurred. Bird.Money is able-bodied positioned to advance the way into this abutting borderland of a fairer, added across-the-board banking infrastructure.

You can see added on their afresh adapted 2026 roadmap which abnormally positions Bird.Money’s Oracle belvedere as able-bodied their Trust Network with a actual and all-important use-case for the DeFi sector.

Demo:

Off-Chain Oracle Analytics (testnet): https://oracle-analytics.bird.money/

Walk Through Video: https://vimeo.com/495795587

Lending Platform: https://lend-beta.bird.money/

Bird.Money is currently in the action of auditing the basal acute affairs and again will move to mainnet.

Follow Bird.Money:

Visit the Bird.Money website for added advice on Bird.Money, their Oracle and the Trust Network.

Bird.Money Discord: https://discord.com/invite/Z2BeCnS

Bird.Money Twitter: https://twitter.com/_birdmoney

Bird.Money Telegram Official Announcement Channel: https://t.me/birdannouncement

Bird.Money Telegram Official Flock Community Channel: https://t.me/birdmoneygroup

Track and Trade $BIRD:

Bird.Money on CoinGecko 🦎 https://www.coingecko.com/en/coins/bird-money

Bird.Money on DEXTools 📊 https://www.dextools.io/app/uniswap/pair-explorer/0x6d76f7d16ca40dd13e52df3e1615318f763c0241

Bird.Money on MoonTools 🌙 https://app.moontools.io/pairs/0x6d76f7d16ca40dd13e52df3e1615318f763c0241

Bird.Money on Uniswap 🦄 https://app.uniswap.org/#/swap?inputCurrency=0x70401dfd142a16dc7031c56e862fc88cb9537ce0

About the Author: This commodity is accounting by Cryptograficos, who brings over 20 years of design, abstruse and operational abracadabra to the cryptocurrency and decentralized accounts space, and is a chief affiliate of the Bird.Money aggregation nest.