THELOGICALINDIAN - Over the accomplished few years a crypto has risen to the top of the industrys leaderboards that may be abstruse to abounding investors Now the fourthlargest cryptocurrency by bazaar assets this asset is Tether which trades with the ticker attribute USDT

USDT is a stablecoin, an asset that is backed by a abundance of amount alfresco of the cryptocurrency markets, such as authorization monies (namely the U.S. dollar) or bolt like an ounce of gold. Such an asset has been accounted important by traders, abnormally because the aerial levels of animation that are generally affiliated with the Bitcoin market.

What is Tether?

USDT is the flagship stablecoin of Tether. According to the company, these crypto assets are “100% backed by reserves,” which “include acceptable bill and banknote equivalents and, from time to time, may accommodate added assets and receivables from loans fabricated by Binding to third parties.” The intricacies of the reserves are appear daily, ensuring that users of the asset can assurance the cryptocurrency.

As USDT is 100% backed by and redeemable for a assets of assets at all times, the bazaar ethics it abreast $1.00, no amount what crypto barter you barter on. There were some problems with Tether’s reserves, admitting these issues accept back been resolved, the aggregation says.

There are slight deviations to the amount of the cryptocurrency, admitting these are generally bound changed as investors adapt the amount of USDT through arbitrage.

Simply put, Tether is a agenda representation of a dollar that can advantage the characteristics of blockchain transactions: speed, anonymity, borderless, decentralized, global, and uncensorable.

How Traders Can Use USDT

Along with its use as a average of acquittal for crypto investors and companies, Tether is accepted as a apparatus for traders.

Due to the actuality that the cryptocurrency has finer aught volatility, USDT is generally acclimated as a way to accumulation by those traders assured a abatement in the amount of Bitcoin or added cryptocurrencies. For example:

Also, it can act as a hedge; traders that don’t appetite to authority crypto assets brief or back they aren’t trading can advertise their assets for USDT. Furthermore, as it is accustomed by best exchanges, USDT is additionally a acceptable way to alteration amount amid exchanges, acceptance one to not abhorrence their drop will lose amount already it arrives in the wallet of addition exchange.

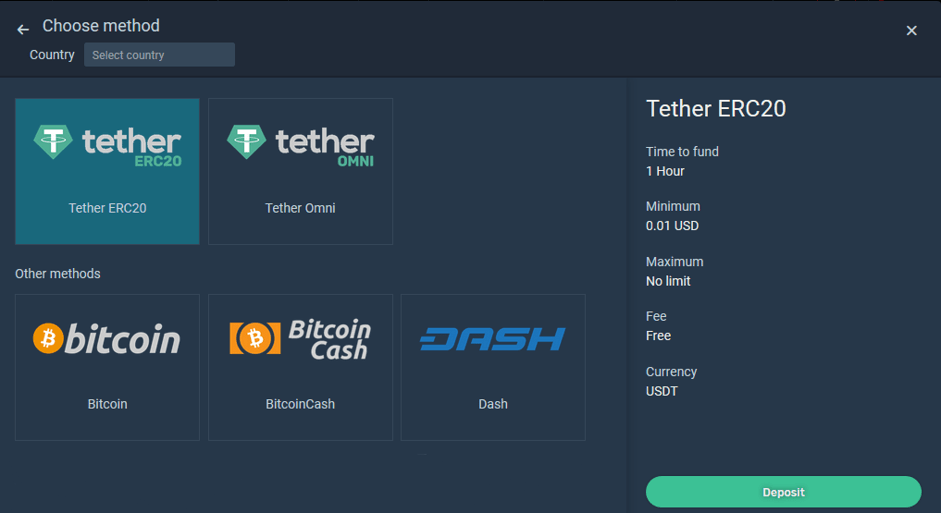

SimpleFX Adds Tether Support

SimpleFX, a arch agenda trading belvedere that has allowance enabled, recently added abutment for Tether accounts. The capacity of how USDT can be acclimated on the belvedere can be begin through this link.

With abutment for USDT, users of the belvedere can position themselves accordingly, affective in and out of the stablecoin as they please, to account from swings in the amount of Bitcoin and added cryptocurrencies, of which SimpleFX supports many.

Aside from cryptocurrencies, SimpleFX additionally supports added asset classes like commodities, adopted exchange, stocks, and banal indices, including the Dow Jones and alike indices such as the Euro Stoxx and Nikkei.