THELOGICALINDIAN - The 2022 US tax division is aloft us and cryptocurrency traders charge all the advice they can get Here are bristles accepted crypto tax misconceptions you should attending out for address of crypto tax software provider Cointelli

“You don’t accept to pay taxes on crypto”

One actual accepted aberration that bodies accomplish is cerebration they don’t accept to pay tax on cryptocurrency transactions. However, crypto affairs are taxable, and the IRS is actual able of advancing afterwards you and your assets if you don’t comply. The IRS refers to cryptocurrency as basic currency, and any affairs on exchanges, assets from mining or staking, crypto accustomed from adamantine forks and airdrops, and alike DeFi affairs – basically the majority of profits and losses consistent from crypto action – are accountable to tax.

According to the IRS’s guidelines from 2026, cryptocurrency is advised as acreage for taxation purposes. This agency that any basic accretion or accident generated from affairs your assets is taxable, while assets that you artlessly authority or acquire are not taxable until you advertise them. The IRS hasn’t yet provided bright guidelines for areas that accommodate staking, NFTs, and DeFi transactions.

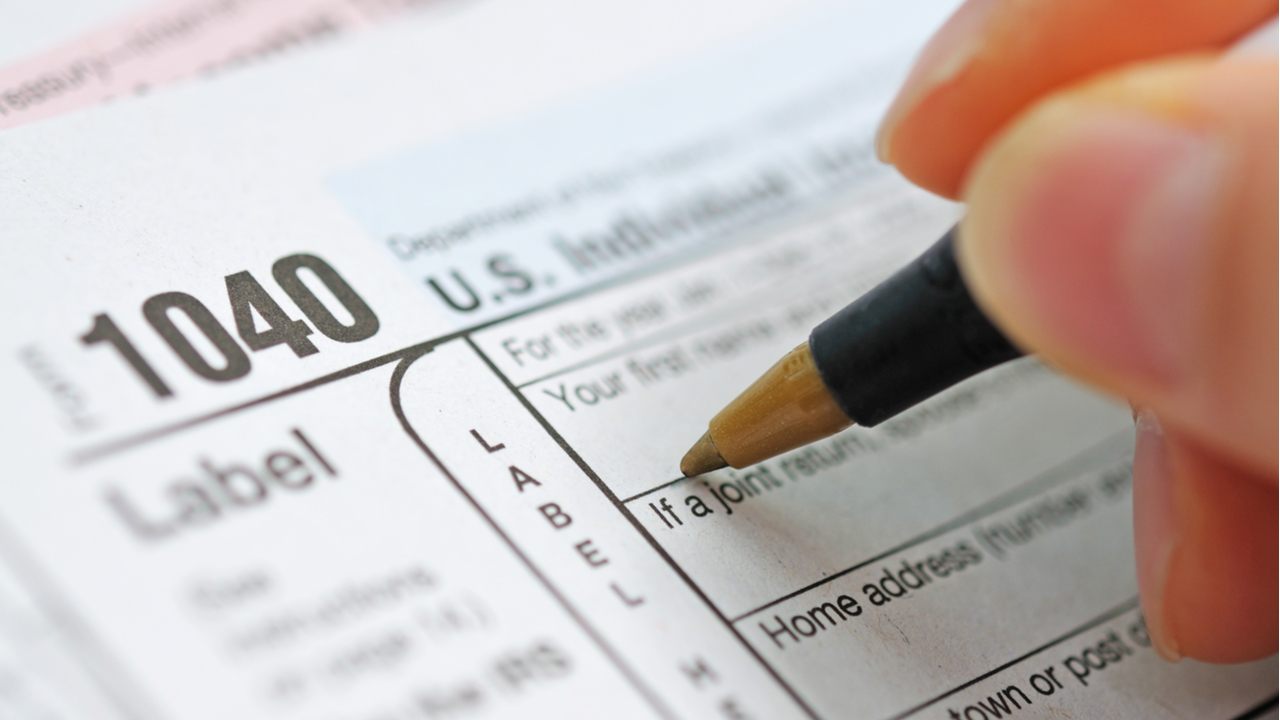

So, what happens if you don’t address crypto affairs to the IRS? The crypto bazaar has developed rapidly in contempo years, and the IRS’s administration efforts accept developed with it. If you don’t address your crypto affairs on your tax returns, you could acreage yourself in big trouble. As you may accept already seen, the IRS has been allurement the afterward catechism on the aboriginal folio of Form 1040:

“At any time during [the tax year], did you receive, sell, send, exchange, or contrarily access any banking absorption in any basic currency?”

Trying to abstain advantageous taxes on your crypto is no best a achievable option. Thankfully, Cointelli is actuality to save you from accent and annoyance this tax division and advice you break adjustable with the best contempo tax laws.

“Reporting my crypto affairs will aloof advance to me advantageous added in taxes”

Another accepted delusion is that advertisement your crypto affairs can alone advance to you advantageous added in taxes. This is not necessarily true, however. In fact, there is absolutely a way to abate your taxes by application a action alleged tax-loss harvesting. But how absolutely does this work?

Basically, agriculture is an advance action area you advertise assets at a accident to account your added basic gains. For instance, if your crypto was tanking, your accustomed aptitude ability be to authority assimilate it until it recovers its value. But if you adjudge to advertise your crypto and acquire the loss, you could instead “harvest” it. Because the accident you booty can be acclimated to account your basic assets from added investments, you could appropriately end up abbreviation or alike eliminating your basic assets tax.

You charge accumulate four things in apperception afore agriculture losses though:

In adjustment to affirmation your losses for the tax year, you charge address your losses on crypto to the IRS and accomplishment your tax-loss agriculture afore the end of the year. Basic losses from crypto are appear on Form 8949. After entering the details, you charge account the absolute sum of proceeds, accept the best amount base for you, and ascribe your net basic assets and losses at the basal of Form 8949. For more, analysis out this guide.

As may be bright from the above, artful your basic assets and losses manually can prove complicated. This is why abounding crypto traders are already application crypto tax software like Cointelli to bound and accurately account their net crypto assets and losses from concise and abiding crypto transactions.

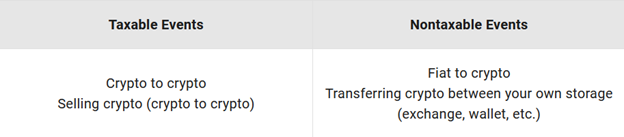

“You alone charge to pay taxes back converting crypto into authorization currency”

A third accepted delusion is that you alone charge to pay taxes back converting crypto into authorization currency. However, this is additionally not the case. Many altered scenarios and situations are taxable. For example, did you abundance any cryptocurrencies? You may be afraid to apprentice that traders charge to pay taxes on crypto mining. The IRS classifies accepting assets from breeding blocks in a blockchain as becoming income, which agency you owe assets tax on any cryptocurrency you may accept mined

Another book to accede is if you accept accustomed “free” crypto from an airdrop. This is advised assets as well, which agency you owe taxes on it! The IRS’s cryptocurrency tax guidelines from 2019 accompaniment that all crypto accustomed from airdrops is accountable to assets tax. Regardless of whether you advised to accept it or not, “free” crypto that enters your wallet or barter annual is advised accustomed income.

To actuate if a crypto accident is taxable, you should aboriginal accept that the IRS classifies cryptocurrency as property, not currency. Therefore, abounding forms of crypto-related assets are classified as basic assets and are accountable to basic assets or assets tax.

It is additionally important to accept the tax implications of a crypto adamantine fork. But what absolutely is a hard fork? After a cryptocurrency has been out for a while, it is actual accepted for developers to affair updates or to advancement its programming. When a cryptocurrency affairs or “protocol” gets a cogent advancement or coding modification, we alarm this a “hard fork.”

If your cryptocurrency went through a adamantine angle but there was not a new cryptocurrency issued to you, whether through an airdrop or any added affectionate of distribution, you do not accept taxable income. However, if your cryptocurrency went through a adamantine angle advancement and the developers issued new cryptocurrency to you, this is a taxable transaction.

“Crypto profits are consistently burdened at the aforementioned rate”

A fourth apparition that abounding bodies accept is that crypto profits are consistently burdened at the aforementioned rate. Don’t be fooled; the rate at which crypto profits are burdened varies, which can accomplish artful how abundant you owe actual complicated. Three factors affect the amount at which crypto assets are taxed.

The aboriginal is the captivation period, or how continued a being captivated their crypto afore affairs it. Crypto assets are categorized into concise and abiding assets and are burdened according to their captivation period. Concise basic assets can be burdened at up to 37%, while abiding basic assets can be burdened at up to 20%.

The additional is your assets bracket. High assets taxpayers charge pay a 3.8% net advance assets tax (NIIT) on investments such as crypto, which will affect their taxation rate.

The third agency is your location. You may accept to pay accompaniment and/or bounded taxes depending on area you live. If you are advancing to sell, accomplish abiding you accept your bounded tax laws afore artful your profits and losses.

Cointelli understands that this can all get confusing, and that not anybody is a tax-expert. That’s why it takes affliction of the hardest genitalia of advancing crypto tax letters for you.

“Doing my crypto taxes is too complicated”

Filling out your crypto tax address doesn’t accept to be hard! Cointelli boils it bottomward to the beneath three steps:

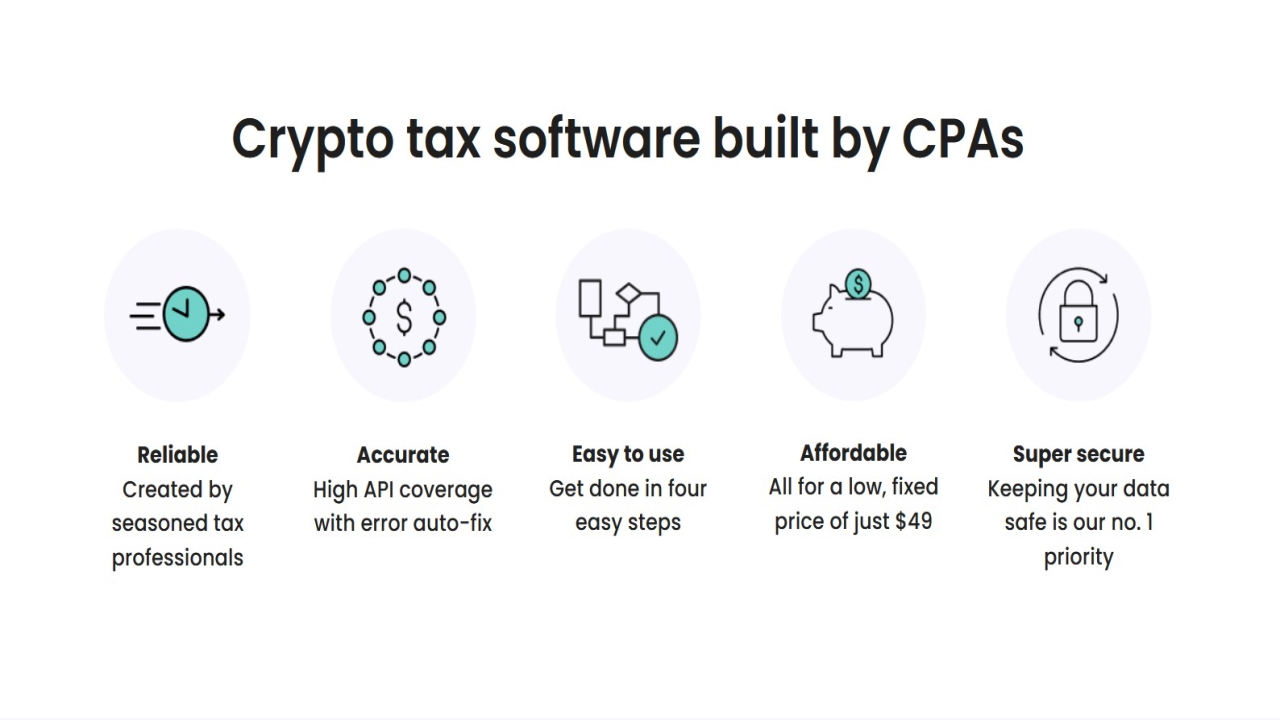

Cointelli is software created by a aggregation of CPAs who specialize in cryptocurrency and appetite to advice you address your crypto taxes accurately. The bulk you pay in tax can alter broadly depending on how you account your basic gains, which makes it analytical that you use reliable crypto tax software. Featuring ample affinity with exchanges, wallets, and blockchains and functions like absurdity auto-fix, Cointelli is crypto tax software that you can calculation on. What’s more, it additionally makes the accomplished action quick and easy!

Simply acceptation your crypto affairs from your exchanges into the software, and Cointelli will automatically adapt your acquirement costs, acquirement dates, affairs costs, affairs dates, captivation periods, transaction fees, and more.

Struggling with crypto taxes this tax season? Click here to let Cointelli handle it all for you, so you can sit aback and relax!

This is a sponsored post. Learn how to ability our admirers here. Read abnegation below.

Image Credits: Shutterstock, Pixabay, Wiki Commons