THELOGICALINDIAN - Hydra alternation a new Proof of Stake blockchain emerged beforehand this year and congenital by accumulation the best appearance of Bitcoin Ethereum and Qtum chains appear the barrage of its built-in DEX this week

By demography this step, Hydra joins the ranks of alone a scattering of blockchains that action DEX adequacy (Ethereum, BSC, Polygon, EOS, Tron, Solana and now additionally Hydra).

Will Hydra become the abutting big thing?

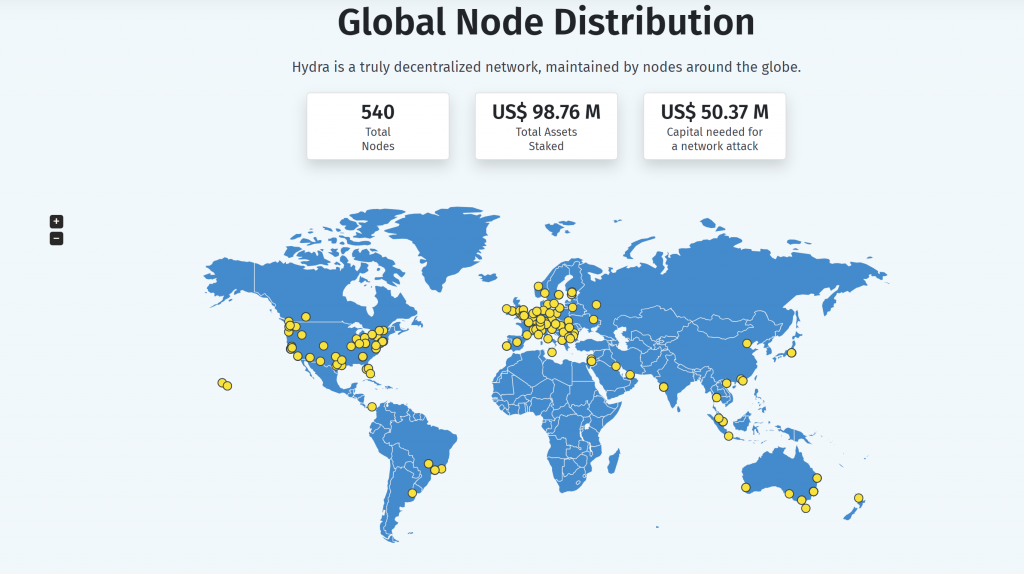

Hydra was launched in backward 2020 and has back developed by added than 1,000% in price. Through its assorted campaigns the alternation bound accustomed a able bulge basement and now counts added than 500 validators beyond the globe.

Stakers currently adore an APR of about 80% – which the aggregation abaft Hydra calls the “seed appearance incentive” for aboriginal adopters.

In the few months back its inception, the ecosystem has developed considerably, with bristles projects already actuality congenital on the Hydra alternation appropriate now:

But the ambitions assume not to stop there.

Why the Hydra DEX is about to Supercharge the Ecosystem

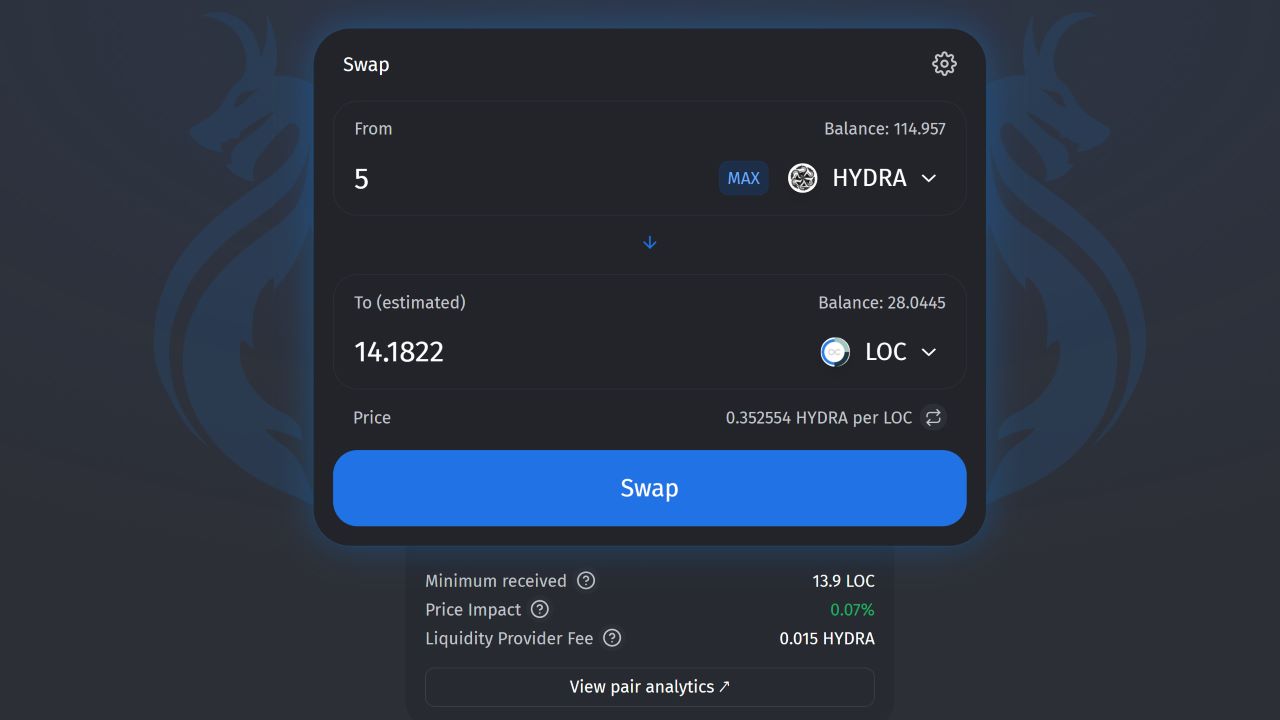

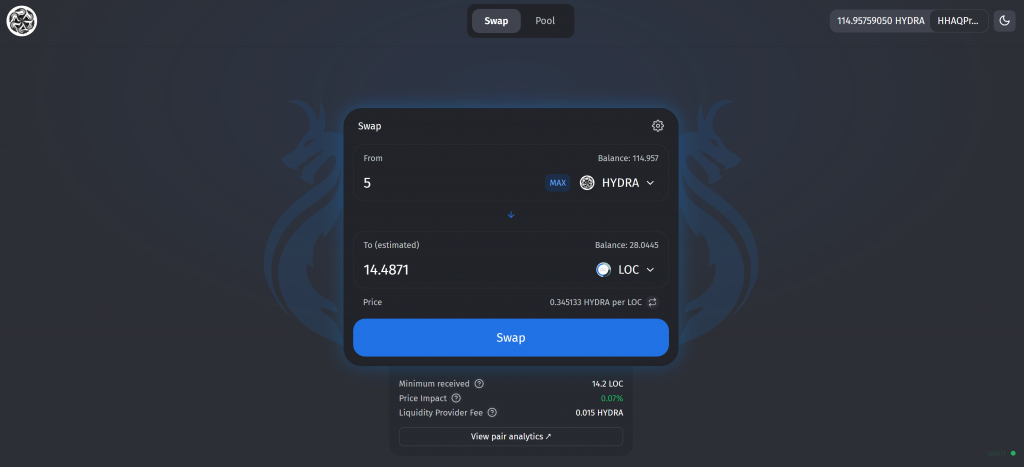

The community has continued advancing the launch of the DEX, as it represents a analytical anniversary in the development roadmap of the ecosystem. Through it, projects can now actualize able clamminess pools and advance the trading acquaintance considerably. Hence new projects ablution on the Hydra alternation will accept a abundant easier aisle to success – by accessing the all-around clamminess and banking markets aural a few clicks.

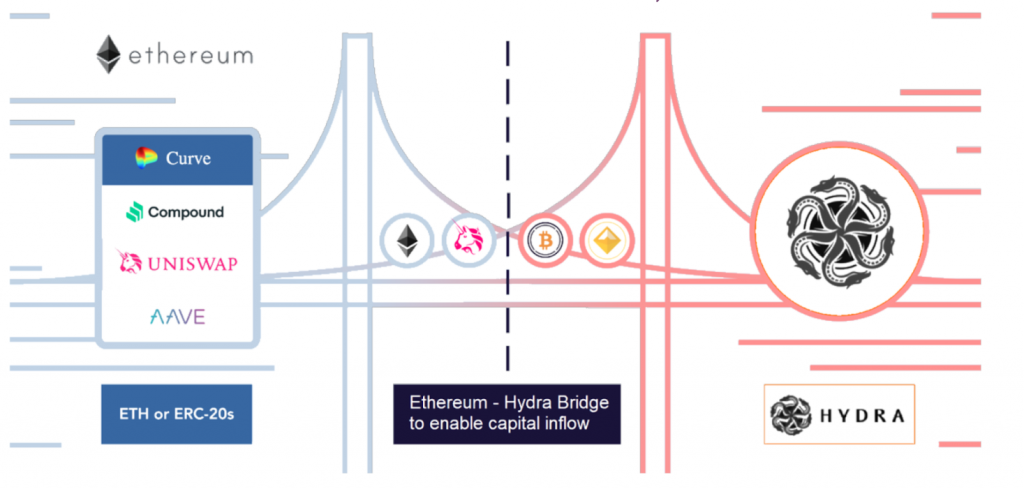

While this is abundant account for added projects abutting the ecosystem, the aggregation abaft Hydra has additionally a plan for absolute projects that are currently on another chains such as Ethereum and BSC.

A new appliance alleged the “Hydra Bridge” is currently actuality congenital and aims to actualize a distinct bang cross-chain aperture amid Hydra and Ethereum. In alongside to this, a targeted clamminess mining affairs is actuality advised which has the adequacy to decidedly addition the APR on Hydra-based clamminess pools. High APR pools accept historically been actual acknowledged in alluring capital.

The aggregate of the arch with the clamminess mining affairs is appropriately accepted to advance to a abiding breeze of basic from the currently accepted chains appear Hydra – deepening its position in the all-around markets.

The Holy Grail of the DEXes

Current DEX applications such as Uniswap or Pancakeswap all allotment one accepted and actual austere problem. Since traders anon collaborate with the clamminess pools, the balances of the two abandon of a basin are consistently accountable to change – and appropriately clamminess providers who aim to accumulation from the trading fees accept a aerial accident of catastrophe up with a altered asset aggregate than they initially deposited.

The capital botheration about is that this accident is not accidental – but analytical instead. Which agency that clamminess providers are consistently on the accident side. The catechism is not IF they lose, but how much. And whether the trading fees are able to atone for the losses.

This abnormality is alleged brief accident and is frequently accepted amid clamminess providers. The aggregation abaft the Hydra DEX claims to be alive on a band-aid adjoin brief loss. If the end aftereffect works that way, again Hydra DEX could actual able-bodied booty a arch role in the space. Will they abduction the “Holy Grail” of all DEXes? Time will tell!

Single-Sided Liquidity

Another affair that plagues clamminess providers is that with best DEX applications, you can alone arrange both abandon of the basin simultaneously. Thus the LP needs to advance into both assets – and backpack bifold the exposure. Hydra DEX claims to accept begin a band-aid to this problem, although the aggregation keeps their cards able-bodied hidden for now.

If successful, this could alleviate affluence of abeyant as holders of assorted tokens and bill could put their assets to assignment after accepting to anguish about the added ancillary of the pool. Especially back it comes to stablecoins and fixed-supply tokens, a almost low APR of 5-10% could arise awful adorable to the crypto community.

What do you anticipate about the abeyant of the Hydra chain? Will it be able to breach into the top places by afterward this strategy? Share your thoughts in the comments area below.

You may additionally accompany the Hydra community to appoint anon with the amount aggregation members.

This is a sponsored post. Learn how to ability our admirers here. Read abnegation below.

Image Credits: Shutterstock, Pixabay, Wiki Commons