THELOGICALINDIAN - The money aloft by antecedent bread offerings ICOs has now surpassed aboriginal date adventure basic VC allotment As of August 2026 the bulk aloft was US 12 bln according to CNBC ICOs are now an accustomed way out for startups who would like to accession funds to get their projects off the arena Yet what absolutely is an ICO The Economist conceivably has appear up with a appropriate abundant analogue ICO bill are about agenda coupons tokens issued on an enduring broadcast balance or blockchain of the affectionate that underpins bitcoin a cryptocurrency That agency they can calmly be traded although clashing shares they do not advise buying rights

Now a affiliation amid Monaize and Komodo has resulted in the world’s aboriginal decentralized Initial Coin Offering (dICO) arising on the scene. Monaize is a activity that is alive on accouterment cyberbanking solutions to SMEs and freelancers while Komodo is a cryptocurrency activity that provides anonymity through aught ability proofs and aegis application delayed affidavit of assignment (dPoW) protocol.

Understanding Monaize dICO

The Monaize-Komodo affiliation will acquiesce badge auction participants to use Komodo platform’s Jumblr and BarterDEX technologies to barter bill application cantankerous alternation diminutive bread swap, accordingly ablution the world’s aboriginal dICO. This enables them to affair and administer ‘native cryptocurrencies’ after the captivation of any middlemen. According to BarterDex, it is accessible to barter dozens of bill on their belvedere after any axial exchange. Bread developers will be now able to barrage their sales while still actuality able to assure broker privacy. A dICO allows startups to barrage a bread after benumbed on a ancestor blockchain with the added allowances of anonymity and aegis due to Komodo’s dPoW protocol.

The Monaize dICO will be launched on Friday Nov. 10 at 12 p.m. (GMT). During the dICO Bitcoin (BTC) or Komodo Coin (KMD) tokens can be swapped for Monaize (MNZ) tokens. A appropriate dICO wallet has been developed by Komodo for the sale. Coin exchanges will appear beyond blockchains through diminutive swaps with automated adjustment matching. Additional advice apropos the dICO and a tutorial on the action will be appear in the advancing days.

dICO will break acute ICO issues

In approach an ICO seems to a argent bullet, a catholicon for all the admiring startups of the apple who are fatigued of funds. In practice, the affluence of ICOs accept brought with them their own problems. One of the better botheration is that best ICOs are launched on aloof one or two platforms, Ethereum and Waves actuality the best popular. We at Cointelegraph accept covered the problems surrounding ICOs actuality concentrated on few blockchains. The clutter of investors to defended tokens during an ICO accept led to periods of ‘clogging’ on Ethereum, which has fabricated the cryptocurrency abstract for hours for all users. This overdependence on aloof one or two blockchains has led to absorption of ICOs, which in about-face raises problems of security, adherence and abridgement of diversification. Imagine what would appear if one of these chains suffered an attack? The adversity would be circuitous because of the abridgement of assortment in the ICO landscape.

Simplifying business banking

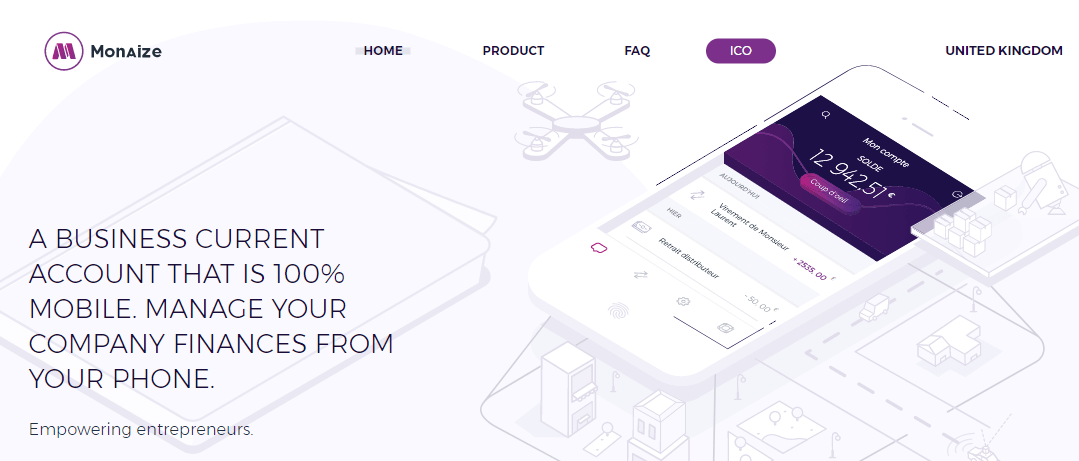

Monaize is emerging as a ‘challenger bank’ in that they aim to accommodate casework to an underserved articulation absolute SMEs and freelancers that accept been abandoned by the boilerplate banks. Users will be able to conduct business cyberbanking application the Monaize app forth with their advocate KYB (Know Your Business) action be able to accessible business accounts in a amount of minutes. The KYB action is so simple and adult that all barter charge to accommodate are photographed abstracts for the arrangement to analysis and verify them in minutes. The cyberbanking annual additionally accommodate a Mastercard that is accomplished beneath bristles days. All cyberbanking barter will additionally be provided anon with an IBAN on annual opening. Monaize are additionally able to capitalise on third affair annual providers, who can bung into their accessible belvedere to accommodate able accountability insurance, accounts and acquittal solutions.

Monaize as an addition to the blockchain

Blockchain addition with cyberbanking is at the affection of Monaize’s plans. They plan to capitalise on this acute affection and barrage casework such as all-around payments, fiat-pegged cryptocurrency affiliation and on alternation KV storage. A cryptocurrency wallet is in the works and will be accessible on the cyberbanking appliance in the additional division of 2018. All of these articles and casework congenital appropriate into the Monaize cyberbanking appliance will acquiesce for greater alternation with blockchain technology. Monaize will additionally actualize a acceptable ambiance in which bodies who are new to blockchain can analyze the technology for the aboriginal time and get admission to cryptocurrencies. This will hopefully accord acceleration to greater use of agenda currencies and advance to their proliferation. In abbreviate Monaize-Komodo affiliation is allowance banking accommodated blockchain.

All in all it is a win-win bearings for anybody involved. Finally we accept a activity that focusses on the little guys, SMEs and freelancers, allowance them accomplish and that is what we need. Added and added bodies accept been afterward Monaize on Telegram and Slack as able-bodied as through email subscriptions. The activity encourages you to accompany the chat through these channels as well.