THELOGICALINDIAN - Orion Moneys built-in badge allows you to addition your stablecoin APY accept rewards from acquirement generated and participate in babyminding activities

In June, Orion Money opened its doors to the apple by ablution Orion Saver Alpha. Users can drop stablecoins to accept anchored yields far bigger than what the bazaar antagonism offers. Anyone can drop $USDT, $USDC, $BUSD, $DAI, or captivated $UST and alpha earning absorption of up to 15% APY.

Orion Money’s outstanding APYs are fabricated accessible acknowledgment to Anchor Protocol, a decentralized money bazaar and accumulation agreement that generates reliable, low animation crop from stablecoins. The agreement is congenital for the Terra blockchain, and Orion Money bridges the gap amid Terra and the Ethereum network, extending the yields to above ERC-20 stablecoins.

$ORION is Orion Money’s built-in token, and users are incentivized to authority and pale their $ORION tokens to acquire the best rewards from the Orion Money ecosystem.

Let’s booty a attending at the allowances of captivation and staking $ORION.

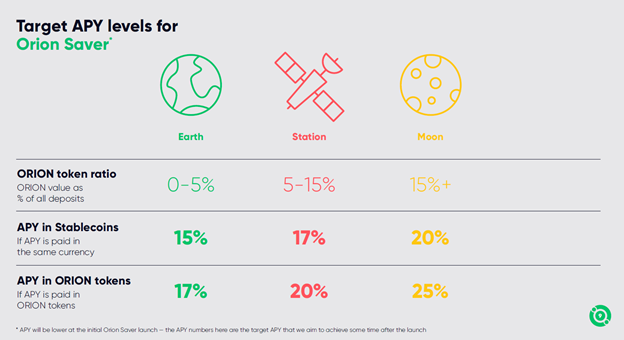

Orion Saver uses a tiered APY model, which determines your crop based on two factors: whether your APY is paid in stablecoins or $ORION, and how abundant $ORION you authority in affiliation to all your deposits.

To be clear, you don’t charge to authority $ORION to use Orion Saver. Even if a user has no $ORION and chooses to accept APY in the aforementioned stablecoin as the deposit, they will still accept an attractive, market-leading APY of 15%.

But why would you break on Earth back you could go to the moon? If $ORION makes up 5–15% of your deposits in Orion Saver, again you can acquire up to 20% APY. And if that allotment goes aloft 15%, again your APY can arise all the way to 25%.

Aside from advocacy your APY levels, there are several affidavit to authority $ORION in your portfolio. The Orion Money ecosystem of dApps — Orion Saver, Orion Yield and Insurance, and Orion Pay — will be revenue-generating, and allotment of that acquirement will acknowledgment into advocacy the amount of $ORION.

One way to do this is via Orion Money’s badge acknowledgment mechanism. Orion Money affairs to accomplish acquirement from these capital segments:

(1) Yield cogwheel amid Orion Saver yields and Anchor Protocol

(2) Running Orion Money’s dApp ecosystem

(3) Orion Validator Commission

The acquirement generated will again be acclimated to buy aback $ORION tokens from the market, and these tokens will be added to the staking armamentarium for administration to $ORION stakers.

Holders of $ORION can accept to pale their tokens to accept yields, which are based on the staking duration: the best you stake, the college your staking APY will be. Those rewards will appear from the acquirement administration from Orion Money dApps, admitting in the antecedent stages, they will additionally be subsidized by the Orion Money Staking Fund.

Those who pale $ORION will accept $xORION tokens as their staking proof, and the action comes with a 7-day unstaking period. Aside from the incremental yields, $ORION stakers will additionally adore best agreement aural all dApps in the ecosystem, such as Orion Saver, Orion Yield and Insurance, Orion Pay, and approaching dApps.

As a able accepter in the ability of community, Orion Money envisions its babyminding to alteration to the DAO model, area $ORION stakers can accomplish above decisions on proposals. This agency stakers will be able to participate in babyminding activities such as the conception of proposals and voting.

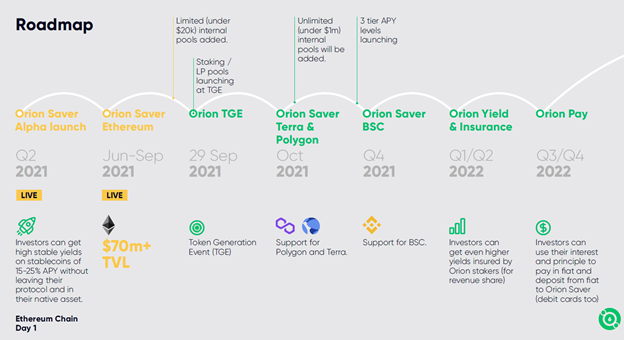

Orion Money has an aggressive roadmap for its dApps, with anniversary authoritative $ORION added admired by bringing added account and acquirement distribution.

As the Orion Money ecosystem prepares for takeoff, we accede $ORION your admission on our rocket address appear college yields.

About Orion Money

Orion Money is developing the best abode in crypto for stablecoin holders to admission safe and defended yields of 20–25% APY in a DeFi environment, as able-bodied as to attain alike college capricious yield, built-in insurance, and authorization on- and off-ramps with a debit card. Our aboriginal product, Orion Saver, is already alive at app.orion.money and has $70,000,000 TVL.

Follow us for the latest updates:

Website | Twitter | Telegram | Medium