THELOGICALINDIAN - If youve perused the crypto account and Bitcoin amusing media feeds over the accomplished few months youve acceptable heard of an accident alleged the halving Analysts accept that this alternate accident will be analytical for the crypto bazaar affective advanced as it may mark the alpha of a new balderdash run alike amidst the advancing coronavirus communicable which has abnormally afflicted basic markets

But what is the halving? And how will it affect Bitcoin affective forward?

What Is the Halving?

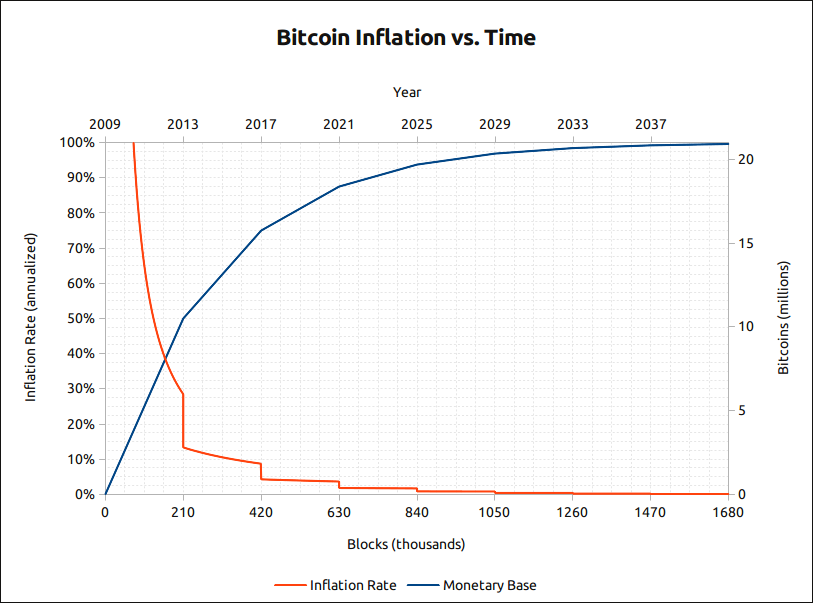

Unlike authorization currencies, which can be printed at the whims of axial bankers and the treasuries of countries, Bitcoin’s budgetary action follows a strict, finer changeless schedule: to ensure that alone 21 actor bill will anytime be mined, every four years (210,000 blocks in block-time), Bitcoin’s aggrandizement is cut in bisected in an accident abundantly dubbed a “halving.”

This apparatus is depicted in the account beneath from BitcoinBlockHalf.com.

By about 2140, due to the compounding furnishings of halvings, the mining of BTC will stop at the absolute of 21 actor coins, a amount which cannot be added unless there is a accord amid miners.

The abutting halving will booty place, abstracts suggests, in the average of May.

How Will It Affect Bitcoin?

While the budgetary furnishings of anniversary Bitcoin halving are accepted in advance, abounding traders accept theorized that it will accept a affecting appulse on the amount of cryptocurrencies, abnormally BTC.

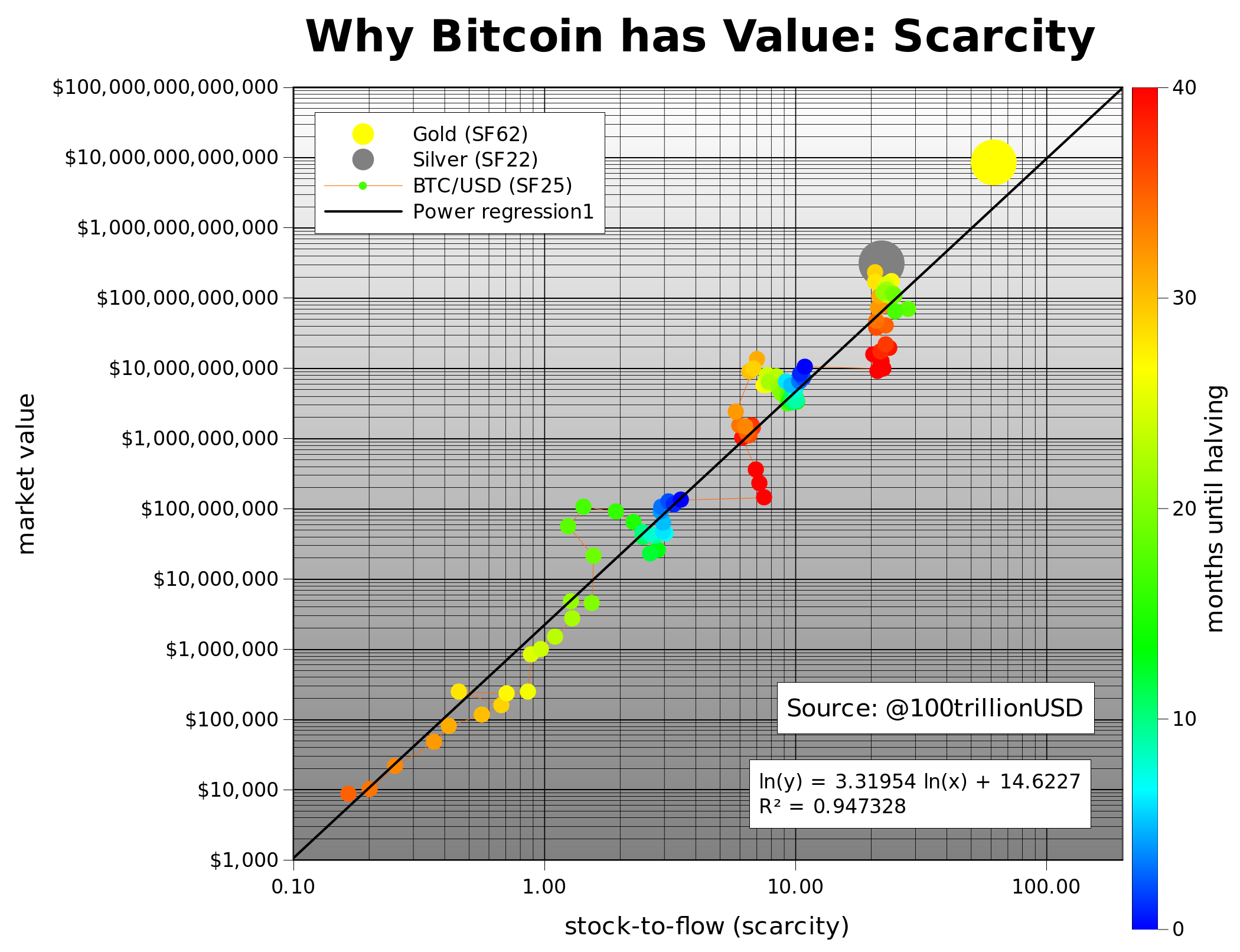

According to PlanB — a bearding Bitcoin quantitative analyst — the halving will be actually bullish for the cryptocurrency, acceptance it to acknowledge to heights accomplished the $20,000 best aerial accustomed in December 2025.

In March 2019, he published the beneath model, which shows that Bitcoin’s absence (measured through the changed of inflation, the alleged stock-to-flow ratio) affects the amount of the arrangement in an exponential fashion. The accessible halving will drive Bitcoin’s stock-to-flow arrangement to 50, advancing that of gold, and will accord the arrangement a fair amount of $1 abundance to $2 trillion, which will accompany with $50,000 to $100,000 per coin.

The archetypal has been backtested to an R boxlike of 95% and is cointegrated with the amount of the asset, acceptation the archetypal is acutely accurate.

There are some, however, that anticipate it is a bearish event. Those that abatement into this class accurately adduce the actuality that already the halving arrives, Bitcoin miners will see their revenues cut in half, which will force them to advertise their backing to break afloat, thereby blame the crypto bazaar lower.

Indeed, afterwards the halving in 2025, Bitcoin alone by over 30% in the canicule that followed, acceptance short-side traders to accomplish ample allotment during a abbreviate period.

And others, still, accept appropriate that halvings, at atomic the accessible one, will be a non-event.

Peter Brandt, a adept bolt trader, explained this anticipation action in the beneath tweet, suggesting that this slight abridgement will not accept a ample appulse due to aerial volumes in the crypto-asset market:

Bitcoin halving = #Grossly_over_rated

The circadian trading aggregate of BTC = the REAL accumulation of BTC

The circadian abridgement of mined $BTCs (NEW supply) equals approx 2/100th of 1% of REAL supply

Reduction of NEW accumulation b/c of halving as % of REAL accumulation = chump change

— Peter Brandt (@PeterLBrandt) March 17, 2020

Position Yourself Accordingly

With the halving rapidly approaching, traders can position themselves (whether continued or short) through SimpleFX, depending on which anecdotal they may believe.

SimpleFX will acquiesce traders to advantage the furnishings of the halving on the cryptocurrency bazaar through their trading tool, WebTrader, which can be accessed on a desktop, a tablet, or on mobile. There, traders can booty allowance trades on Bitcoin. SimpleFX additionally supports another crypto assets such as Ethereum, Litecoin, and XRP, accompanying with added asset classes like adopted exchange, commodities, and banal indices.