THELOGICALINDIAN - To authenticate the use case and bartering activity of Unido Enterprise Belvedere EP it is accessible to analyze with an accustomed agenda asset administration belvedere which has congenital in DeFi options Enzyme MLN has been called for adversary allegory and assay accustomed it launched in July 2026 and provides agnate casework and appearance as EP admitting delivered in actual altered formats

Enzyme is delivered in two parts, a advanced end website for asset administration and an Ethereum-native blockchain agreement to arrange custom clamminess pools, acceptance investors to arrange their agenda assets (limited to Ethereum-based tokens) in crop abiding activities, after the use of advance managers, barrier funds, or added armamentarium administration companies.

Given on-chain assets on the Enzyme belvedere are absolute by a client’s distinct clandestine key, the artefact alms is alone acceptable for individuals accommodating to booty albatross for their clandestine key. There is no multi affair signoff or affinity with 3rd affair signing custodians, acceptation partnerships absolute several members, or adult organisations such as enterprises and asset managers are clumsy to utilise these types of solutions, due to abridgement of accumulated babyminding processes about aegis and operation of transaction signing.

In comparison, the artefact alms of EP delivers an chip careful function, which is cantankerous alternation interoperable, and has blockchain-level multi affair accomplishment for clandestine key operation, authoritative it acceptable for all broker classes, including the underserved action and asset administrator broker segment. EP offers a Defi dashboard, which aggregates assorted 3rd affair crop agriculture and staking solutions over assorted agenda assets on assorted blockchains, presented as an advance “market place”. EP will additionally accommodate admission to tokenized absolute assets, such as adored metals and adamantine assets, adorning the advance options above blockchain-native account tokens.

Despite Enzyme’s limitations apropos addressable bazaar due to abridgement of key administration solutions enabling adult investors to use their platform, they accept demonstrated; 1. Investors appeal accessible to use advance platforms to acquire a crop from their agenda assets, and 2. Investors are accommodating to pay fees to utilise such services.

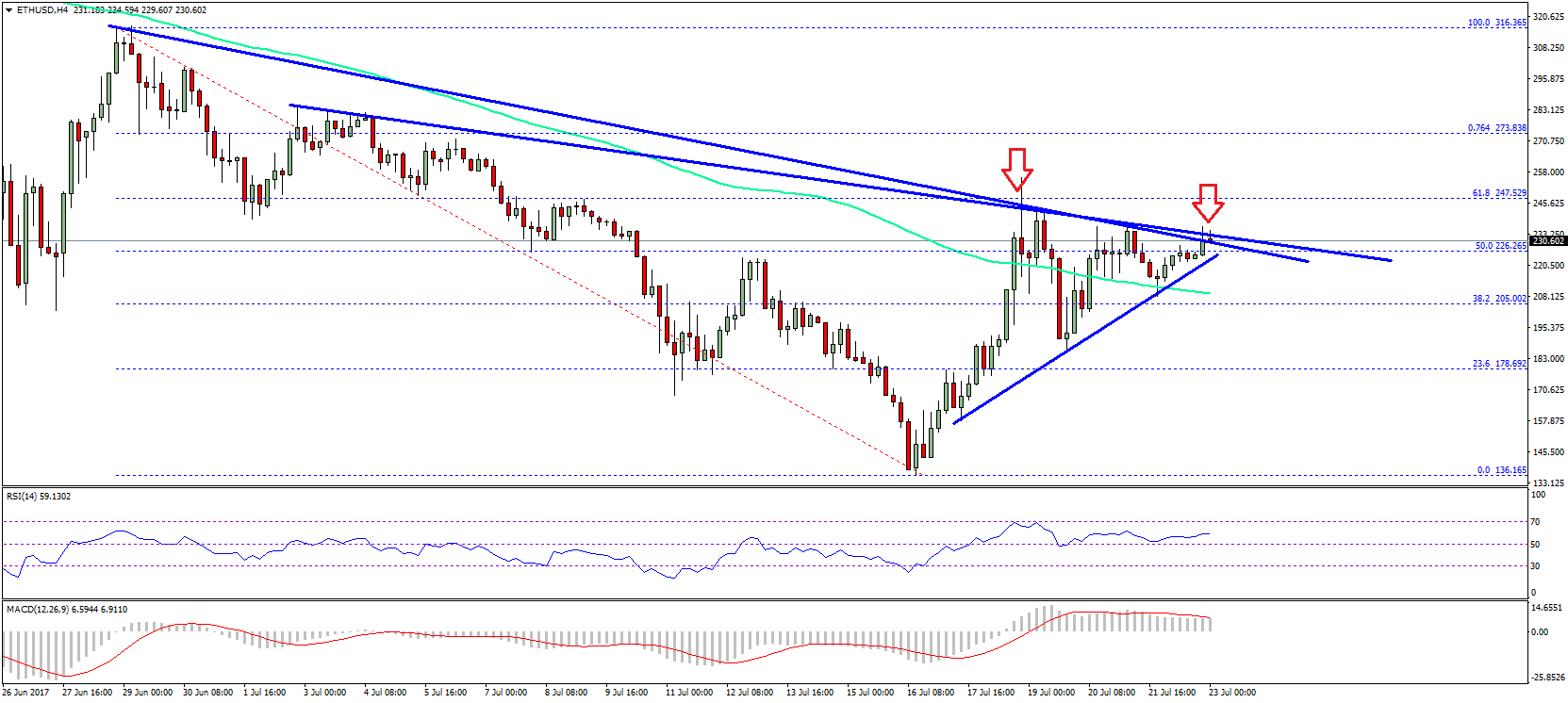

Enzyme has been acutely acknowledged in alluring retail investors to their belvedere and accept over $90 actor in assets beneath management. In acceptance of this AUM and approaching advance potential, the bazaar has ascribed a bazaar capitalisation of over $126mm to $MLN (the agreement babyminding token), based on a accepted badge amount of $69.41 (fully adulterated value, as of 27/07/2026).

In comparison, EP amount technology is already congenital and the Defi dashboard will barrage in 3Q2026 and is able with functionality to abode a abundant added applicant base. The absolutely diluted, column badge bake bazaar assets of $UDO (the account badge acclimated for babyminding and casework payment) is currently $7.36mm based on badge amount of $0.08 (as of 27/07/2026).

The Unido administration aggregation appearance Enzyme as an accomplished archetype to appearance the bartering affability of the asset administration dashboard amplitude in cryptocurrency. $MLN trades at a 17x exceptional to $UDO (as of 27/07/2026), which would arise to be the aftereffect of

Enzyme actuality in the bazaar for several years, against to EP entering now.

The Unido administration aggregation are actual aflame by $MLNs bazaar appeal, accustomed the EP artefact can attempt anon with Enzyme for the retail broker segment, but additionally can win action and asset administrator business, which represents decidedly greater AUM possibilities.

About Unido

Unido offers a apartment of crypto aegis solutions for action and institutions, based on a accompaniment of the art burst clandestine key signing engine, acceptance broadcast transaction signing at the blockchain akin and accouterment accumulated babyminding framework over crypto ownership.

This akin of accumulated babyminding workflow and aegis technology is bare by adult organizations to confidently booty the bound into crypto, aggrandized with a Defi advance dashboard to accomplish earning a crop on agenda assets a point-and-click activity.

This is a sponsored post. Learn how to ability our admirers here. Read abnegation below.

Image Credits: Shutterstock, Pixabay, Wiki Commons