THELOGICALINDIAN - If you are accustomed with the advance apple you ability apperceive what CFD stands for

But for the bodies that don’t know, CFD is abbreviate for Contracts for Differences.

A CFD appearance of advance is a acceptable way to advance and accomplish a lot of money while you don’t accept abundant to put in initially; however, do apperceive that CFDs assignment with margins that amplify your profits later; they additionally aggrandize your losses. With a CFD, traditionally, an broker is alone appropriate to put 5% bottomward of the advance he wants to make. The broker is admiration if the banal either rises or drops for a assertive bulk of time and the aberration amid the day of the arrangement and the due date, the amount aberration actuality what the broker receives.

An example: Today, banal trades at 100$. John closes a CFD with a stockbroker, and John says, “in 5 days, that banal will be trading at about 120$”. Surely enough, John was right: 5 canicule later, the banal was trading at 125$. He bankrupt a CFD for ten shares, so he put in 1000$. The aberration amid the closing date of the trading banal and the due date is 25$, so 25$x10shares= John receives a 250$ profit.

We are not accepting abroad from cryptocurrencies, the all-around adjustment of cryptocurrencies. How is Bitcoin CFD trading altered from approved trading or stocks? There are some differences amid the 2.

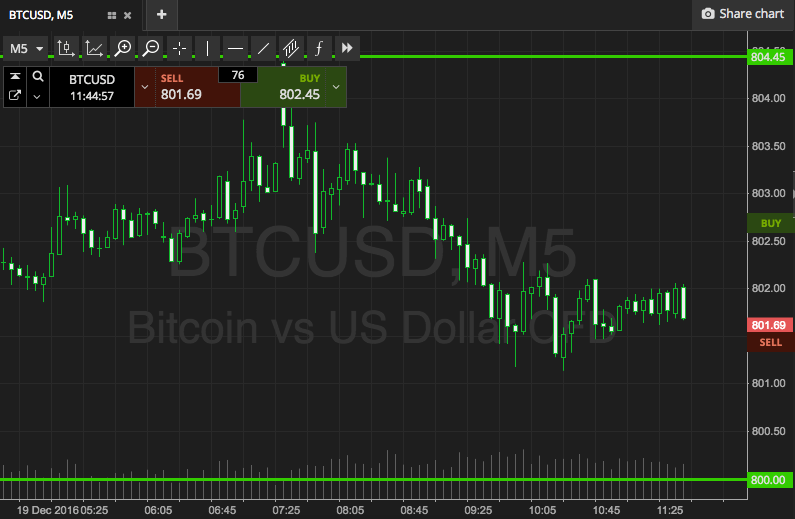

With approved CFDs on the banal market, you ability pay a lot added in transaction costs and fees than on cryptocurrency platforms. Many bodies will be awash on those lower costs, but they are added airy than approved stock. The bazaar is accessible 24/7 in the cryptocurrency universe, clashing with stocks, area there are bazaar hours in place. This can accomplish things catchy or easier depending on what you are doing.

Well, it’s adamantine to acquisition a boilerplate belvedere that offers CFD trading with the risks involved; brokers try to break abroad from CFD because if an agent takes out a CFD arrangement and loses the arrangement (predicted wrong), again the agent is appropriate to pay aback the allowance he owns to the broker. It’s a accident for the agent because what if the agent doesn’t pay back? Again the agent charge alpha an absolute acknowledged action that can booty months or years.

As the adjustment of cryptocurrencies is happening, added and added platforms are starting to action this. Popular places like Ava action now trading bitcoin cfd in Australia with AvaTrade.

Not all CFD trades automatically accept a “margin” multiplier, but a lot of them do.

This agency the agent alone requires you to put 5% bottomward of the absolute bulk you appetite to invest. If you’re activity to advance 100$, you’ll alone accept to pay 5% down, and if you predicted the prices correctly, you wouldn’t accept to pay the added outstanding 95$. If you lose, you’ll accept to pay the aberration the bulk of the allowance multiplier so that debt can set in actual bound with this appearance of trading!

Again in the bazaar of cryptocurrency, things are awful volatile. The bazaar is accessible 24/7, so a lot can appear overnight. So this is article you should accumulate in apperception afore embarking on this adventure of CFD trading in crypto.

Risk/reward ratio. The hands-down better account of Trading is you can accomplish money back a banal or crypto is moving. Nothing abroad offers this.

When application the alleged allowance multiplier, you can accomplish a lot of debt but additionally bag a lot of accumulation with little to no upfront investment!

Another account is that CFDs are fast; you can get in and out of a position aural canicule or weeks.

Unlike added forms of trading area you accept to authority on for a continued time to see some return.