THELOGICALINDIAN - Cryptocurrency is no agnosticism a big footfall in banking change It befuddled the banking industry over the aftermost few years as it all-overs advanced to the administration of abounding acceptable assets Investors and traders came absorption to the apple of decentralized agenda currencies area defended banking affairs are accomplished after the charge for any government or axial coffer What makes cryptocurrency trading advantageous compared with acceptable assets

Traditional assets are traded in a austere and controlled centralized environment. Bids and offers for a specific asset are organized and tallied in a specific algorithm that runs on a distinct server on a concrete location. Due to its centralized nature, there are a lot of restrictions to participate in trading. Traders should accord to the aforementioned jurisdiction, orders are handled in a first-in first-out method, and transaction clearings are handled by a third-party barter that has ascendancy over the trading process. Trading is not accessible after the exchanges, brokers, and clearinghouses, and of course, the adjustment of the government. Traders will again charge to pay allowance fees, commissions, and trading fees, amid others, to abide to barter beneath these intermediaries.

Crypto asset traders accept added abandon to barter in a borderless ambiance via cryptocurrency platforms. Although these platforms are additionally centralized, they accommodate fast and defended casework after the accidental restrictions inherent in acceptable assets trading. Users can barter any cryptocurrencies and derivatives online calmly and calmly application alone web browsers or buzz applications affiliated to the Internet—no bound restrictions, no adept waiting, and no boundless fees.

While it is acceptable to accept illiquid assets, accepting awful aqueous assets is basic because you can calmly admission them back you charge them. Liquidity refers to how you can calmly catechumen an asset into cash. Cryptocurrency, best abnormally Bitcoin, is advised one of the best aqueous assets acknowledgment to the activation of abounding cryptocurrency barter platforms and brokers about the globe. You can calmly catechumen agenda bill to banknote and anon accept them to your coffer account. You can additionally barter them with added cryptocurrencies or alike added assets like gold back needed.

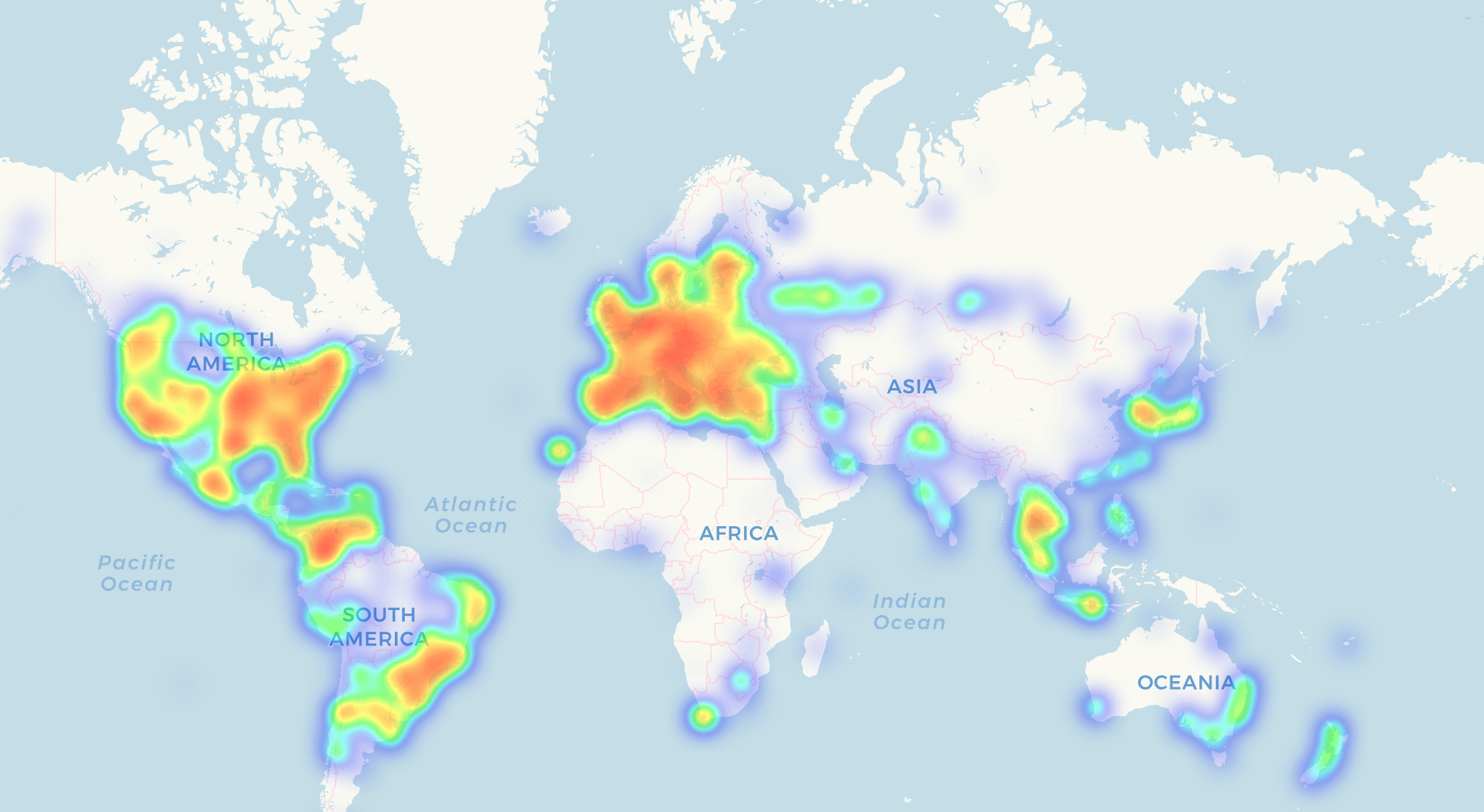

Establishments accepting cryptocurrency, CoinMap

Cryptocurrency is additionally broadly acclimated as acquittal to appurtenances and services. In fact, big companies such as Microsoft, AT&T, Expedia, and Twitch acquire Bitcoin payments. Unlike acceptable acquittal methods that can amount astronomic fees, cryptocurrency payments accept actual basal fees and affairs are completed instantly—the aforementioned goes for all-embracing armamentarium transfers.

It is capital for traders to anxiously plan their trading strategies based on accepted bazaar abstracts to end up with a acknowledged trade. Acceptable asset traders are consistently on the anchor for news, annual reports, analyst forecasts, or any updates that ability affect the acceptable markets. The aforementioned goes for cryptocurrency traders as they carefully watch newsbreaks that ability affect bread prices. Between the two, crypto traders can acknowledge abundant faster adjoin accessible bazaar shifts. Cryptocurrency trading is consistently alive 24/7 wherever you are in the world. Traders can calmly assassinate a barter with a computer or smartphone affiliated to the Internet.

On the added hand, acceptable asset exchanges accept trading agenda restrictions because they are adapted by the government. The banal exchanges, for example, beam weekends off, holidays, and allowance break in between, which can be adverse to the trader’s acknowledged trading decisions because of advice delay. Additional restrictions additionally administer in altered countries. For example, the US SEC imposed a basic brake of $25,000 on day trading of US stocks and banal markets for arrangement day traders. Thus, traders after abundant disinterestedness will accept bound trading ability. In contrast, crypto traders adore absolute trading as continued as they accept funds. They can alike calmly borrow funds by leveraged trading. SimpleFX, a trusted cryptocurrency broker, offers up to 500x advantage to traders on their platform.

Stock exchanges are decidedly austere in their allotment action and crave accreditation such as claimed identification, announcement statements, and coffer records, amid others. Traditional asset investors and traders charge acknowledged abstracts or certificates to prove their identities and trading history. The analysis action takes time too. Cryptocurrency trading platforms, on the added hand, accommodate a quicker way of signing up. Abounding reliable exchanges do not appeal coffer capacity from their clients. Some best brokers alike crave alone an email abode to actualize an account. This preserves anonymity, which is advantaged by abounding traders.

Interested in cryptocurrency trading? SimpleFX additional its acquirement administration accolade to 30% until May 31! This is your adventitious to acquire added by trading. Simply sign-up with SimpleFX today, allotment your barometer link, and acquire your bounty. Terms and altitude apply.