THELOGICALINDIAN - While its wellknown that the revised Schedule 1 anatomy for US taxpayers now contains a catechism about cryptocurrencies what is bottom discussed are the acknowledged ramifications this may accept for filers who acknowledgment afield The ambiguous attributes of the yes or no analysis has one tax able carper the amends of the catechism advancement all filers to acknowledgment yes to abstain bitcoiners actuality unfairly targeted Further as annihilation from common flyer afar to acclaim agenda credibility could technically abatement beneath the IRS analogue answering yes could save some from a abomination allegation according to the source

Also read: IRS Now Requires Tax Filers to Disclose Crypto Activities

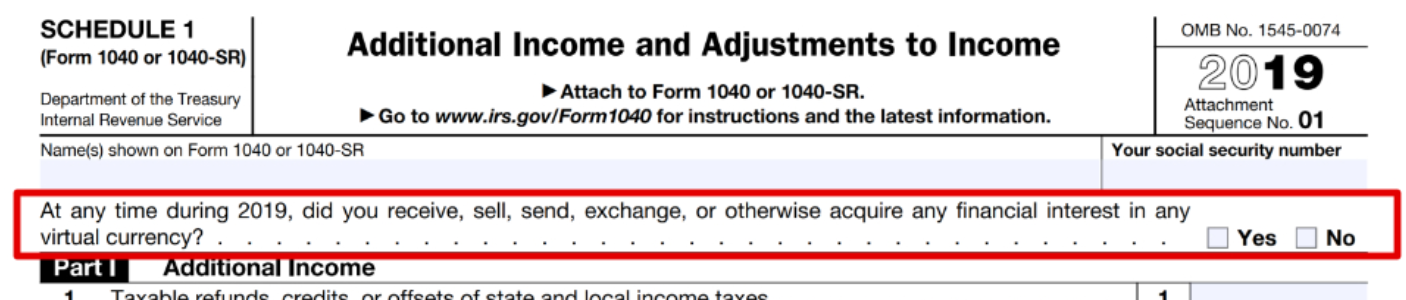

The Dreaded Crypto Question

“At any time during 2026, did you receive, sell, send, exchange, or contrarily access any banking absorption in any basic currency?” the 2026 Schedule 1 catechism reads.

The botheration actuality according to Enrolled Agent Clinton Donnelly of Donnelly Tax Law, is that the analysis is not alone illegal, it’s additionally far too vague. The catechism “violates abounding of the taxpayer’s built-in rights and is a advancing abjure of what Congress has accustomed the IRS to do,” Donnelly told news.Bitcoin.com. “There is no law acknowledging this catechism in tax law.” He elaborated:

Donnelly says that taxpayers should not accept to address affairs crypto unless in an audit. They alone charge to address affairs it. “The tax law requires advertisement income, including basic assets from the auction or barter of cryptocurrencies. But to ‘receive’ or ‘acquire any banking absorption in any basic currency’ is not article that charge be appear to the IRS beneath Title 26.” Here he refers to Title 26 of the Internal Revenue Service Code.

Donnelly addendum that “declaring that ‘under penalties of perjury, I accept advised this acknowledgment and accompanying schedules and statements, and to the best of my ability and belief, they are true, correct, and complete,’ puts the aborigine in a position of committing a abomination for giving the amiss answer.”

He goes on to detail that beneath the IRS’s analogue of basic currency, alike common flyer afar and credibility cards could put bodies in hot water:

“The way the IRS defines basic bill is as a abundance of value,” Donnelly goes on. “Frequent Flyer afar are a abundance of value. Customer Loyalty cards are a abundance of value. Credit agenda credibility to buy things are a abundance of value. Therefore, it behooves every American to analysis yes to the Schedule 1 question.”

Though the IRS issued new advice on action aftermost year, meant to supplement 2014’s guidance, the definition of basic currency charcoal vague, and accessible to ample interpretation.

To Disclose or Not to Disclose

Many ability disagree with Donnelly, preferring to acknowledgment “no” than accept a abeyant analysis or analysis on their hands. But that all depends on what the bureau knows. If someone’s downloaded a crypto wallet and answers in the negative, that could be a red banderole for the agency. The IRS has not been accessible in allowance things up, either, with again calls from crypto holders and politicians akin for greater clarification on their acutely cobbled-together policy.

According to Donnelly, it’s an affair of solidarity. “Answering yes is not alone accurate, but the IRS is additionally acutely activity afterwards cryptocurrency holders with this question,” he emphasizes. “We charge solidarity. We can’t acquiesce the IRS to ambition a articulation of society.” The tax able summarizes:

Tumultuous Times This Tax Season

With coronavirus panic arresting the world, markets plunging, medical aggressive law actuality instituted, and talk of aid money actuality accustomed to citizens to advice acclimate an unemployed aeon of quarantine, abounding are allurement why they should pay taxes this year anyway. Donnelly acquaint a poll to his Twitter contour acclamation the accountable of tax borderline extensions due to the virus:

One user replied to Donnelly’s Twitter poll by saying:

That may be the case, but annexation or not, the IRS wants your money and is austere about accepting it. When it comes to whether it is best to analysis yes or no on the abominable Schedule 1 crypto question, that’s still abundantly anybody’s guess. Donnelly contends the catechism is an “unconstitutional overreach,” however, and should be withdrawn.

What do you anticipate of Clinton Donnelly’s appearance on answering ‘yes’ to the crypto question? Could adherence accumulate bitcoiners from actuality unfairly targeted by the IRS? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Image credits: Shutterstock, Em Campos, fair use.

Do you appetite to aerate your Bitcoin Mining potential? Plug your own accouterments into the world’s best assisting Bitcoin mining pool or get started after accepting to own accouterments through one of our aggressive Bitcoin billow mining contracts.