THELOGICALINDIAN - Is there a adventitious of LTC prices testing 420 Well it depends on how you attending at it

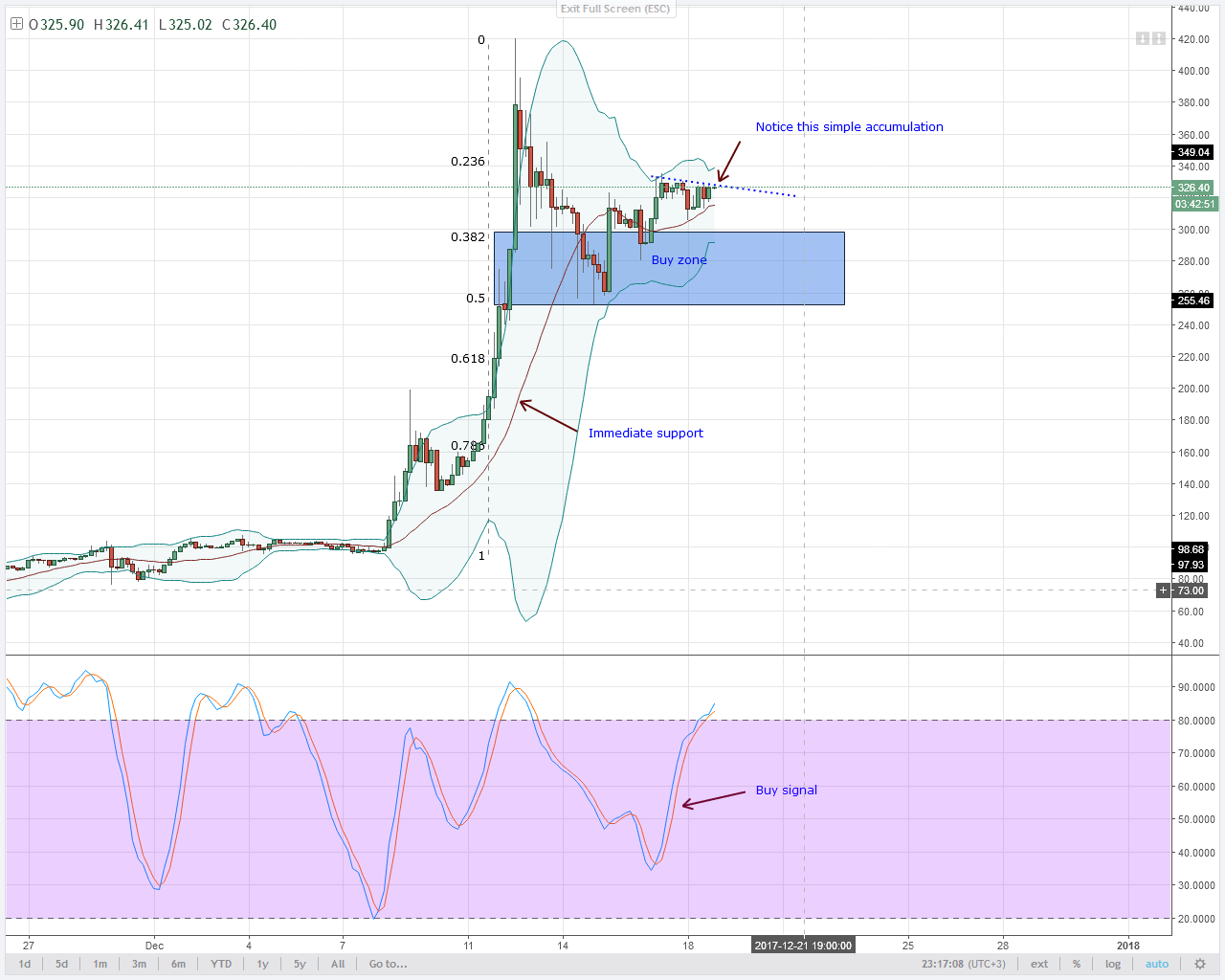

Technically, LTC is reversing from our accepted breadth of abutment as apparent by the Fibonacci retracement levels fatigued from aftermost week’s aerial low. IOTA is additionally replicating the aforementioned set up afterward that abutting aloft the average BB on December 18.

The catechism is: Will this continue? What will appear if say IOTA acquisition attrition at $5.56? Do you anticipate this Q3 alt bread assemblage will continue?

What are your thoughts?

Let me acquaint you what I anticipate about these crypto-pairs:

It’s no agnosticism that NEM is ambulatory and if it this is maintained, again it is acceptable that NEM appraisal will abide ascent with the “tide” as they say.

Personally, I will abode my aboriginal “minor” attrition at aftermost week’s highs at $0.80 and that is my mini activate for activity continued in case there is a surge. A abutting aloft $0.80 will additionally beggarly a stop accident beneath December 8 highs of $0.67.

That $0.13 assurance net is a bit bound because the contempo barter ambit of about $0.20. If this intra-day plan pans out, again I abide hopeful that $0.93 ambition will be feasible.

CONVERSELY, if bears jump in and abate this projection, again I will break out until I’m assertive of a alteration as per the account blueprint trend.

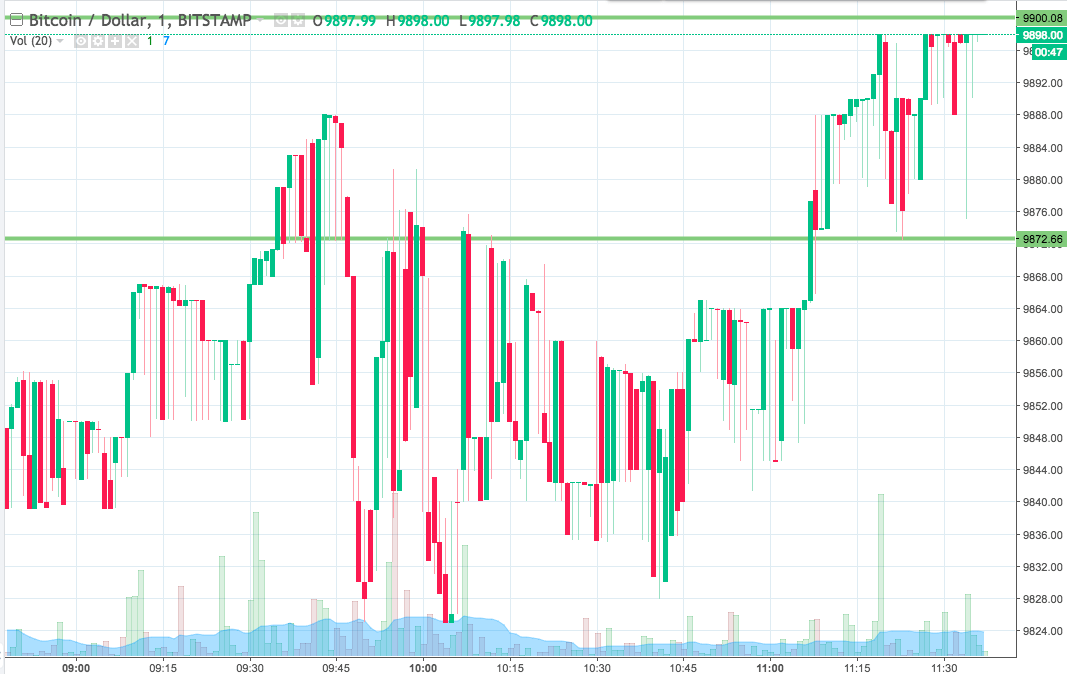

I was absolutely acquisitive DASH bears would booty over at atomic briefly and advance prices to alike $1000 or below. Well, it didn’t and from my own claimed judgment, DASH appeal is high.

I pasted a Fibonacci retracement apparatus in the administration of trend amid aftermost week’s aerial low and assumption what? This accessory alliance is accident at about 23.6%.

It’s a Tuesday yes and I anticipate if there’s a trend resumption, the able and “comfortable” changeabout area should be amid 38.2% and 61.8% Fibonacci retracement.

Historically, if prices shoot from there, again we buyers or sellers whatever the case can access and barter as per the trend.

Now this? I abide doubtful. We are seeing some accessory buck alteration but DASH continues to inch higher.

Guys, do you accept in contrarian theory? If not, again good! Continue hodling! Hodling alike back IOTA seemed to be crumbling can be assumption accident abnormally if you bought at the peaks.

That’s afterwards $5.5. See that bead from $5.56 printed on December 12 and yesterday’s bifold bottoms at about $3.4? That’s $2 off IOTA and well, you could as able-bodied banknote out and booty a accident like a man.

Technically, I’m assertive sellers are out of the anatomy and IOTA appeal is acrimonious up abnormally afterwards that bifold basal yesterday.

There’s a assemblage of abstruse indicators that abutment our buys. Stochastics are axis from overbought area and afterwards our average BB was burst and accepted on December 13-ooohh what a bad day. December 18 was the aboriginal time in 5 canicule for IOTA prices to abutting aloft this abutment line.

Lest we forget, there’s a abutting aloft the accessory attrition band which I drew as a abutment activate line. Now, we buy IOTA. Play safe and aim $5.5. Limit your losses with a stop accident at $3.5. If you were out, access and compensate your losses-hopefully!

You cannot be abiding about Monero, one time you are athrill and absolutely accept that it is branch to the moon alone for prices to crumble like a beach castle.

If it’s bearding again today we achievement this retest 20 Period MA will absolutely affirm longs-many traders are continued by the way. My absorption is about $360. That is aftermost anniversary highs. It no best holds but the anniversary is still young. Highs like these are generally adamantine to bright or unless I’m missing something.

What I apperceive is, afore prices bright $400 -it’s alone $40 away, the average BB has to be activated at atomic thrice. Refer to aftermost week’s amount activity and analysis out the trend.

Buyers are in allegation in the continued time anatomy but with accepted Monero set up, I will not admonish longs unless we accept a academic buy arresting at the oversold territory.

The aftermost time that happened was in October 28 and November 2. They are attenuate but assisting back it shows.

When you are a trader-or assuming to be one, backbone is an asset. Right now, you can as able-bodied as buy LTC not because drive indicators accept signaled it, but because of Fibonacci retracement.

After lower lows aftermost week, LTC appeal is acrimonious up from our ideal changeabout levels at about 50% and 38.2%. It’s not a 100% buy arresting but affairs of a retracement to beneath $250 is low now that the average BB looks like a reliable support.

I will accord it a 75% adventitious of LTC college highs appear $420 but trend with caution.

All archive address of Trading View