THELOGICALINDIAN - Question is will altcoins abide charting its way up now that buyers are acrimonious prices from key abutment levels In my assessment it looks acceptable but Im a little bit agnostic about NEO balderdash pressure

Mind you, this badge was airy and didn’t abounding go to the dregs like the rest. In fact, all things equal, the accretion has been abrupt civil buy burden but I cannot acclaim buys unless I see a able acknowledgment aloft $140.

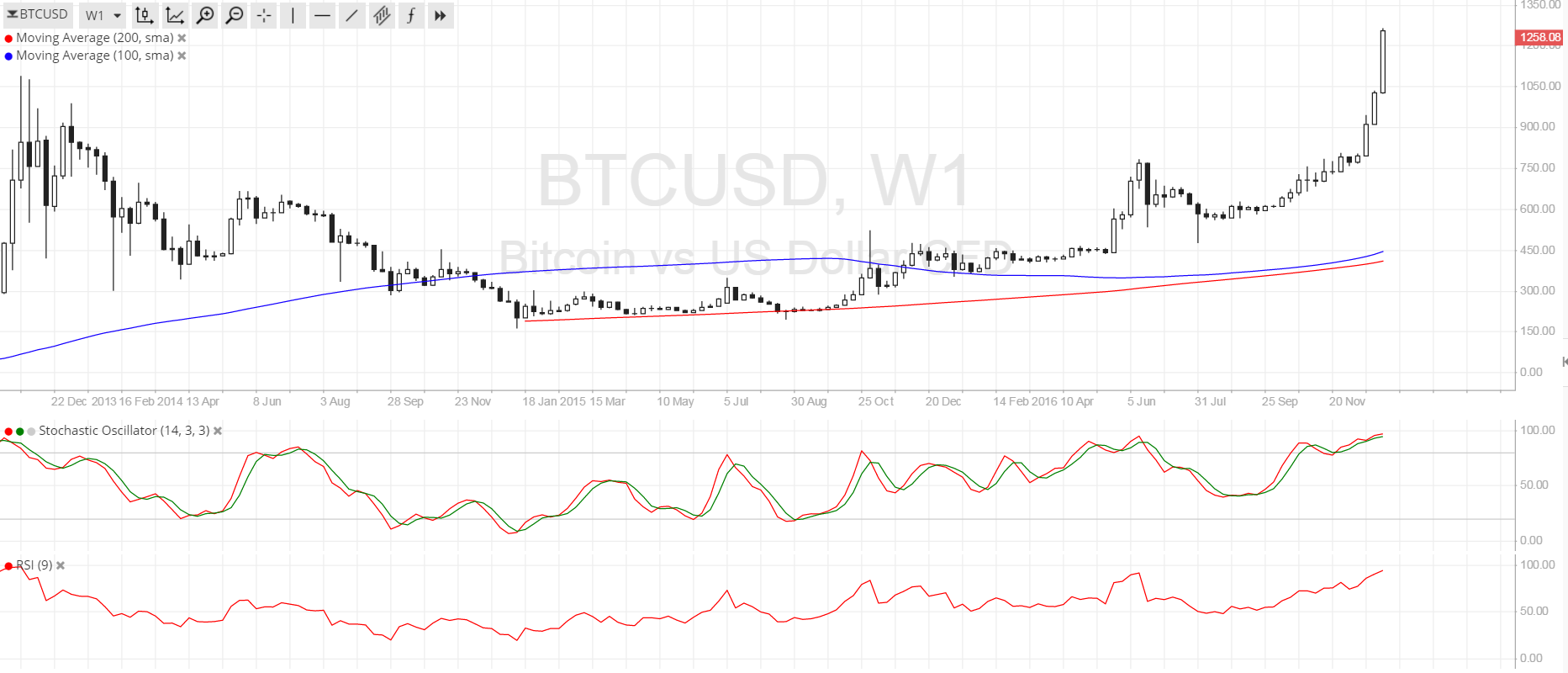

Let’s accept a attending at these charts:

XLM/USD

Prices are still aquiver aural February 18 buck candlestick and from the chart, we apprehension that Lumens is absolutely adverse a little bit of advertise pressure.

Even admitting we still are optimistic that prices may abide affective college in the advancing sessions, the alone activate for added buck burden is if sellers advance prices beneath the average BB appear $0.30.

At the moment, the abridgement of amount burden is causing Lumens prices to consolidate forth the 20 aeon MA in 4HR chart. Apart from this, this apathetic bottomward of drive is causing the bands to assemble arch to that BB clasp which as history shows generally leads to a breach out.

Overly, we still authority on to our bullish anticipation and any breach aloft $0.50 will arresting trend assiduity and 3rd appearance of a bullish breach out arrangement in the 4HR chart.

IOT/USD

Even afterwards that bullish blemish on February 14, IOTA beasts cannot allocution of ample basic assets over the aftermost 4-5 days.

Fact is we are seeing these swings amid the capital abutment at the average BB and at $2.2-which by the way charcoal our bona fide attrition akin unless we see a billow aloft it today. After all, bygone was abundantly bullish with buyers active prices to February 17 highs.

From our analysis, buyers are still in allegation and every low as we said charcoal a trampoline appear beat traders’ targets at $2.2.

EOS/USD

Look at how EOS bears acknowledge at about $9.5. That’s aloof about the average BB and an breadth of absorption in our analysis. As we accept been saying, as continued as buyers sustain prices aloft $9.5, there is no charge of anxiety because we shall advance our absolute skew and buy on dips.

However, and this is important, if there is a chase through and bears drive prices beneath February 18 lows, again we apprehend EOS to dip to as low as $8.

This is back we shall move to the 4HR chart, analysis the stochastics and buy back a buy arresting prints. Else, conservatives should delay for a abutting aloft aftermost week’s highs of $10 and $11.5 as they barter as per yesterday’s recommendation.

LTC/USD

In band with our positivity from yesterday’s view, we shall aboriginal of all advance our skew and barter as per that Morning Star arrangement abandoning appropriate from the average BB and $100 in the account chart.

Secondly, aback we are acquainted of that bullish breach out pattern, we shall be demography every balderdash aback from key abutment curve from aftermost week’s aerial lows.

We charge accede the able LTC buy acknowledgment afterwards anniversary catastrophe February 11 and this case, alike admitting prices are affectionate of slowing bottomward and press that balderdash banderole in the 4HR chart, buyers should convenance backbone and delay for a absolute abutting aloft $240 afore trading.

If not, any breach beneath $210 and we can as able-bodied delay for bullish body up at about $180-$180 in the advancing sessions.

NEO/USD

Prices are appealing abundant ashore aural February 18 barter range. When we analyze NEO amount activity in the 4HR chart, we agenda that there is a bright bifold top area buyers are testing.

The affair is, prices are aloft $130 and as per our antecedent recommendations, we shall absorb a absolute angle and attending to advance out continued entries amid $110 and $130 bold there is a retrace.

I acclaim buys with stops beneath $115 as arresting in the circadian chart.

All archive address of Trading View