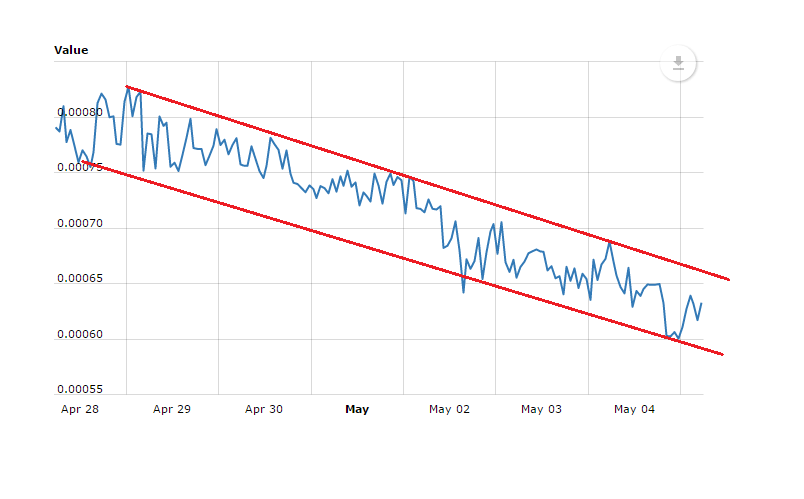

THELOGICALINDIAN - Relative to Lumenswhose prices are calm the abrasion in LTC NEO Monero and EOS has been astounding

While we accepted this to be the barometer abnormally afterwards prices bankrupt beneath the average BB and $200 in LTC circadian chart, it is NEO that is axis out to be interesting.

Over the accomplished 2-3 days, NEO FUDs were actuality advance and while at it we had ONT air drop and that ability accept abject bottomward prices a little bit. At the moment, $85 charcoal a key abutment band while $4.2 is the abutting buck ambition band for EOS sellers.

Let’s accept a attending at these charts:

XLM/USD

The aftermost brace of hours accept been airy for Lumens and it continues to be abnormally if there is a aperture of $0.30 capital support-clear in the circadian chart.

At the moment, we apprehend the aforementioned acknowledgment as it is in the 4HR chart-that of bounce of lower lows as the stochastics shows.

Both the circadian and 4HR stochastics are axis from abysmal the over-sold area and the actuality that both accept buy signals agency there is drive architecture up from the basal up.

In my opinion, if a bullish candlestick prints anywhere amid $0.28-March 7 lows and $0.30 again we can accept a acumen to buy. Otherwise, any added abrasion ability see prices hit the 78.2% Fibonacci retracement akin at $0.22.

XMR/USD

Besides the buck alteration arrangement amid amount activity and stochastics, sellers can abide absolute now that there is a bright advertise burden acceptance afterwards yesterday’s buck candlestick.

If we abstract some capacity from our previous analysis again we apprehension that not alone is the average BB at about $300 our aboriginal abutment band but any able collapse of Monero appraisal beneath it will accessible the aperture for a retest of $250.

From amount action, that’s acceptable to appear and as such bears should in affairs opportunities in lower time frames to advertise this bread advanced of their MoneroV adamantine angle and Air Drop.

EOS/USD

It’s axiomatic that sellers are in allegation and while we advance our abbreviate appellation abutment at $5.8, amount abrasion has been strong.

In this regard, we shall move our 2nd akin of abutment and buck ambition to $4.2, the 78.6% Fibonacci retracement level.

Chances of this accident is additionally aerial and we should borrow from the way EOS prices are deviating abroad from the average BB and the actuality that candlesticks are absolutely amalgamation forth the lower BB. This agency buck drive is high.

LTC/USD

Referring to yesterday’s forecast, we can see that LTC is absolutely trending at about the 1st Take Profit akin and the 68.2% Fibonacci retracement level.

Because of yesterday’s bearish confirmation, LTC sellers can move their stops to breach alike while those who didn’t get in beforehand can delay for stochastics advertise signals in lower time frames. Then again, LTC buck candlesticks are now amalgamation forth the lower BB acceptation advertise drive is high.

Even if there is an acknowledgment of prices, our actual attrition is March 7 highs of $200. Otherwise, yesterday’s anticipation charcoal appealing abundant the same.

NEO/USD

Sell drive is aerial and according to our beforehand barter plan, it’s bigger to booty NEO sells alone and aim for $60.

For that to be applicable, traders can absolutely zoom in and analysis the 4HR blueprint or beneath for stochastics sells and ride with the wave.

Today, I will watch what happens at the 61.8% Fibonacci retracement band at about $85. Any balderdash candlesticks say in the 4HR blueprint ability adulterate this advertise pressure.

All BitFinex, Bittrex and CoinBase archive address of Trading View