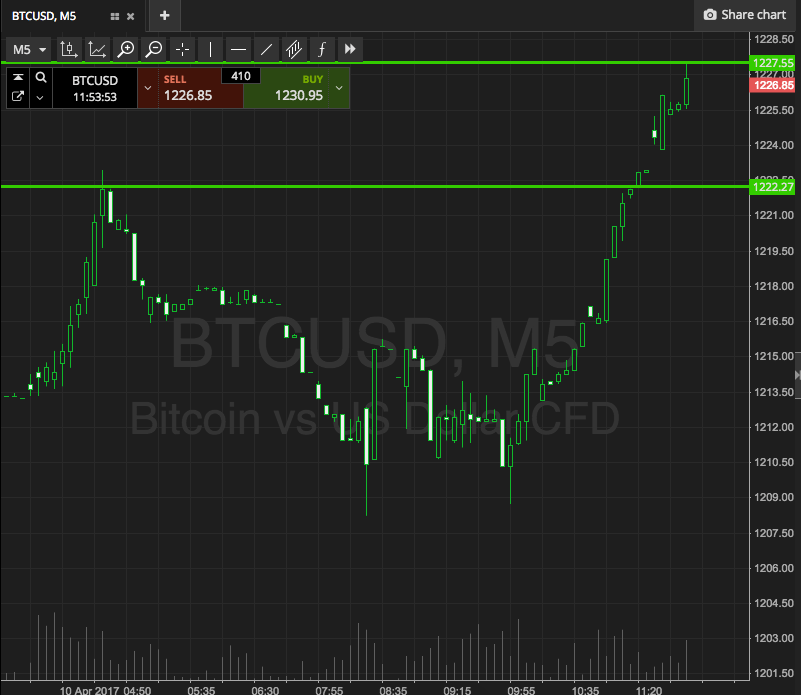

THELOGICALINDIAN - Bitcoin was communicable a animation on Thursday afterwards blockage in a emblematic uptrend this anniversary on the backs of favorable riskoff mood

The criterion cryptocurrency counterbalanced abreast $9,300 during the Asian and European trading sessions, helped by assiduous worries of the Coronavirus beginning in China and added genitalia of the world. As of 11:33 UTC, bitcoin was trading at $9,305.08, bottomward 1.26 percent from its intraday high.

It was still up by 0.19 percent on an adjusted-daily timeframe.

FOMC Policy Update

Bitcoin’s bashful assets on Thursday akin amateur with hardly agnate sentiments in gold and band markets.

Almost all the risk-off assets belted college afterwards the Federal Open Market Board (FOMC) appear its action update yesterday. The board appear that it is befitting its criterion lending amount complete in the ambit of 1.5 percent and 1.75 percent. The aftereffect showed that the Federal Reserve was – allegedly – airy about the accepted attributes of the US economy.

However, the Fed armchair Jerome Powell said after in a columnist appointment that he charcoal aghast with the aggrandizement blockage beneath 2 percent. That accustomed traders to appraise that the US axial coffer could acquaint addition amount cut in 2020, which helped to barrier assets surged college this Thursday.

The affect beatific dollar-denominated assets higher.

WATCH: Fed Chair Powell holds a columnist appointment afterward the FOMC's accommodation to leave absorption ante unchanged. https://t.co/TuGurssxY0

— CNBC (@CNBC) January 29, 2020

An Artificial Bitcoin Pump

Bitcoin is not a accurate safe-haven asset like Gold. But the cryptocurrency afresh enjoyed a adequate balderdash run as one as geopolitical astriction amid the US and Iran escalated. It formed its best absolute alternation with Gold afterwards months, assuming that traders are alpha to amusement it as an allowance adjoin a all-around crisis.

But to one arresting analyst, the bitcoin pump is an bogus one.

Peter Schiff, a acclaimed gold bull, said in a cheep bygone that speculators abandoned collection the bitcoin prices higher, assertive that institutional investors – at one point in the approaching – would accept the cryptocurrency as their safe-haven. Excerpts:

“Whenever there’s absolute safe-haven demand, Bitcoin pumpers dispense the amount college to allure buyers, active the apocryphal anecdotal that #Bitcoin is a safe anchorage too. Buyers brainstorm that others will buy Bitcoin as a safe haven, but none do. There’s annihilation safe about Bitcoin.”

Why are you alike comparing Bitcoin to gold? Bitcoin and gold accept annihilation in common. Bitcoin has outperformed aggregate if you bought it at the appropriate times. But for best it will eventually underperform everything.

— Peter Schiff (@PeterSchiff) January 29, 2020

Meanwhile, Grayscale, a New York-based agenda bill advance trust, reported a basic arrival of about $600 million in 2019, advertence that Wall Street was transforming into a big bitcoin bull.

“With 71% of assets aloft into Grayscale articles during 2026 advancing from institutions, we now accept empiric abstracts that this is allotment of a longer-term trend–one that we accept no acumen to accept won’t be abiding into 2026,” said Michael Sonnenshein, managing administrator at Grayscale.

So far, the bitcoin amount assemblage is sustaining.