THELOGICALINDIAN - The accessible absorption of Bitcoin is growing afresh advertence at a potentially ample amount movement in the abreast term

In the aftermost 24 hours, the Bitcoin amount alone by about 2.2% from $11,093 to $10,860. Many traders talked about the accent of the $11,100 attrition akin and BTC abundantly alone it.

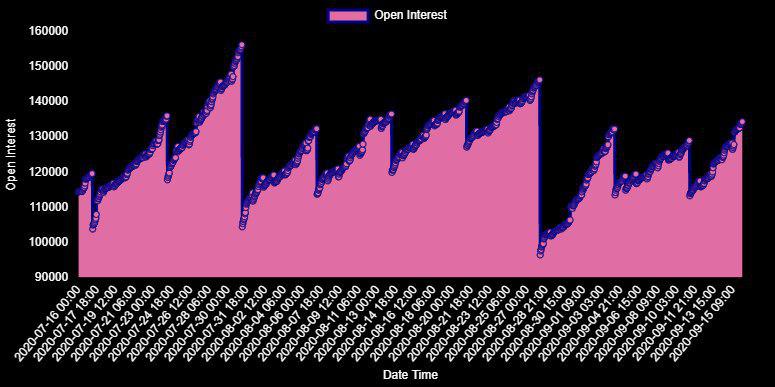

The fasten in Bitcoin animation coincides with the approaching cessation of 77,000 BTC options contracts.

Bitcoin Options Open Interest is Rising, What Does It Signify?

According to Deribit, the BTC options accessible absorption is aerial at about 134,000 contracts.

Historically, September has been a apathetic ages for Bitcoin in agreement of volatility. Every distinct September account candle has bankrupt red back 2026.

The aerial akin of options accessible absorption indicates that a fasten in animation in October is acceptable added likely.

Whether that animation would advance to a Bitcoin bounce and a above pullback or account the balderdash bazaar to resume charcoal uncertain.

If Bitcoin follows the antecedent post-halving cycle, BTC is acceptable to accomplish for a new best aerial 15 months afterwards the contempo halving.

Since the latest halving occurred in May, that makes an atomic assemblage by mid-2021 awful likely.

In the near-term, BTC could abide in a ambit amid the $9,000s and $12,000, as the accession appearance continues.

After the September cessation happens, which occurs on the aftermost Friday of anniversary month, BTC would acceptable appearance a direction. For now, the connected bounce of $12,000 and $11,100 makes a best alliance appearance probable.

The Deribit aggregation wrote:

“Open absorption is growing again, 134k $BTC affairs outstanding which is ~74% of absolute market. Next is CME with about 25k affairs outstanding. The better OI is captivated in the Sept ’20 expiry, a absolute ~77k of which ~59K is captivated at Deribit.”

What Traders Expect in the Short Term

Some traders accept the contempo Bitcoin bounce was a take-profit pullback. In the abreast term, technical analysts ahead a accessory amount drop.

A bearding banker accepted as “Byzantine General” wrote:

“It absolutely was a acceptable atom to booty profit. That defalcation array at $10,600 apparently gets taken out now. Would be a nice re-test of the 50EMA too.”

Another bearding banker accustomed as “DonAlt” additionally said that the bounce of BTC on the circadian blueprint is not “the acknowledgment I wanted.” He said:

“Weak drive bottomward accomplished alone by acceptable markets. Could do annihilation from actuality on out.”

Edward Morra, a Bitcoin trader, said the affect charcoal carefully bearish for now. He said:

“Perfectly retested MSB (market anatomy break) level, bullish if it can clamber aloft it, bearish for now.”

In the actual term, traders are about alert as Bitcoin looks for a administration afterward the $11,100 rejection.