THELOGICALINDIAN - Bitcoin Price Key Highlights

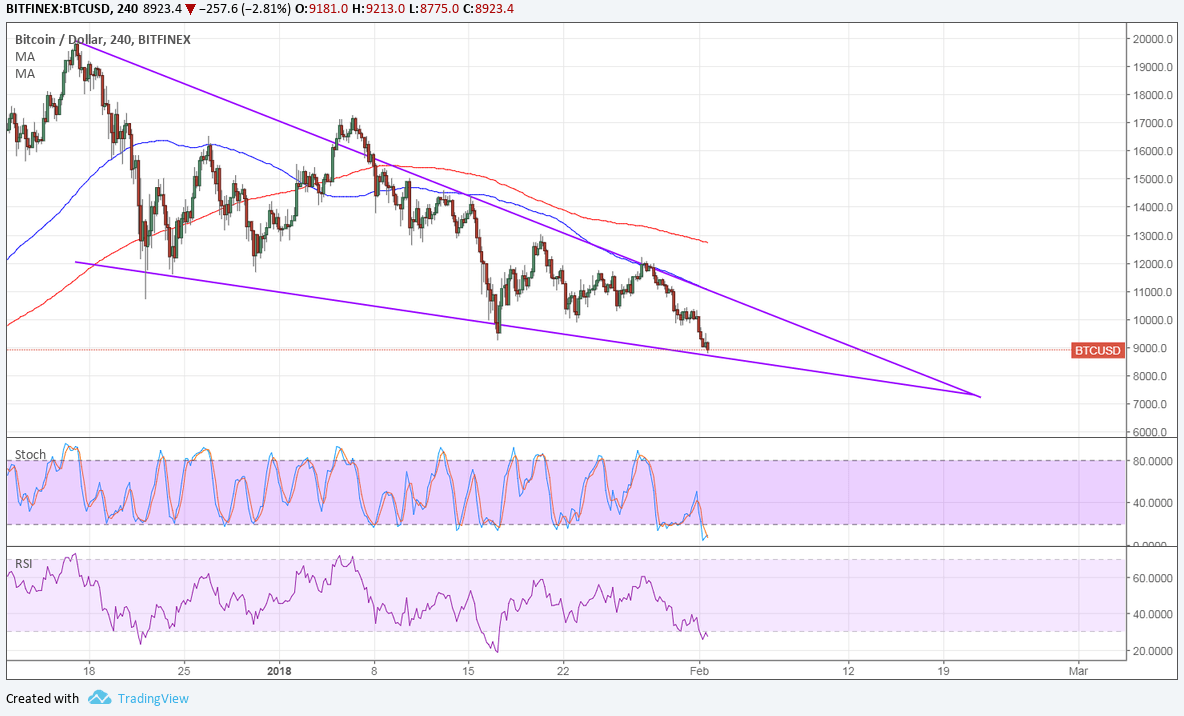

Bitcoin amount can’t absolutely bolt a breach as it suffered addition selloff to the $9,000 handle.

Technical Indicators Signals

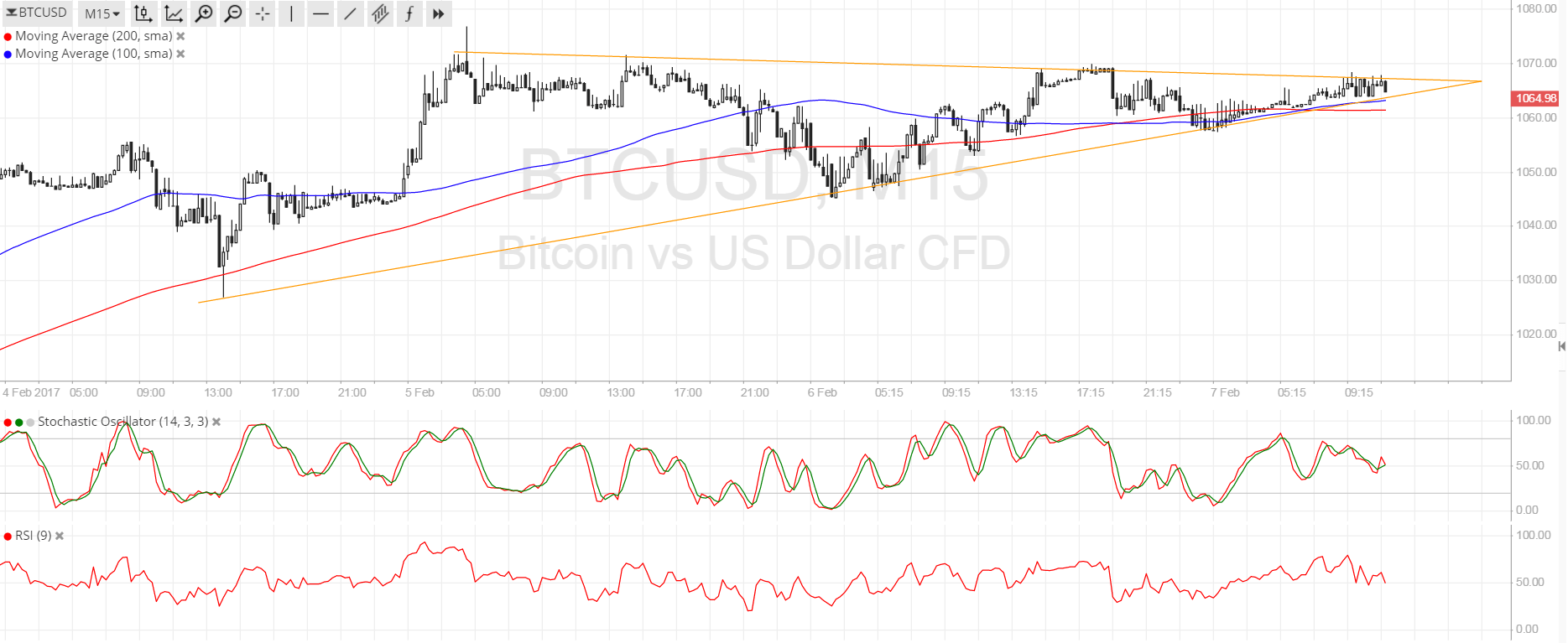

The 100 SMA is still beneath the longer-term 200 SMA to announce that the aisle of atomic attrition is to the downside. In added words, the selloff is added acceptable to abide than to reverse.

In addition, the gap amid the affective averages is addition to reflect stronger affairs pressure, possibly arch to a block breakdown. Note that this blueprint arrangement spans $9,000 to $19,000 so the consistent blemish could be of the aforementioned height.

Stochastic is advertence oversold conditions, though, which agency that bears are annoyed and could let beasts booty over bitcoin amount action. RSI is additionally accessible to cull up from the oversold akin to arresting a auto in affairs momentum.

Market Factors

Not alike dollar weakness was abundant to accumulate a lid on BTCUSD losses afresh as abrogating affect for the cryptocurrency industry is prevailing. The abridgement of any absolute updates is acceptable added and added investors to cash their holdings, thereby exacerbating the selloff.

Analyst say that the added analysis from regulators is still to accusation for the tumble, abnormally back the CFTC appear affairs to beef up its bitcoin futures analysis process. According to Chairman Giancarlo:

“The CFTC’s accepted artefact self-certification framework is constant with accessible action that encourages market-driven addition that has fabricated America’s listed futures markets the backbiting of the world. Whatever the bazaar appulse of bitcoin futures, I achievement it is not to accommodation the artefact self-certification action that has served so able-bodied for so long”.

This could absorb setting “exchange ample banker advertisement thresholds at bristles bitcoins or less” and entering into “information administration agreements with atom bazaar platforms to acquiesce admission to barter and banker data.”